After a couple of years where the housing market felt stuck in neutral, 2026 may be the year things shift back into gear. Expert forecasts show more people are expected to move – and that could open the door for you to do the same.

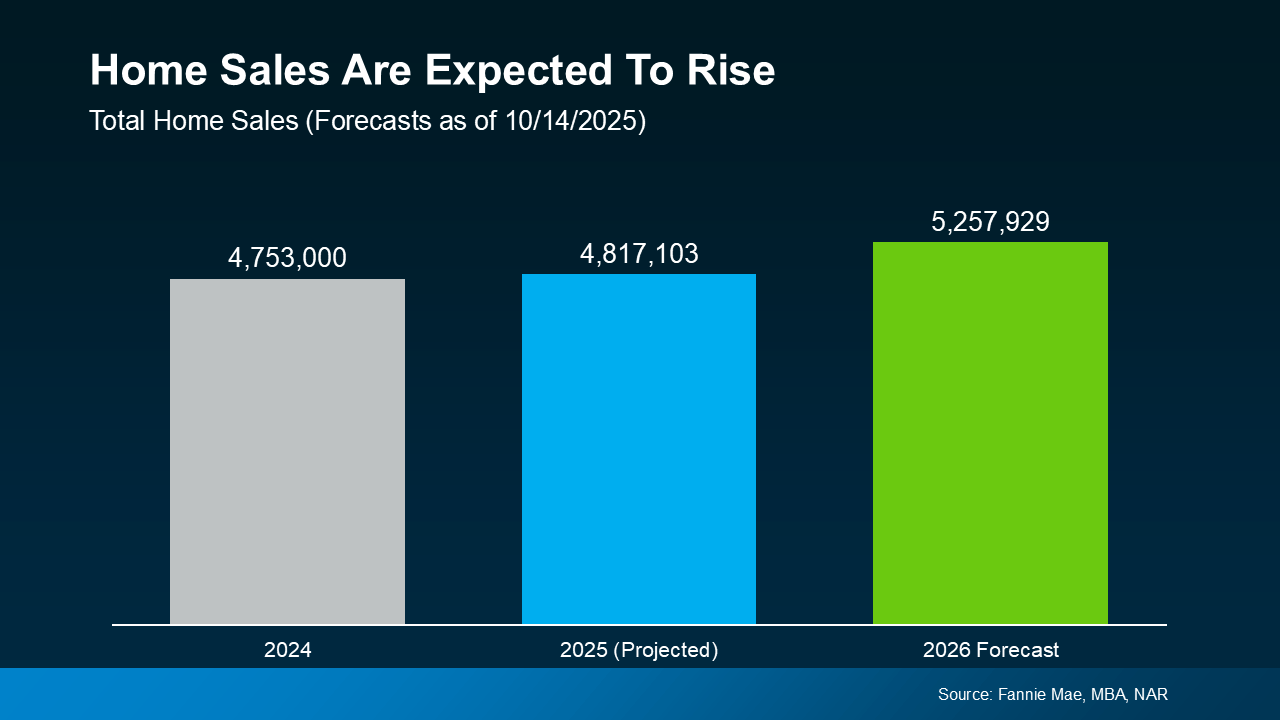

More Homes Will Sell

With all of the affordability challenges at play over the past few years, many would-be movers pressed pause. But that pause button isn’t going to last forever. There are always people who need to move. And experts think more of them will start to act in 2026 (see graph below):

What’s behind the change? Two key factors: mortgage rates and home prices. Let’s dive into the latest expert forecasts for both, so you can see why more people are expected to move next year.

What’s behind the change? Two key factors: mortgage rates and home prices. Let’s dive into the latest expert forecasts for both, so you can see why more people are expected to move next year.

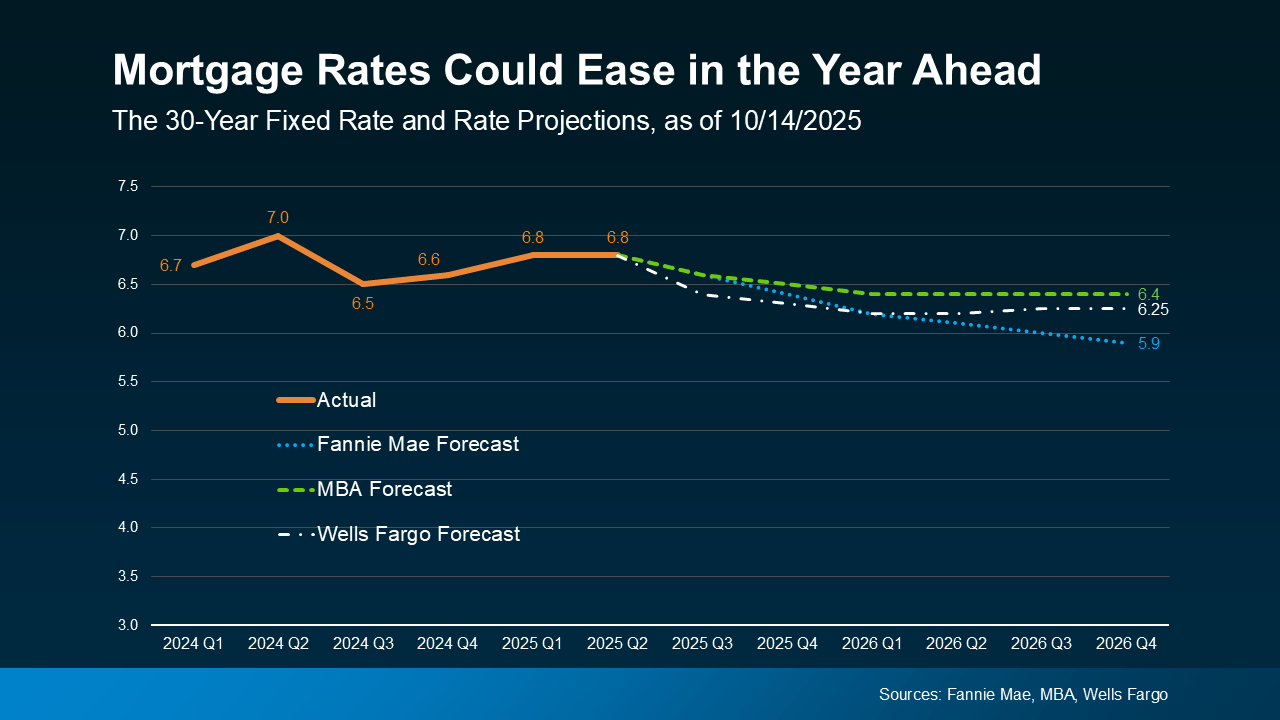

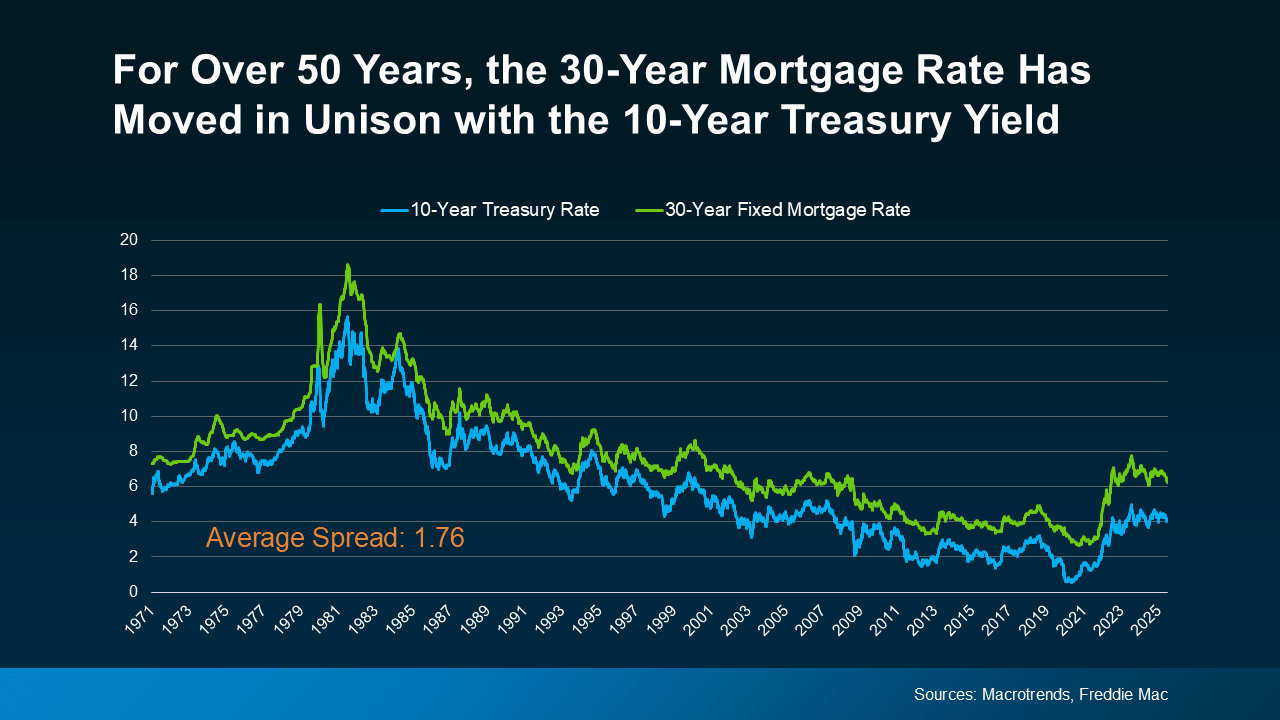

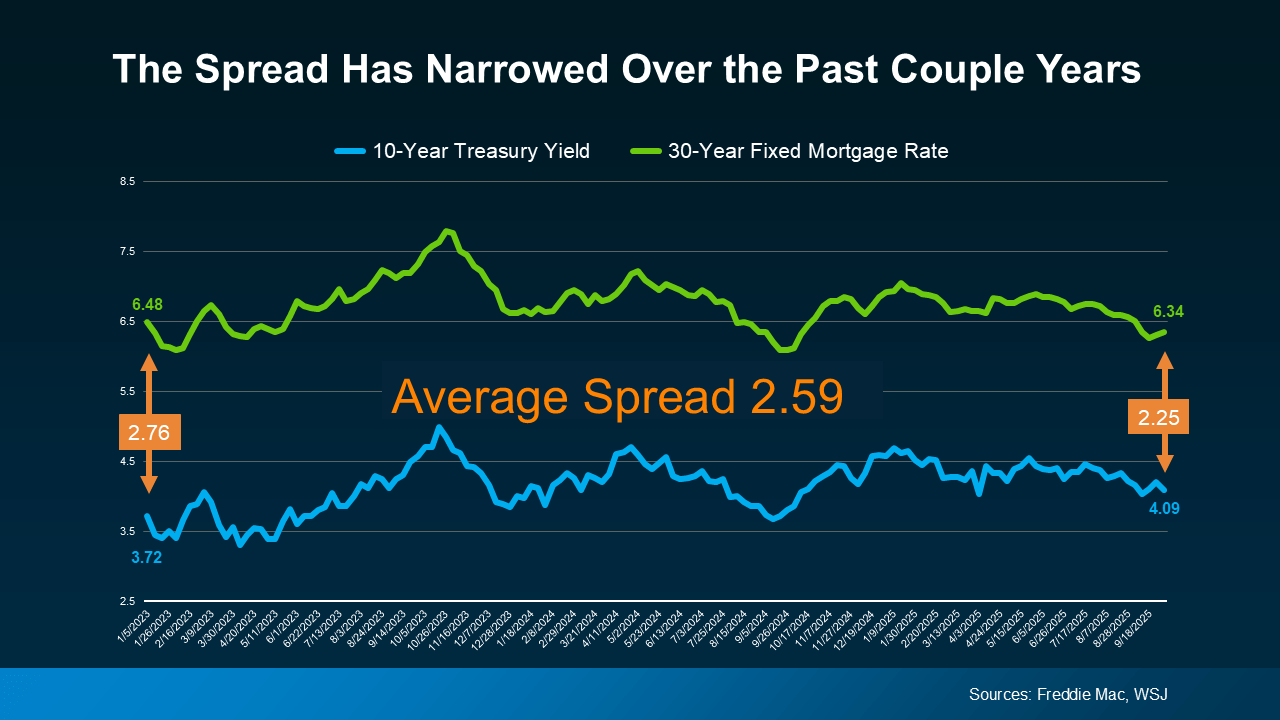

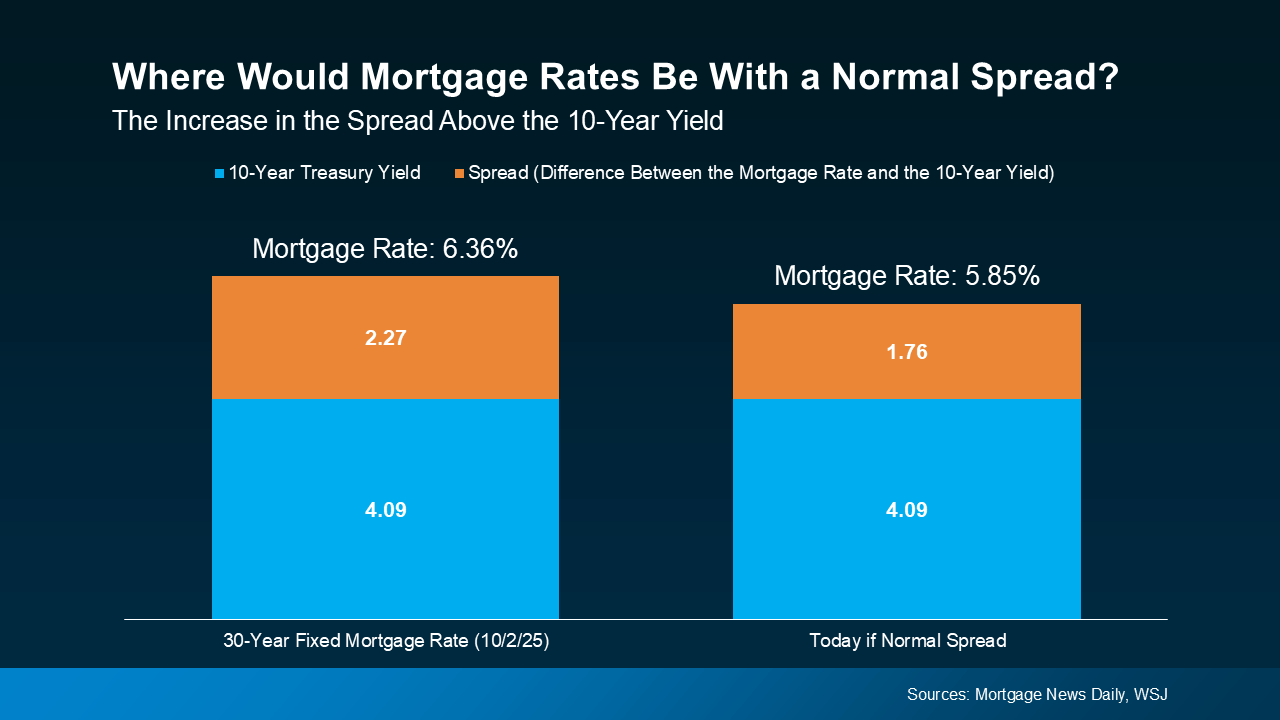

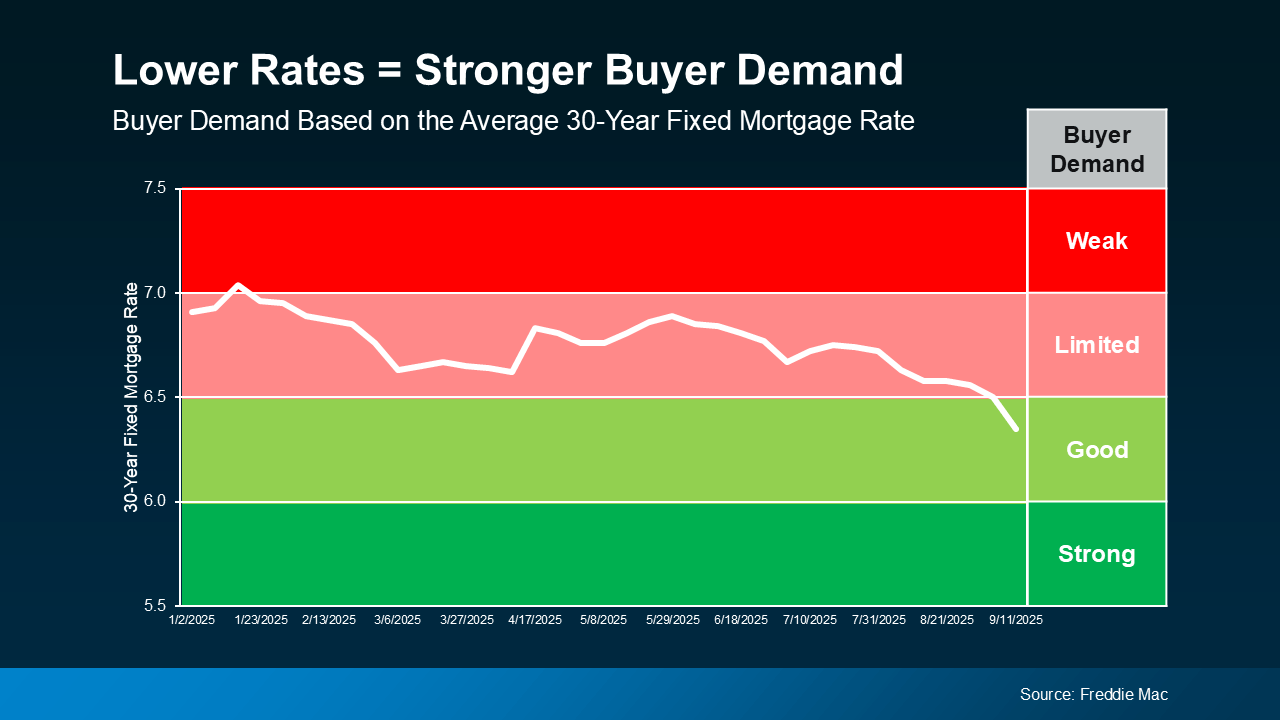

Mortgage Rates Could Continue To Ease

The #1 thing just about every buyer has been looking for is lower mortgage rates. And after peaking near 7% earlier this year, rates have started to ease.

The latest forecasts show that could continue throughout 2026, but it won’t be a straight line down (see graph below):

There’s a saying: when rates go up, they take the escalator. But when they come down, they take the stairs. And that’s an important thing to remember. It’ll be a slow and bumpy process.

There’s a saying: when rates go up, they take the escalator. But when they come down, they take the stairs. And that’s an important thing to remember. It’ll be a slow and bumpy process.

Expect modest improvement in mortgage rates over the next year but be ready for some volatility. There will be volatility along the way as new economic data comes out. Just don’t let it distract you from the bigger picture: the overall trend will be a slight decline. Forecasts say we could hit the low 6s, or maybe even the high 5s.

And remember, there doesn’t have to be a big drop for you to feel a change. Even a smaller dip helps your bottom line.

If you compare where rates are now to when they were at 7% earlier this year, you’re already saving hundreds on your future mortgage payment. And that’s a really good thing. It’s enough to make a real difference in affordability for some buyers.

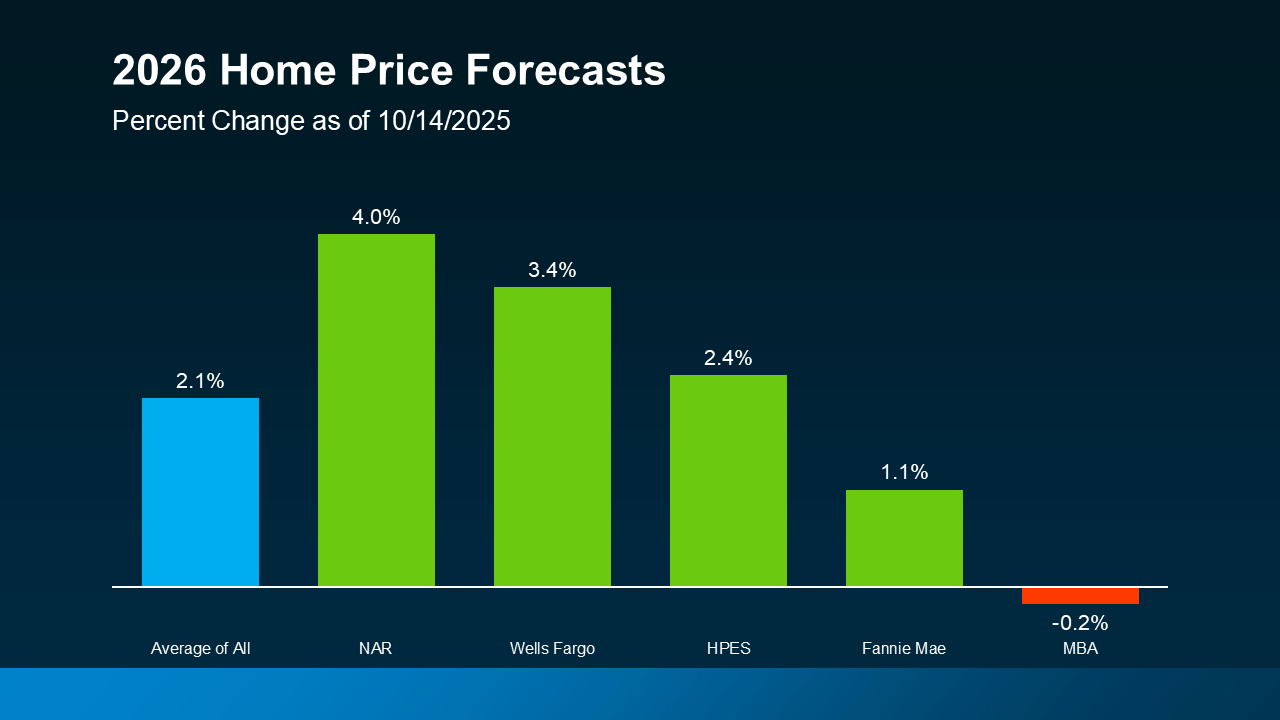

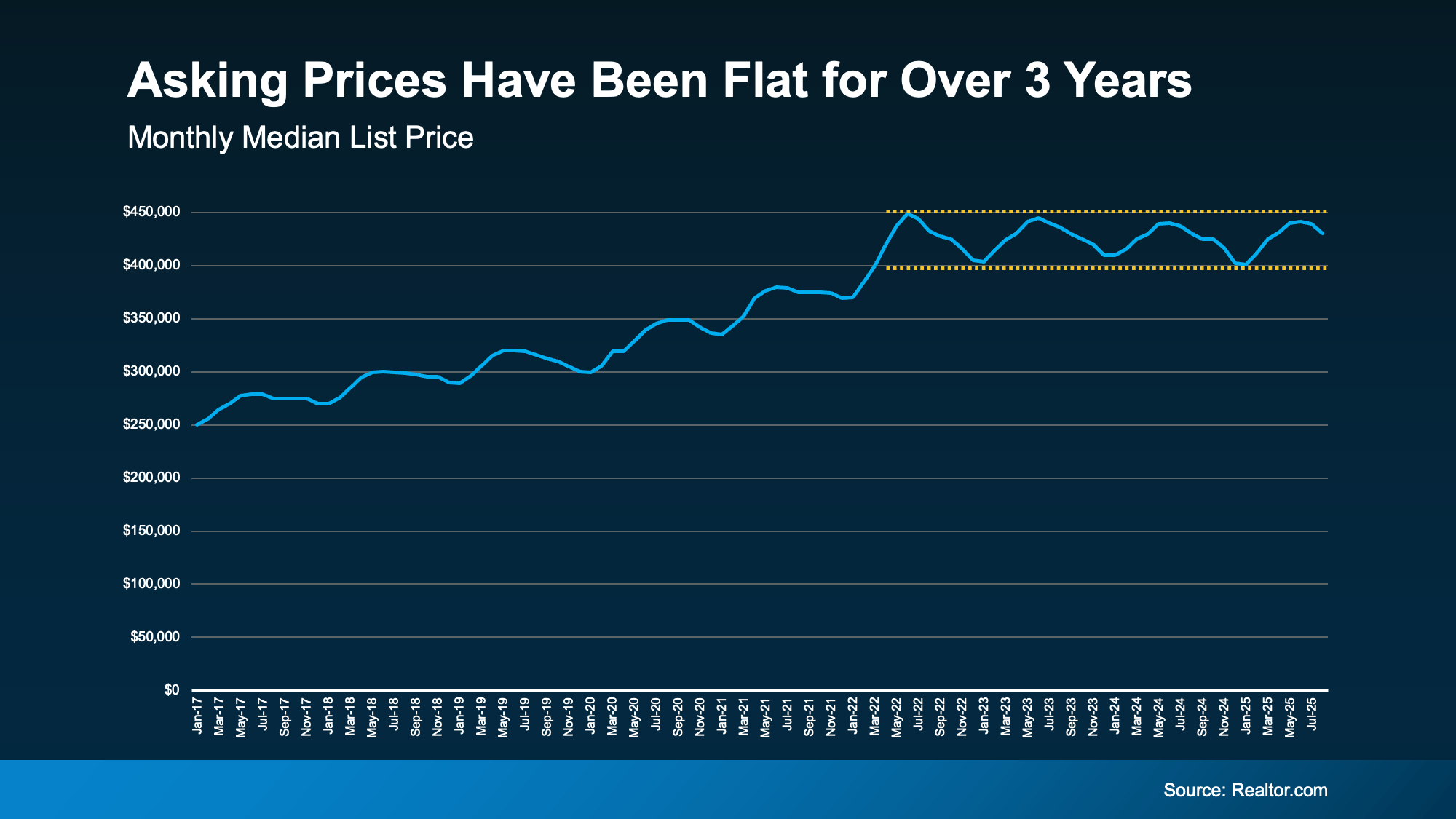

Home Price Growth Will Be Moderate

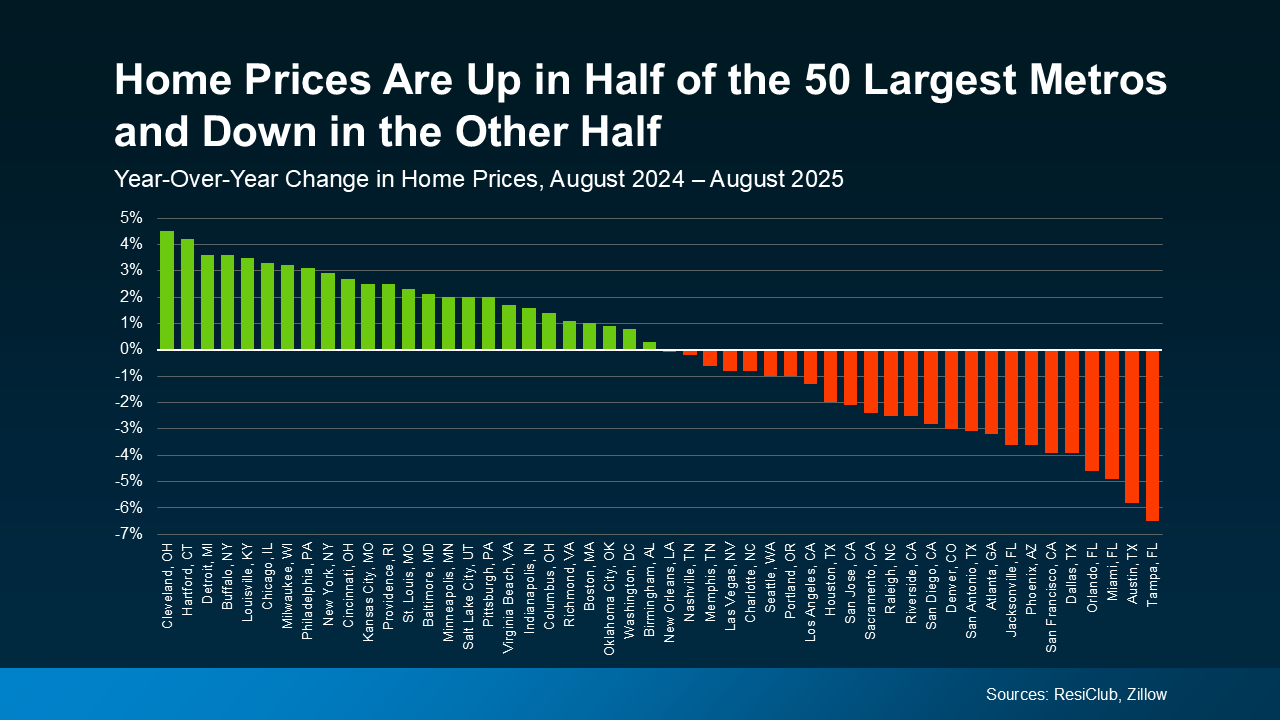

What about prices? On a national scale, forecasts say they’re still going to rise, just not by a lot. With rates down from their peak earlier this year, more buyers will re-enter the market. And that increased demand will keep some upward pressure on prices nationally – and prevent prices from tumbling down.

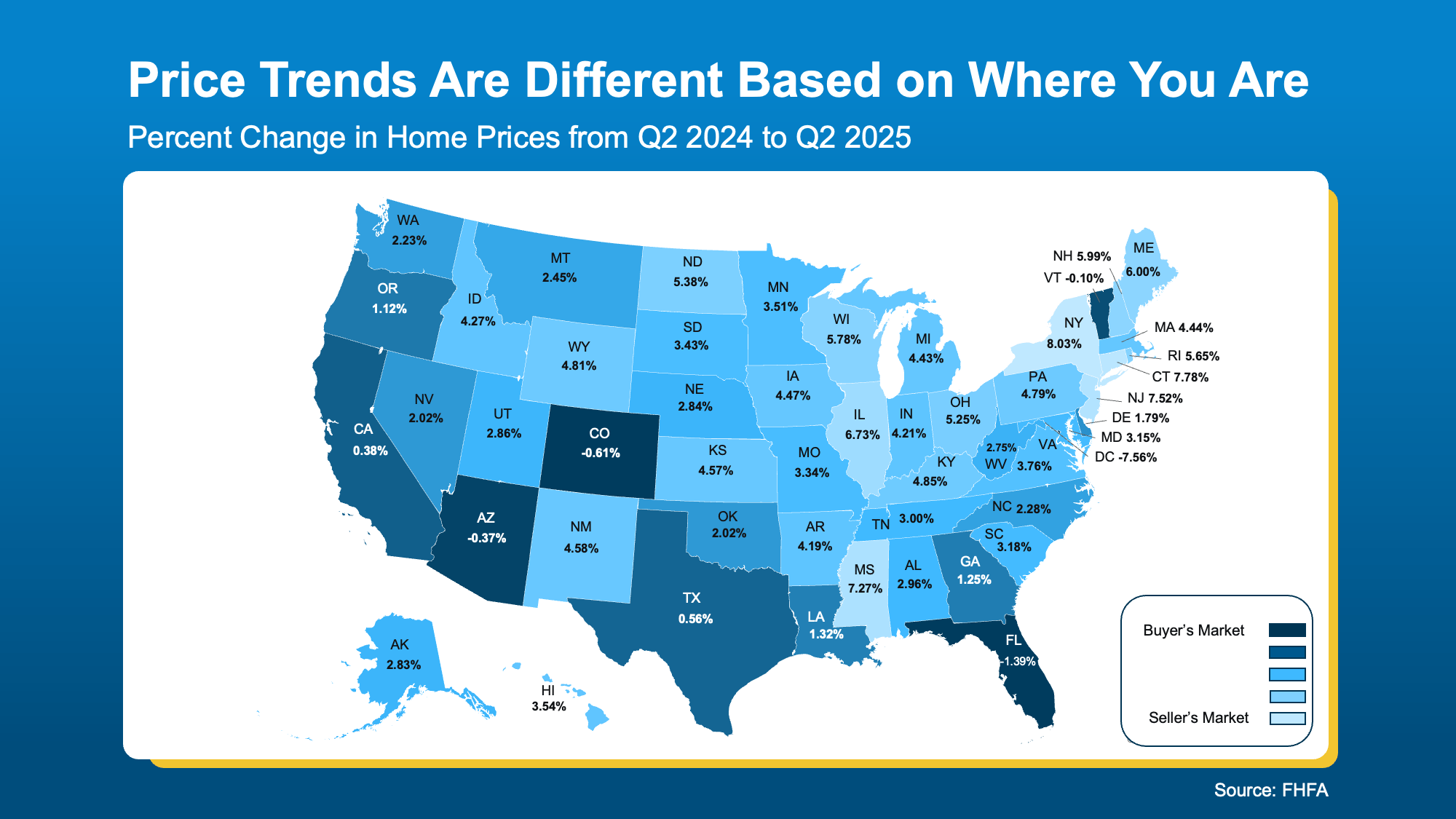

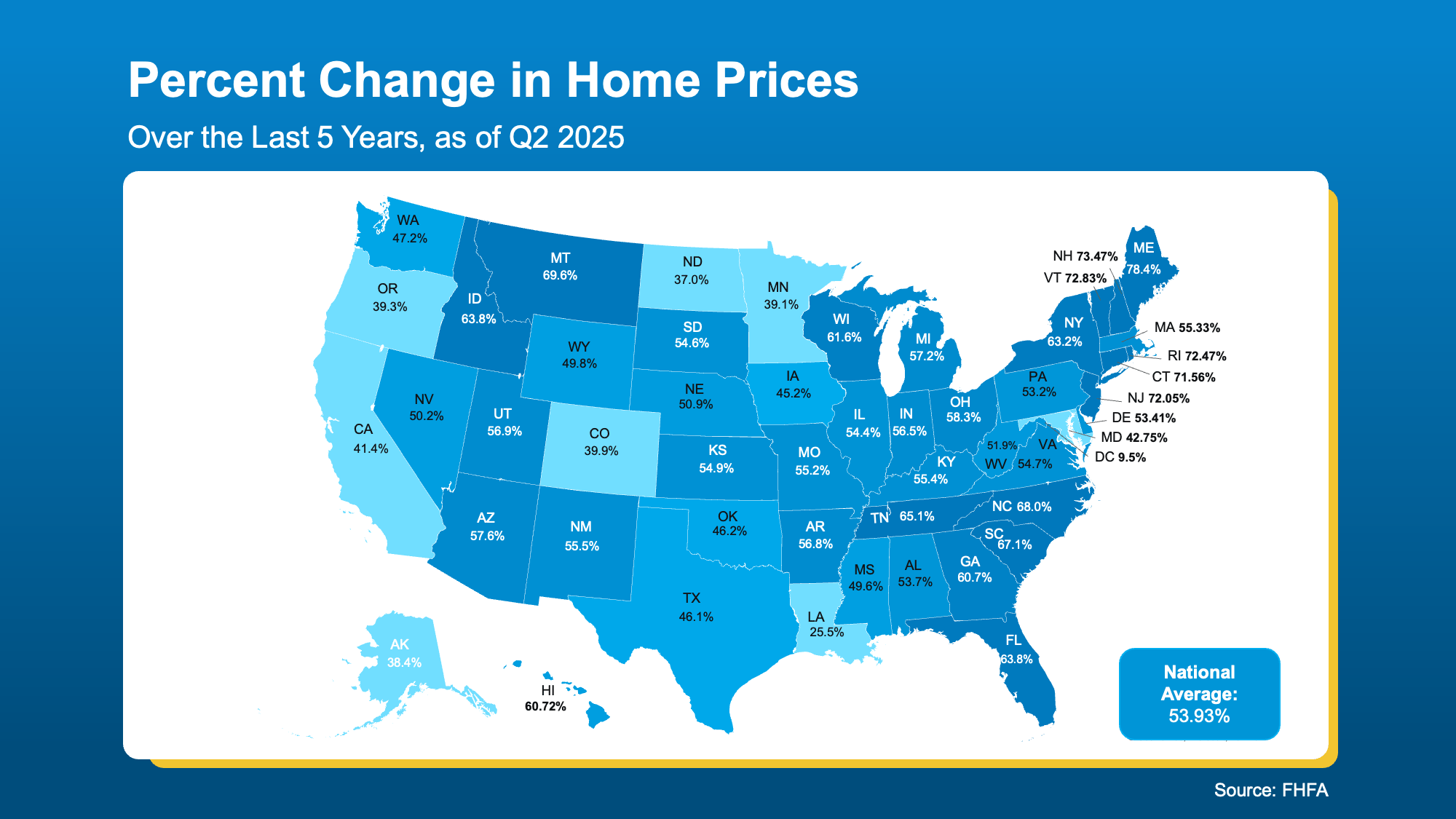

So, even though some markets are already seeing slight price declines, you can rest easy that a big crash just isn’t in the cards. Thanks to how much prices rose over the last 5 years, even the markets seeing declines right now are still up compared to just a few years ago.

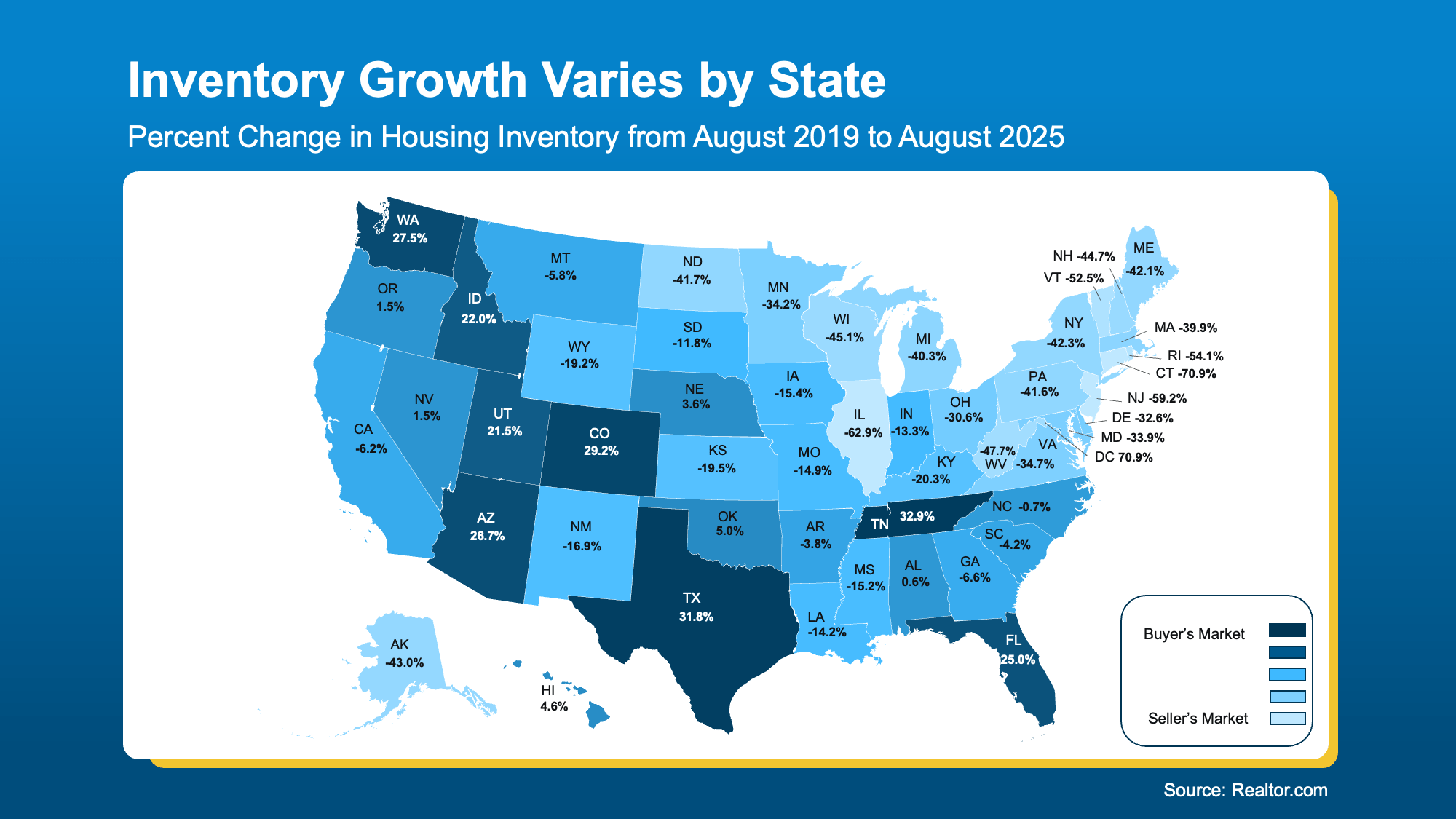

Of course, price trends will depend on where you are and what’s happening in your local market. Inventory is a big driver in why some places are going to see varying levels of appreciation going forward. But experts agree we’ll see prices grow at the national level (see graph below):

This is yet another good sign for buyers and overall affordability. While prices will still go up nationally, it’ll be at a much more sustainable pace. And that predictability makes it easier to plan your budget. It also gives you peace of mind that prices won’t suddenly skyrocket overnight.

This is yet another good sign for buyers and overall affordability. While prices will still go up nationally, it’ll be at a much more sustainable pace. And that predictability makes it easier to plan your budget. It also gives you peace of mind that prices won’t suddenly skyrocket overnight.

Bottom Line

After a quieter couple of years, 2026 is expected to bring more movement – and more opportunity. With sales projected to rise, mortgage rates trending lower, and price growth slowing down, the stage is set for a healthier, more active market.

So, the big question: will you be one of the movers making 2026 your year?

Connect with an agent if you want to get ready.

BrightMLS

BrightMLS

Prices Follow Inventory

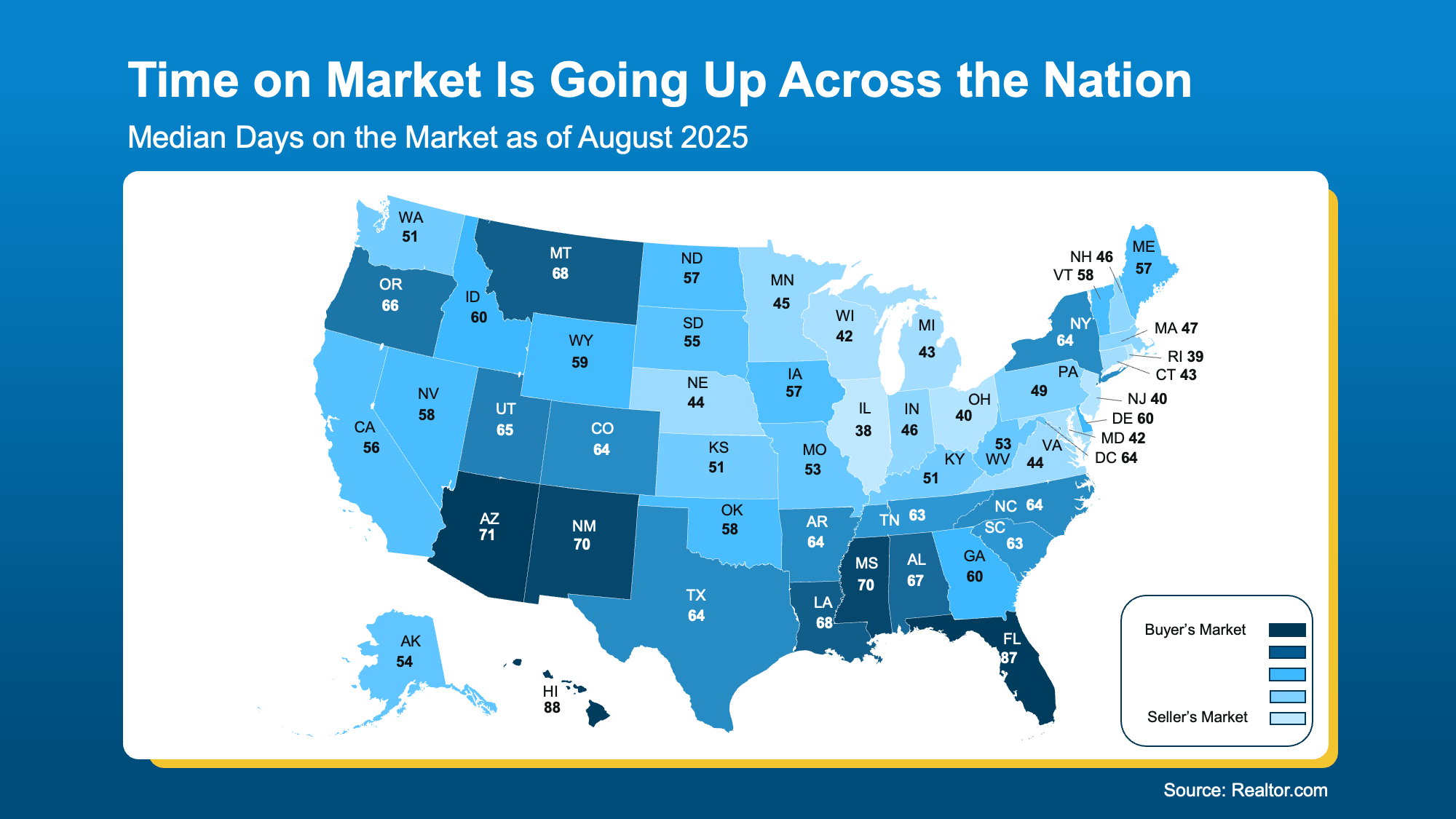

Prices Follow Inventory Time on Market Tells the Same Story

Time on Market Tells the Same Story

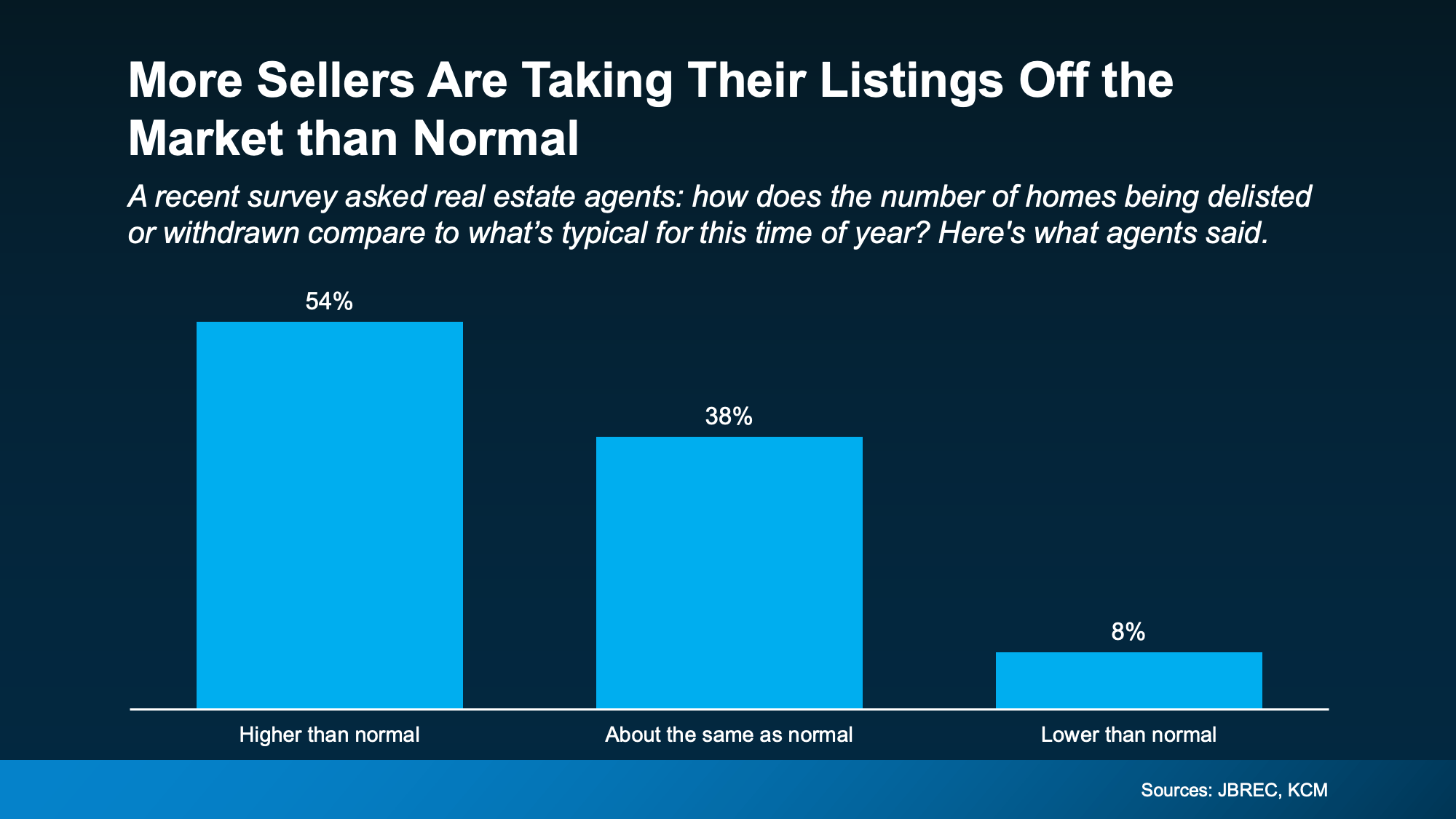

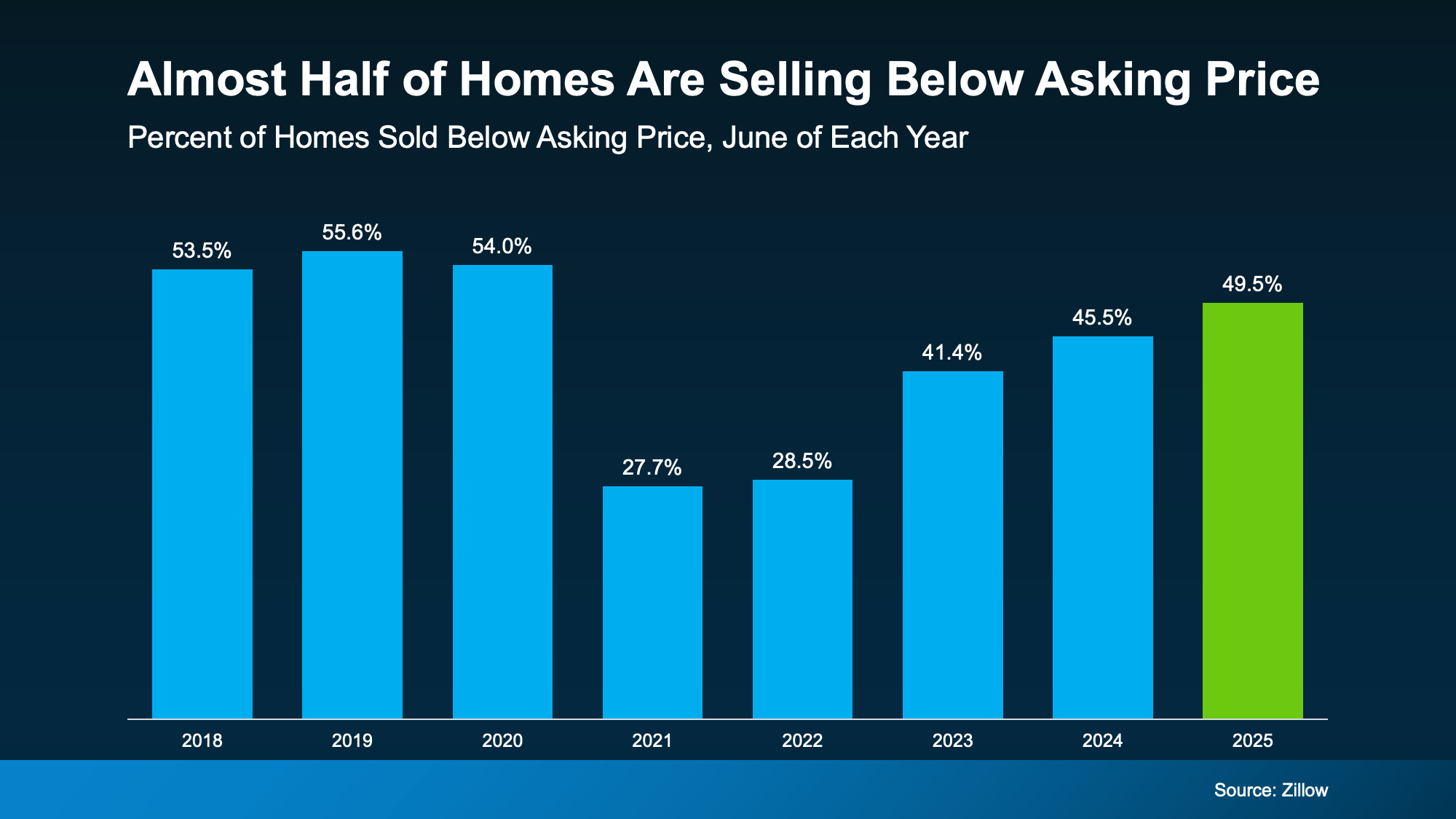

Why This Matters If You’re Selling Your House

Why This Matters If You’re Selling Your House