After several years of high mortgage rates and hesitation from buyers, momentum is quietly building beneath the surface of the housing market. Sellers are reappearing. Buyers are re-engaging. And for the first time in what feels like forever, there’s movement happening again.

No, it’s not a surge. But it is a shift – and it’s one that could set the stage for a stronger year in 2026.

So, what’s driving the comeback? Here are three big trends that are slowly breathing life back into the housing market right now.

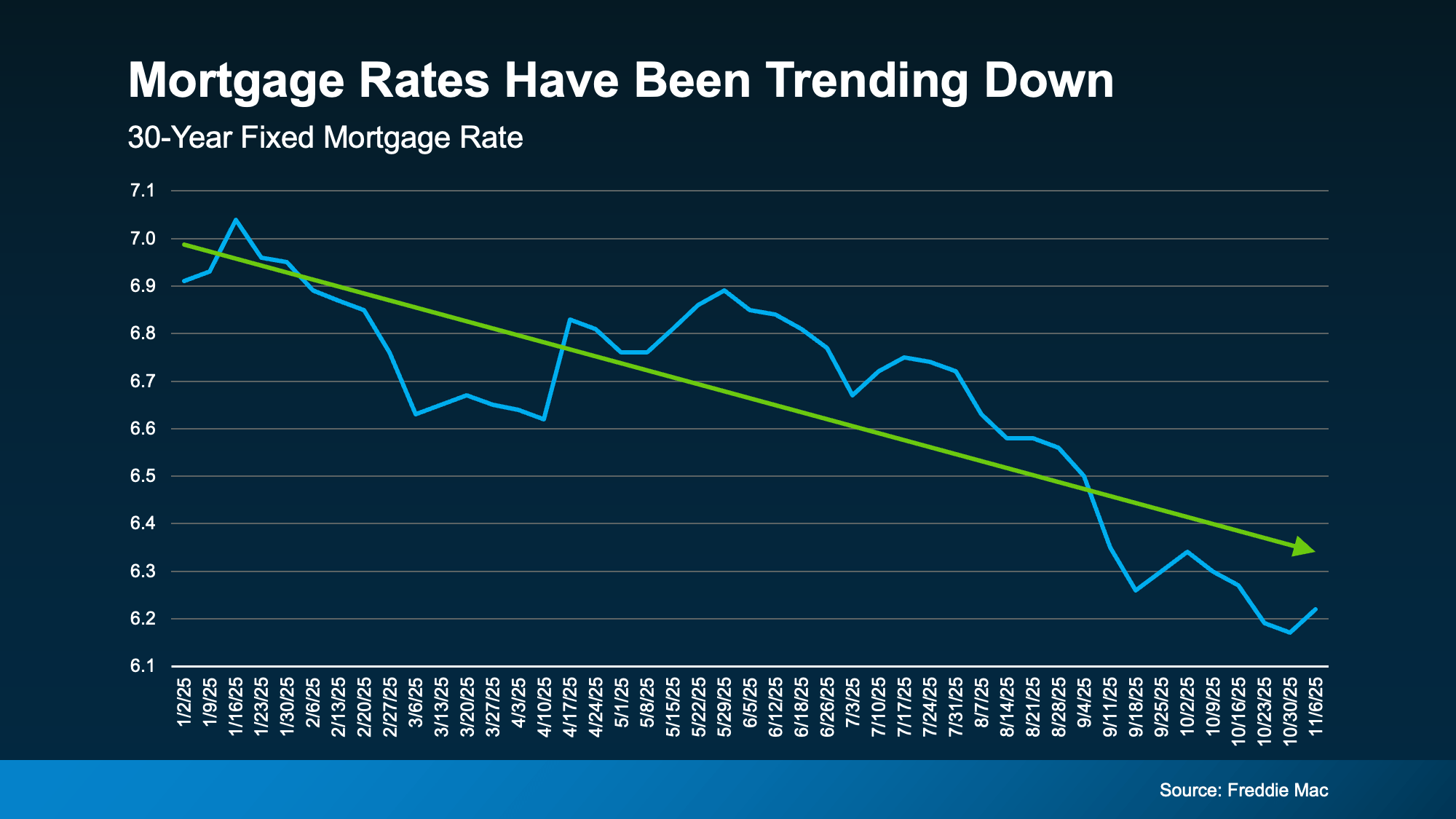

1. Mortgage Rates Have Been Coming Down

Mortgage rates are always going to have their ups and downs – that’s just how rates work. Especially with the general economic uncertainty right now, some volatility is to be expected. But, if you zoom out, it’s the larger trend that really matters most.

And overall, rates have been trending down for most of this year (see graph below):

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

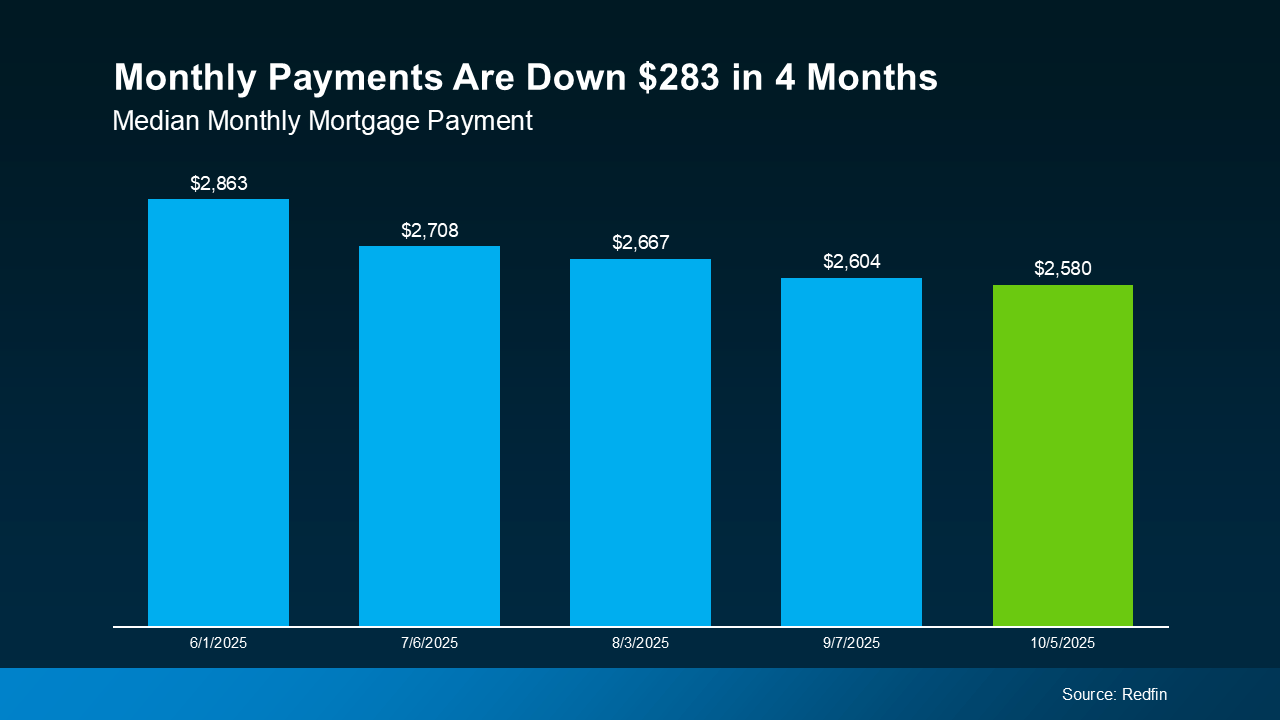

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

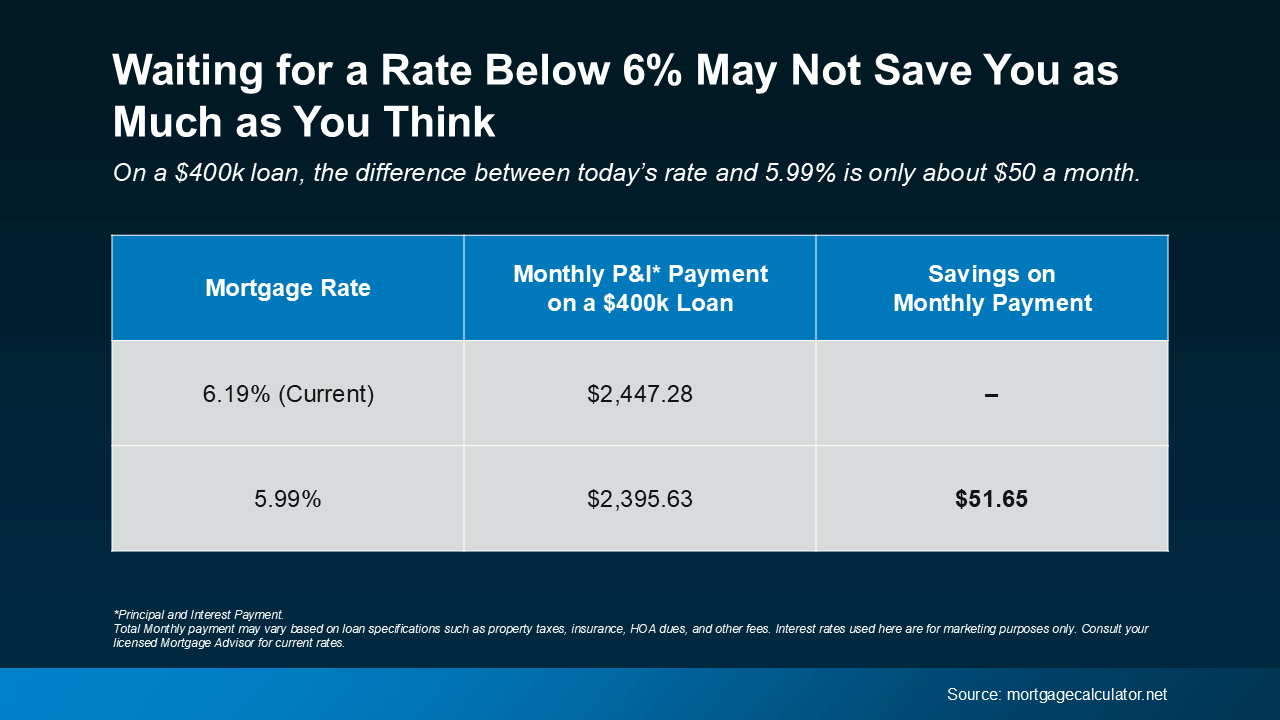

Here’s why that matters for you. This shift changes what you can actually afford. It means lower borrowing costs and more buying power. Take this as an example.

Data from Redfin shows a buyer with a $3,000 monthly budget can now afford roughly $25,000 more home than they could one year ago. That’s a big deal. And it’s just one of the reasons why activity is picking up.

2. More Homeowners Are Ready To Sell

For a while, many homeowners stayed put because they didn’t want to give up their low mortgage rate. That “lock-in effect” kept inventory tight. And while plenty of homeowners are still staying where they are today, the number of rate-locked homeowners is starting to ease as rates come down. Life changes are becoming a bigger part of what’s driving more people to move, and that’s opening up more inventory.

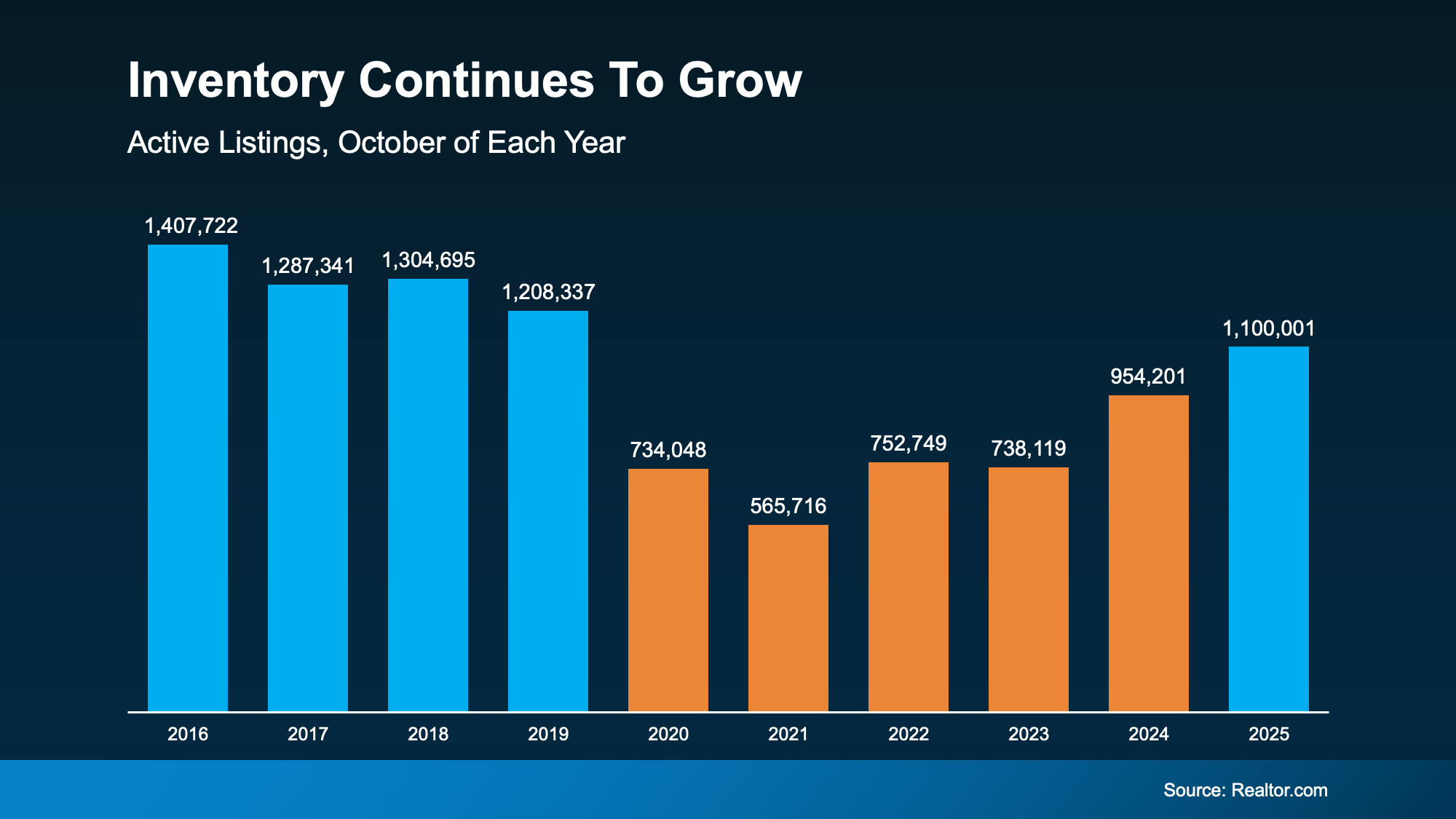

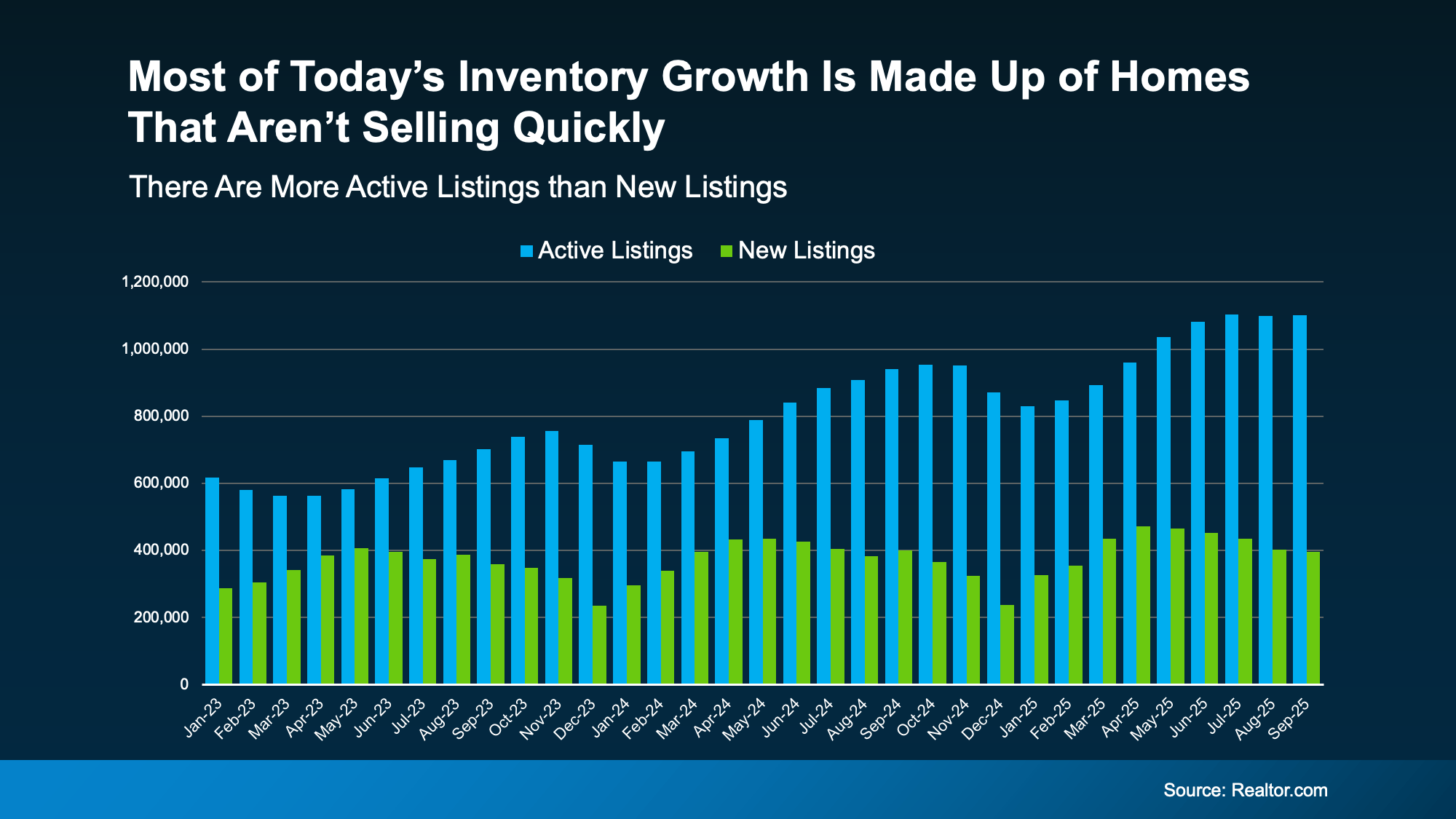

Data from Realtor.com shows just how much the number of homes for sale has grown. And the really interesting part is that the market is approaching levels that haven’t been seen for the past six years (see the blue on the graph below):

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

3. More Buyers Are Re-Entering the Market

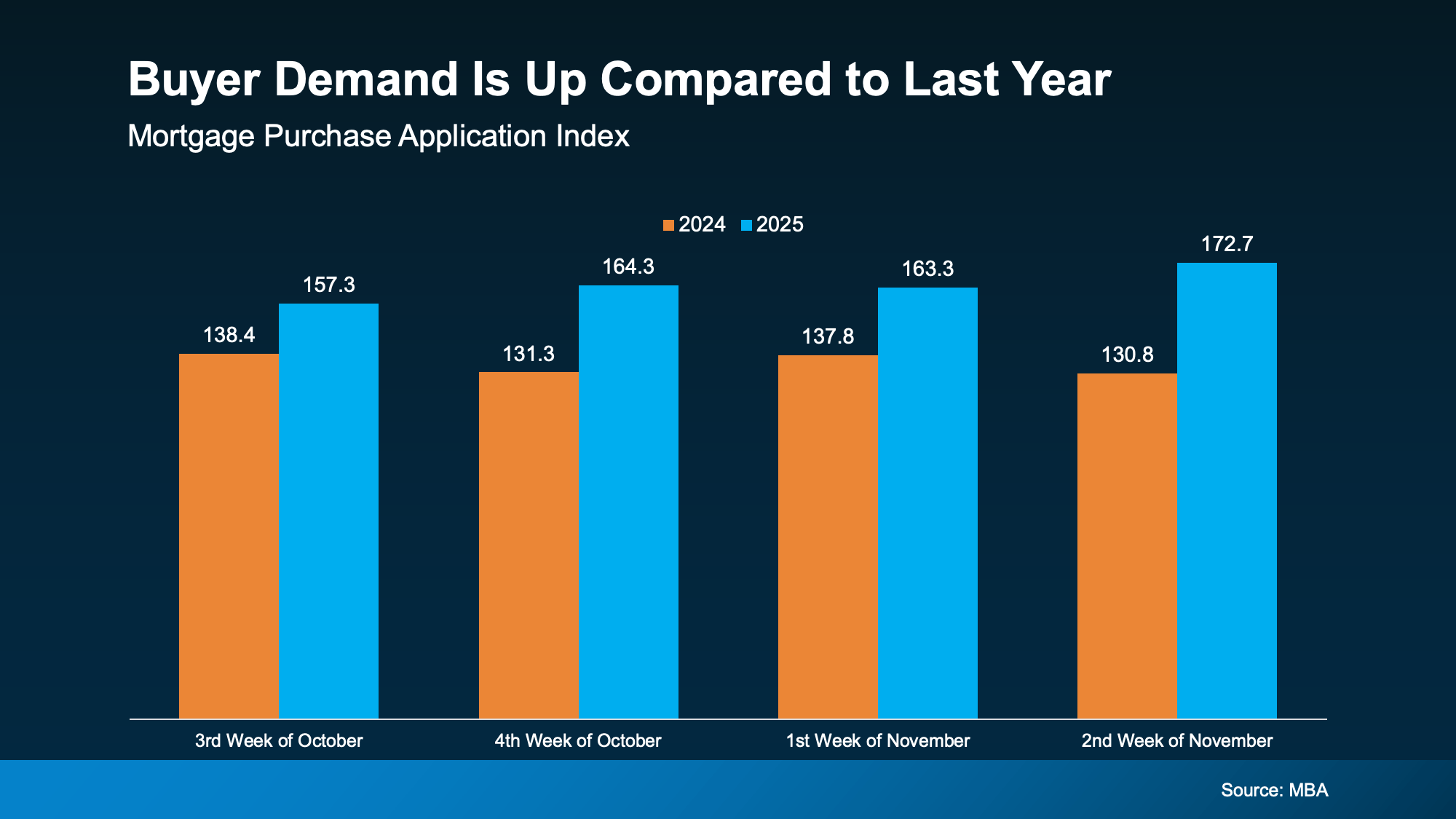

And it’s not just sellers making moves. With more options and slightly better affordability, buyers are getting back in the game, too. The Mortgage Bankers Association (MBA) reports purchase applications are up compared to last year, a clear signal that demand is building again (see graph below):

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

Now, this recovery won’t happen overnight. It’s not a flood of activity. But it is the start of steady improvement going into 2026. And that’s something a lot of people have been waiting for.

Bottom Line

After several slower-than-normal years, the market is finally starting to turn a corner. Declining mortgage rates, more listings, and growing buyer activity all point to a market gaining real traction.

Connect with a local real estate agent about what’s changing and how you can make the most of it in 2026.

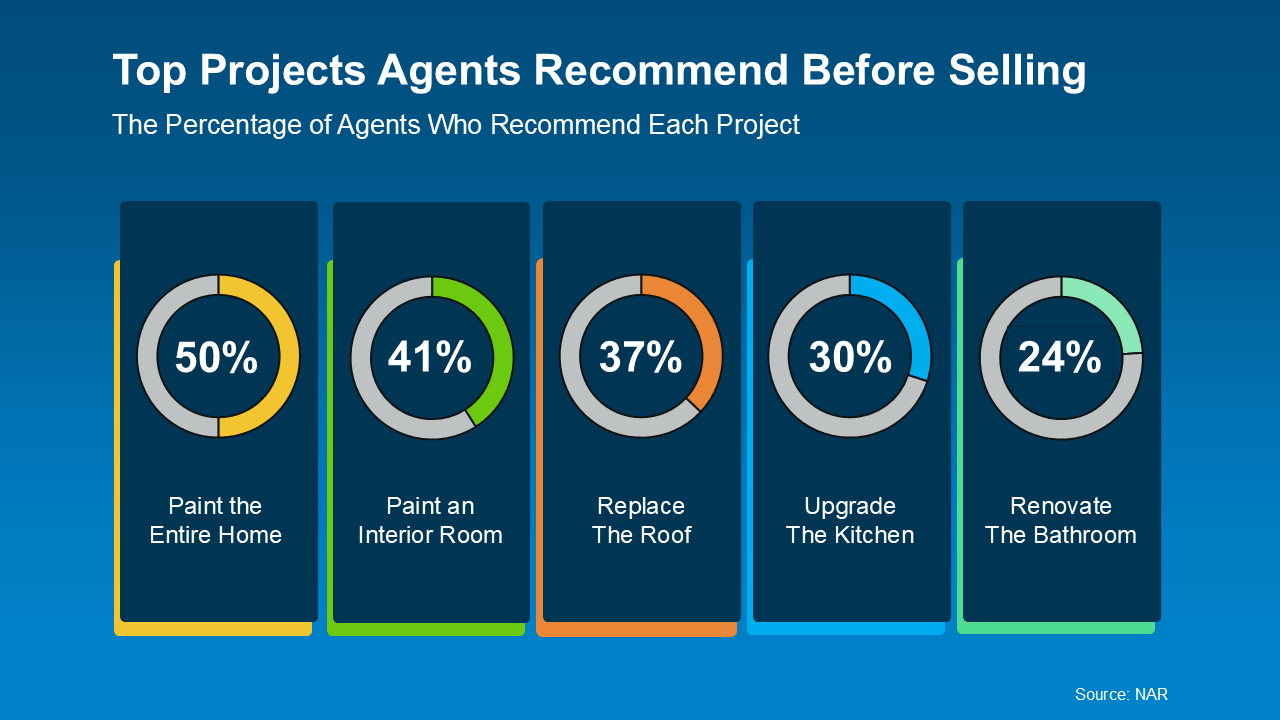

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.