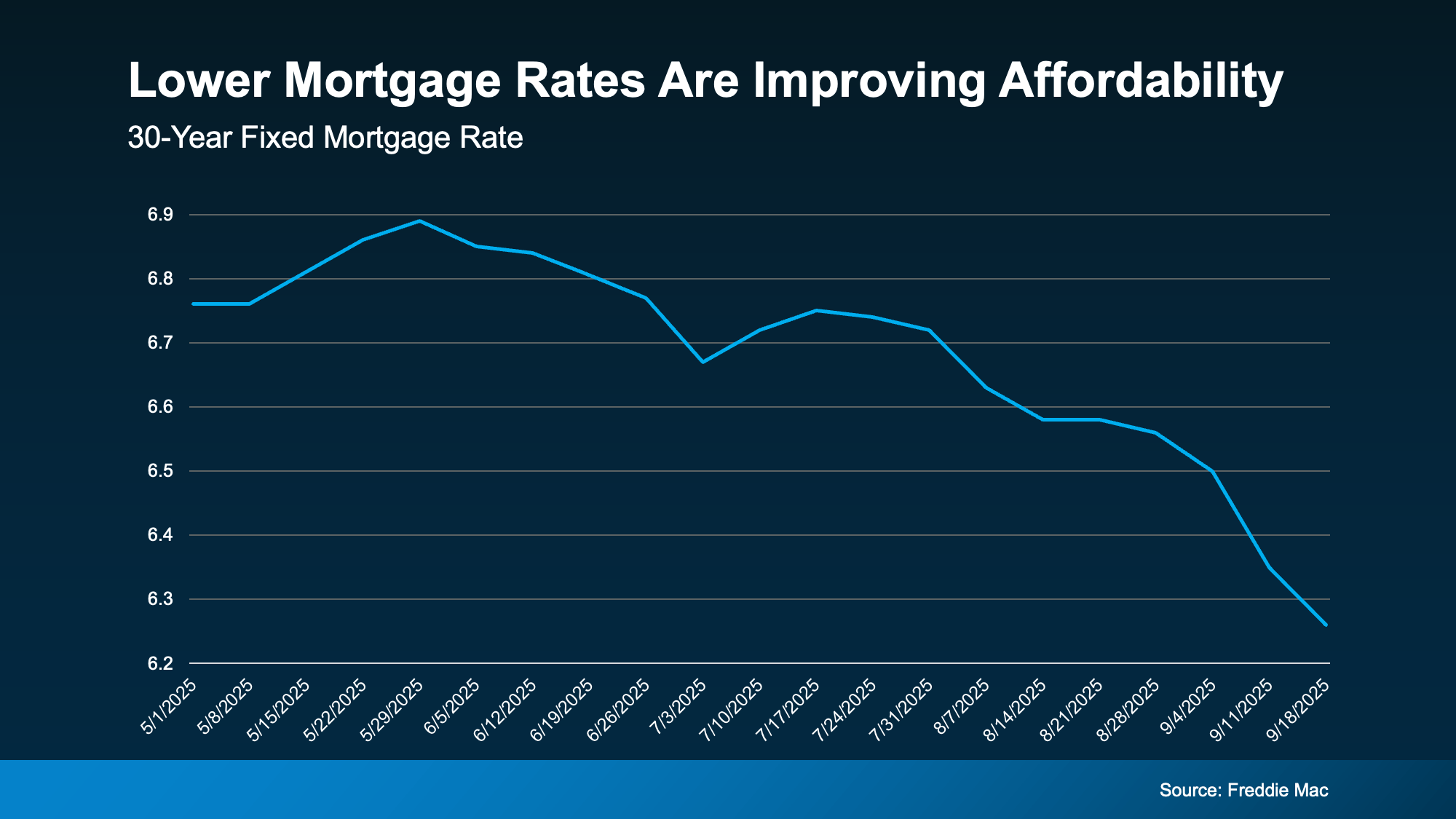

Mortgage rates have been the monster under the bed for a while. Every time they tick up, people flinch and say, “Maybe I’ll wait.” But here’s the twist. Waiting for that perfect 5-point-something rate could end up haunting your wallet later.

The Magic Number

According to the National Association of Realtors (NAR):

“. . . a 30-year fixed rate mortgage of 6% would make the median-priced home affordable for about 5.5 million more households—including 1.6 million renters. If rates were to hit that magic number, it’s likely that about 10%—or 550,000—of those additional households would buy a home over the next 12 or 18 months.”

When the market hits that mortgage rate sweet spot, as expert forecasters are starting to say is more likely in 2026, the psychological shift to lower rates will kick in for more of today’s hopeful buyers. That will unleash some pent-up demand that’s been waiting on the sidelines, and the increase in activity will cause prices to rise.

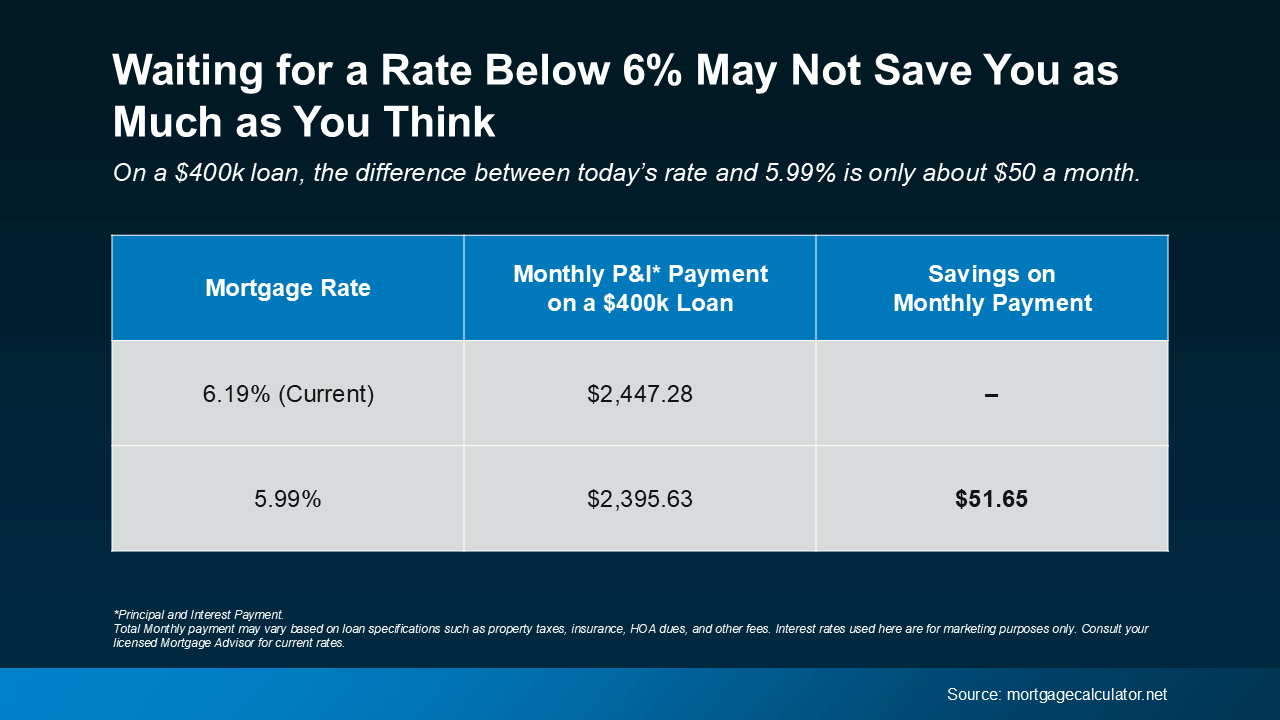

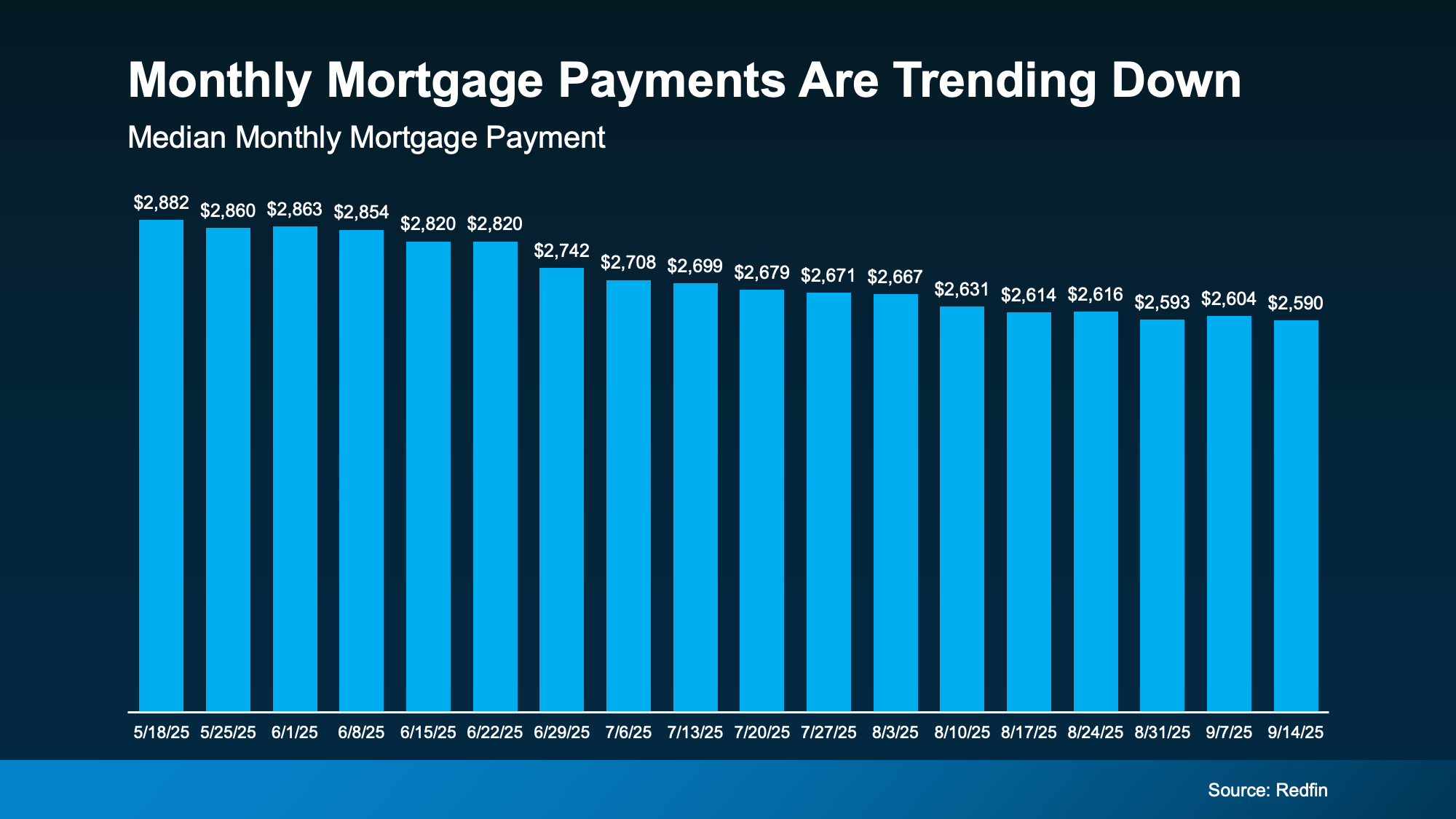

And while a 5.99% rate might sound like a big win, if you’re waiting for that number to make your move, it might not actually save you as much as you think. Here’s how the math looks when you run the numbers (see chart below):

On a $400,000 mortgage, the difference between today’s rate (around 6.2%) and 5.99% is roughly $50 a month. That’s less than many people spend on weekly coffee runs or occasional DoorDash orders. And as prices tick up with more buyers in the market, that could quickly negate any of your potential savings.

On a $400,000 mortgage, the difference between today’s rate (around 6.2%) and 5.99% is roughly $50 a month. That’s less than many people spend on weekly coffee runs or occasional DoorDash orders. And as prices tick up with more buyers in the market, that could quickly negate any of your potential savings.

So, if you’re waiting for 5.99%, that difference might not be worth missing out on today’s opportunities, like having more homes to choose from, better negotiation leverage with today’s sellers, and fewer buyers out there looking for the same houses.

Because the reality is, those benefits start to slip away when more buyers begin to make their moves – and a rate under 6% is exactly they’re waiting for.

Why Acting Now Makes Sense

Jessica Lautz, Deputy Chief Economist and VP of Research at NAR, says:

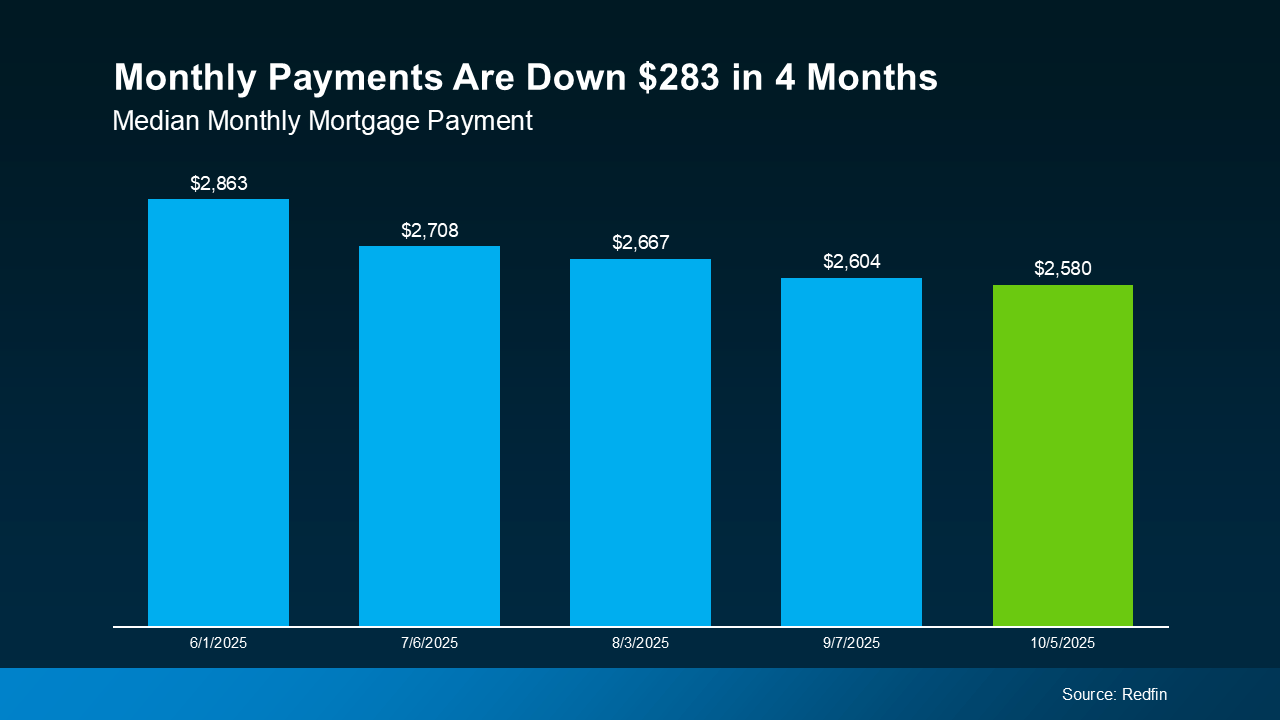

“Over the last 5 weeks, mortgage rates have averaged 6.31%. This has provided savvy buyers a sweet spot to reexamine the home search process with more inventory, widening their choices.”

And like Matt Vernon, Head of Retail Lending at Bank of America, notes:

“Rather than waiting it out for a rate that they like better, hopeful homebuyers should assess their personal financial situation—if the house is right for them, and the upfront and monthly payments are affordable, it could be the right chance to make a move.”

Bottom Line

If moving at today’s rate scares you, remember, waiting doesn’t always pay off. Once rates dip below 6%, as some experts project they’ll do next year, more buyers (and higher prices) will be back.

So, don’t be afraid of today’s mortgage rates. Because if you’re ready, this might just be your chance to make a move before the market wakes up again.

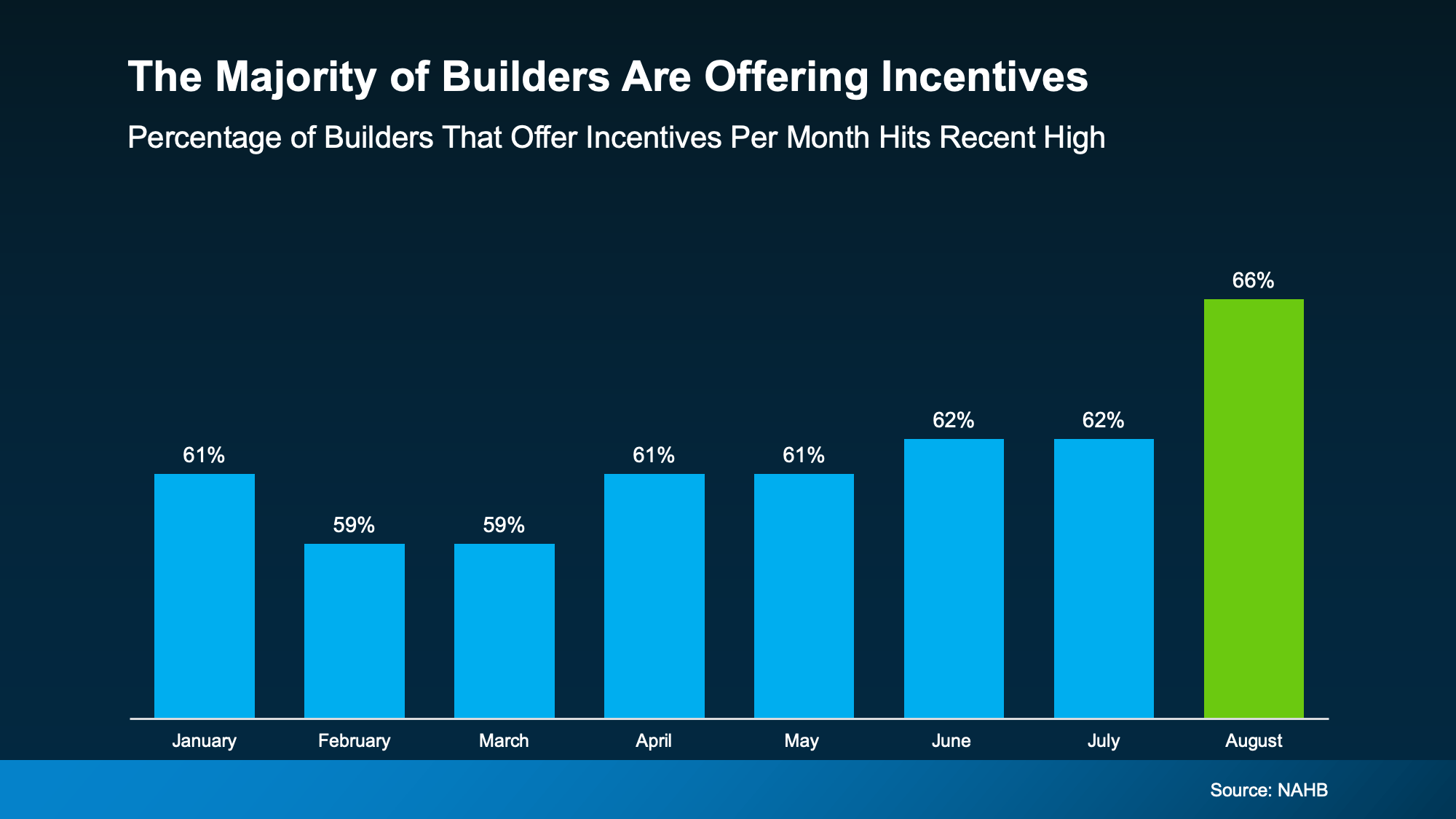

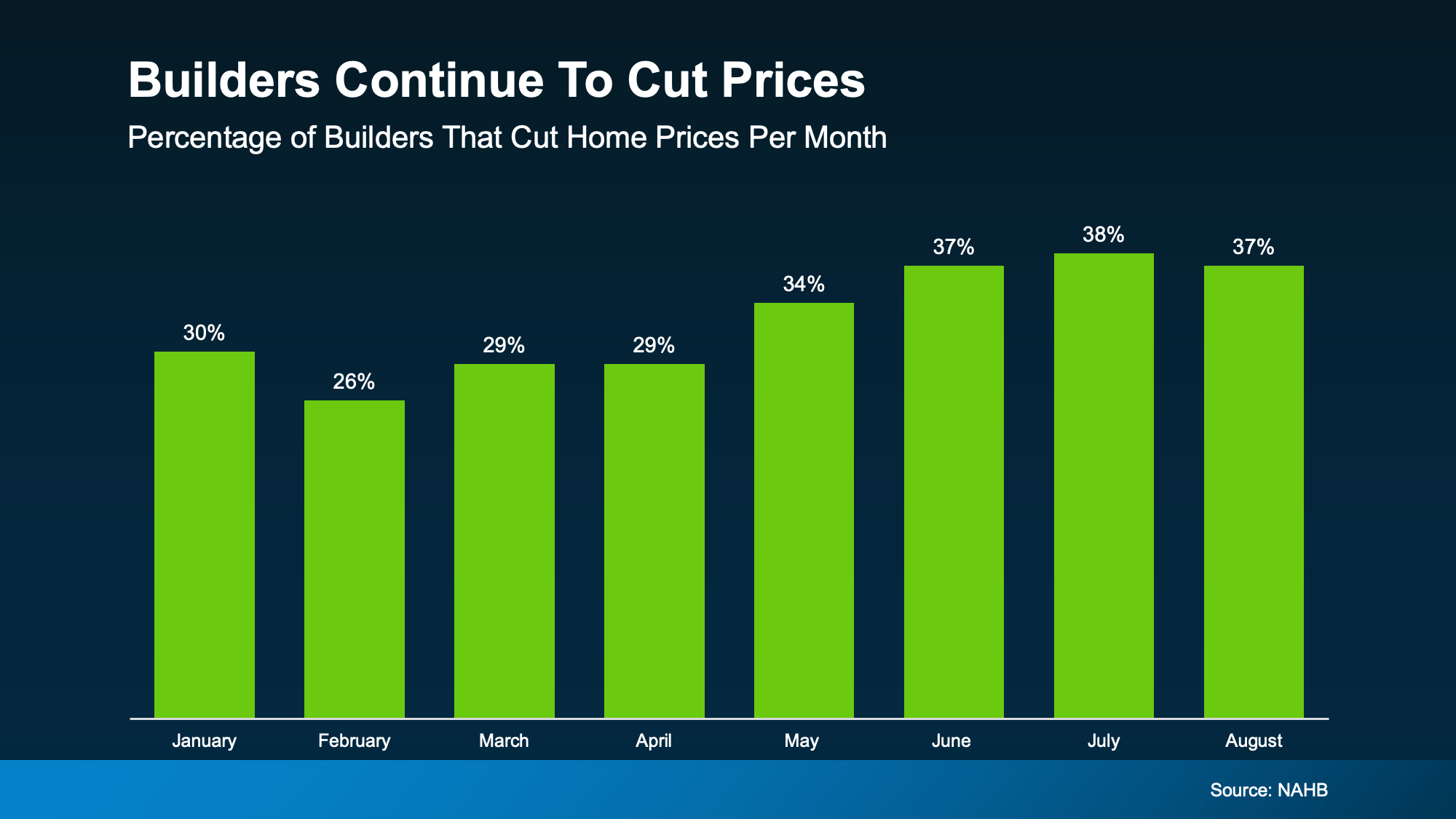

Why Builders Are Throwing in Perks

Why Builders Are Throwing in Perks

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.