Thinking about buying a home? If so, you’re probably wondering: should I buy now or wait? Nobody can make that decision for you, but here’s some information that can help you decide.

What’s Next for Home Prices?

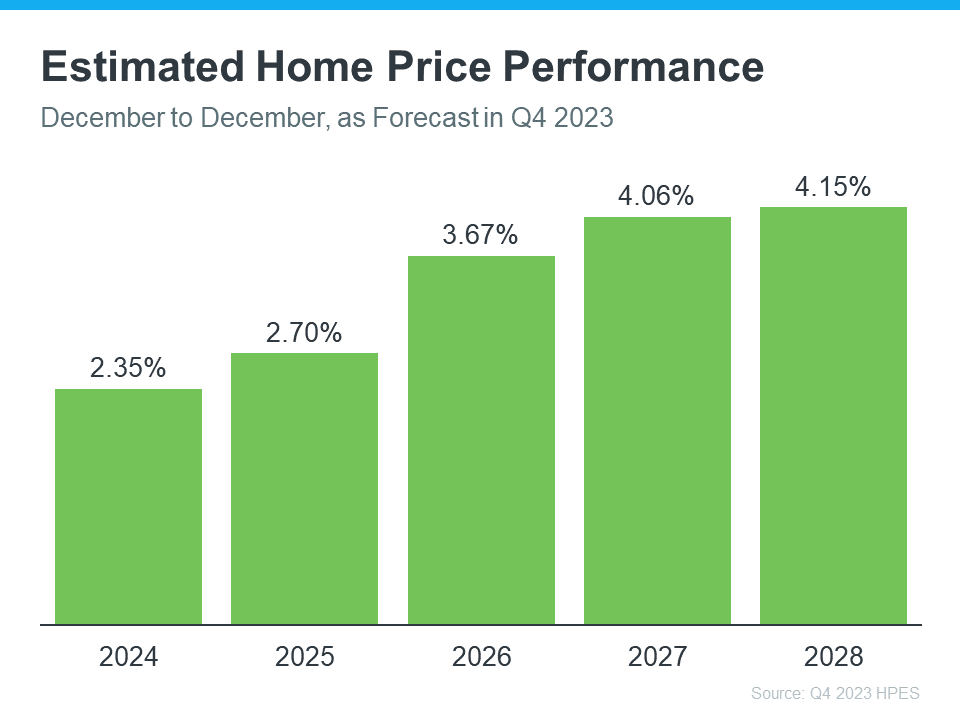

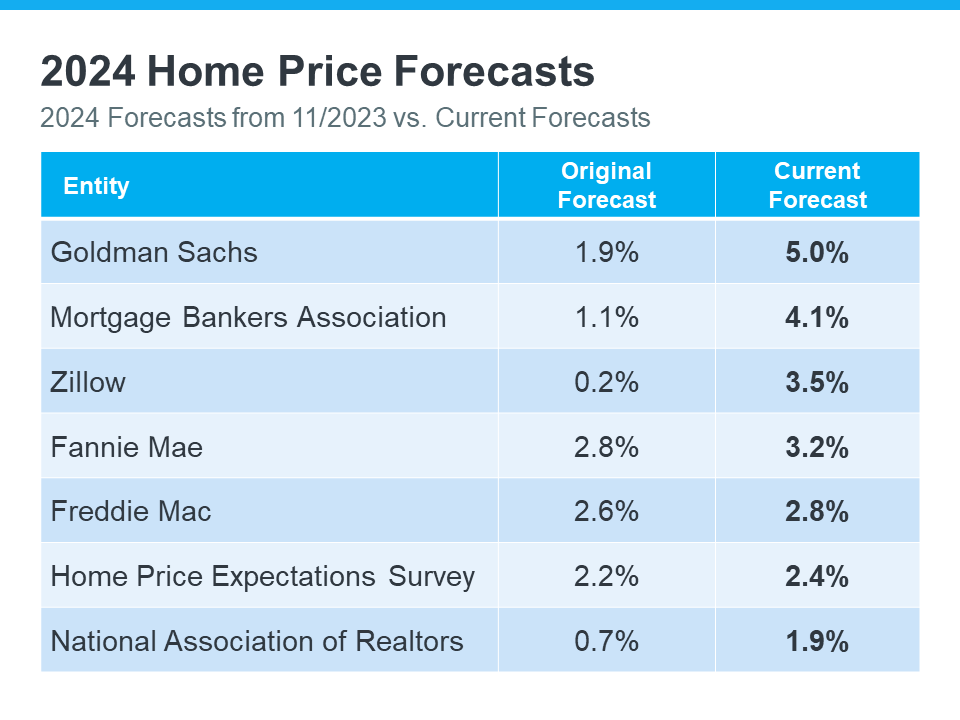

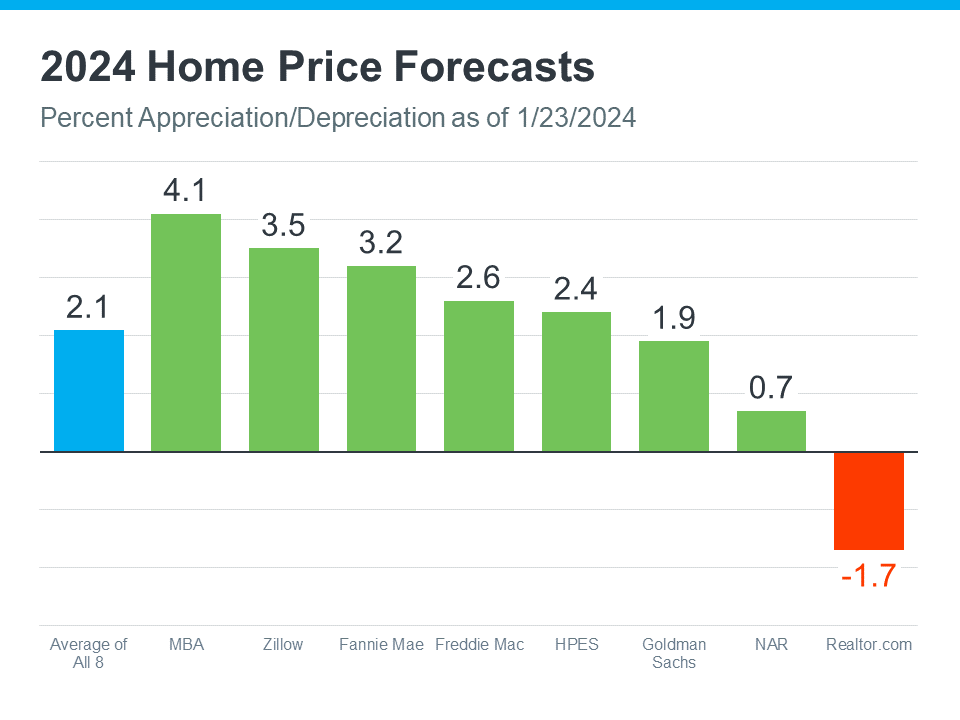

Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 experts—economists, real estate professionals, and investment and market strategists—what they think will happen with home prices.

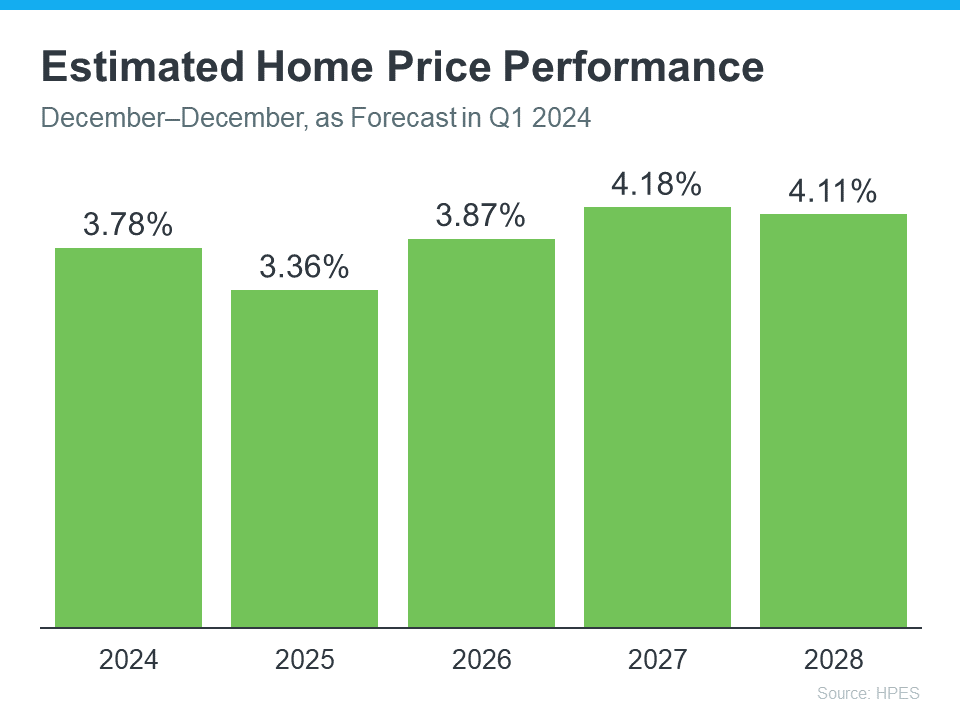

In the latest survey, those experts say home prices are going to keep going up for the next five years (see graph below):

Here’s what all the green on this chart should tell you. They’re not expecting any price declines. Instead, they’re saying we’ll see a 3-4% rise each year.

And even though home prices aren’t expected to climb by as much in 2025 as they are 2024, keep in mind these increases can really add up over time. It works like this. If these experts are right and your home’s value goes up by 3.78% this year, it’s set to grow another 3.36% next year. And another 3.87% the year after that.

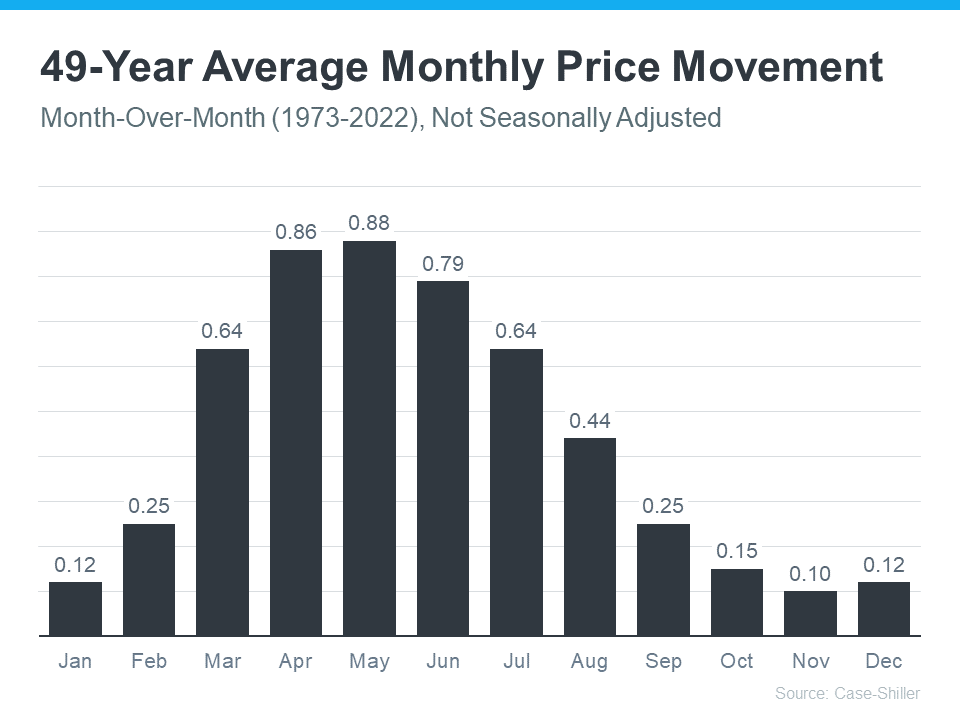

What Does This Mean for You?

Knowing that prices are forecasted to keep going up should make you feel good about buying a home. That’s because it means your home is an asset that’s projected to grow in value in the years ahead.

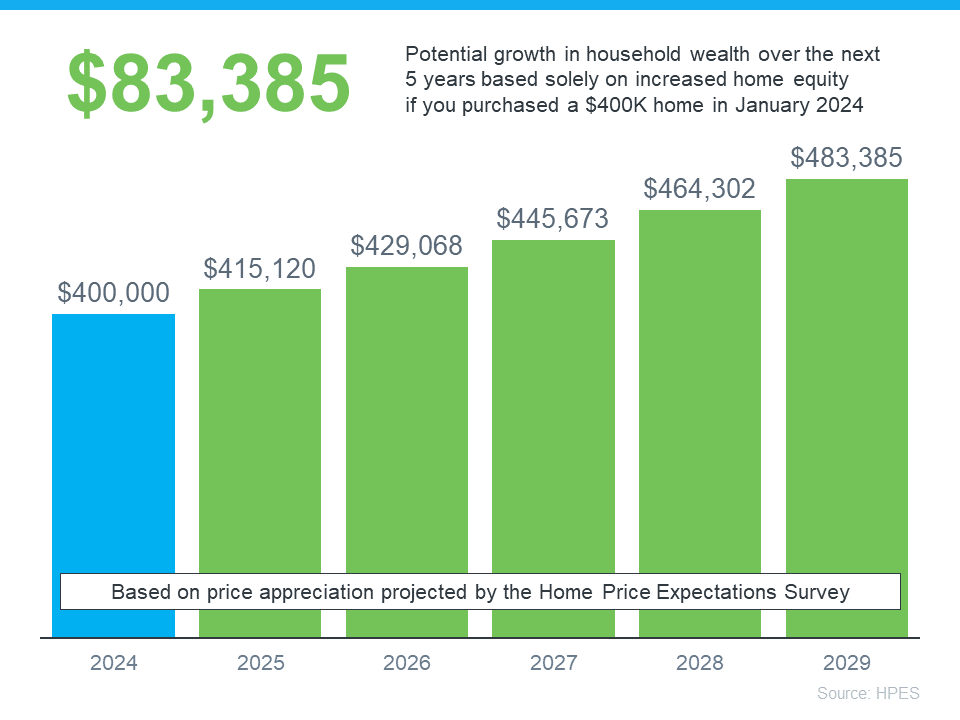

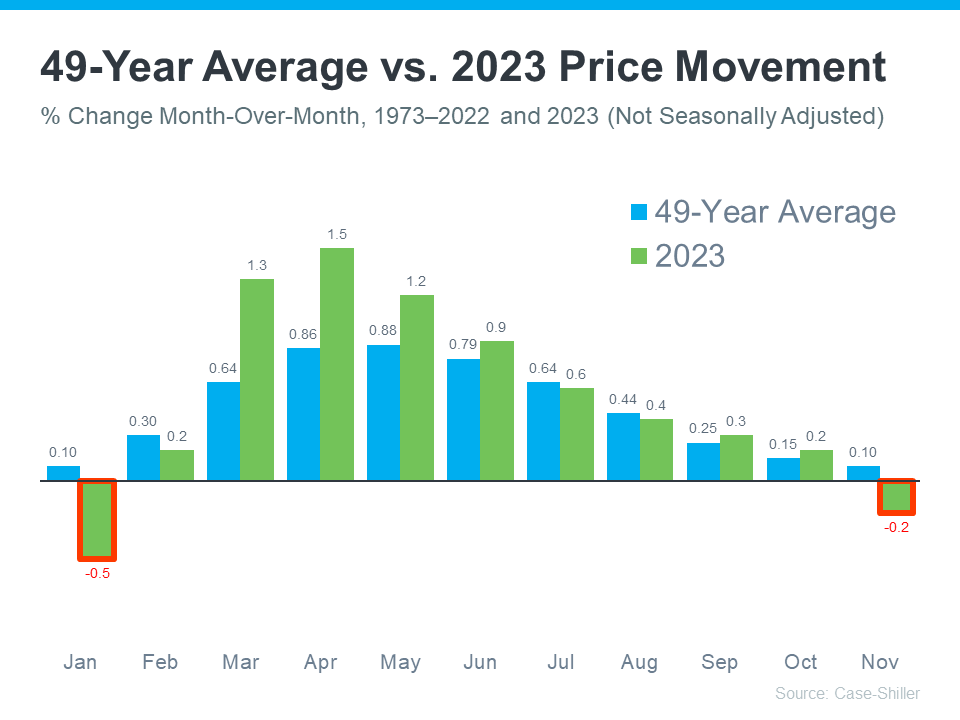

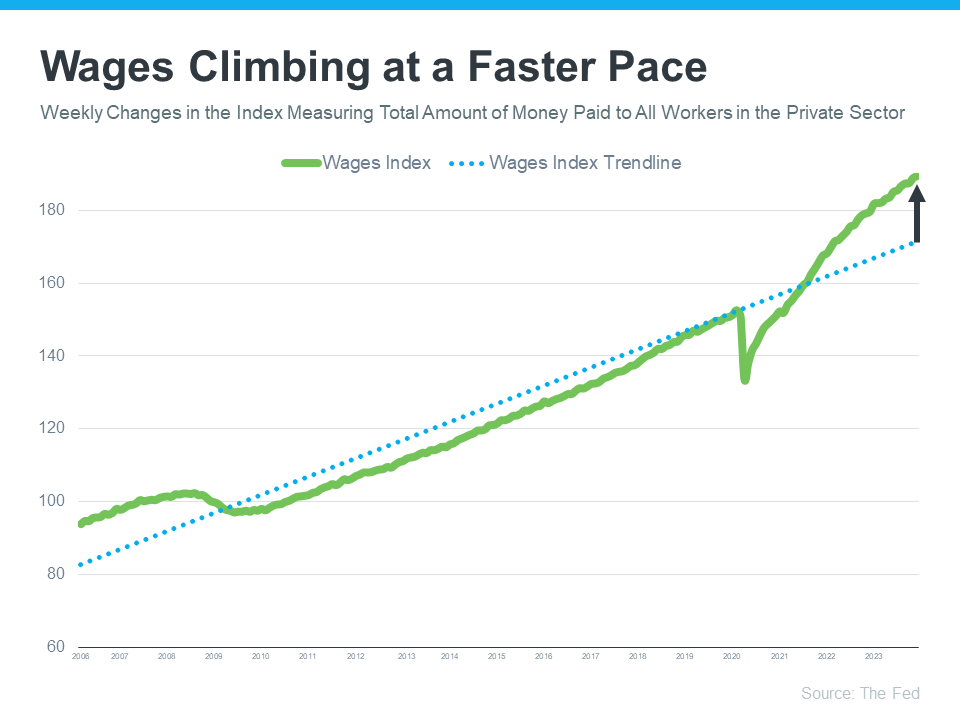

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using expert projections from the HPES. Check out the graph below:

In this example, imagine you bought a home for $400,000 at the start of this year. Based on these projections, you could end up gaining over $83,000 in household wealth over the next five years as your home grows in value.

Of course, you could also wait – but if you do, buying a home is just going to end up costing you more.

Bottom Line

If you’re thinking it’s time to get your own place, and you’re ready and able to do so, buying now might make sense. Your home is expected to keep getting more valuable as prices go up. Teaming up with a local real estate agent is a good first step to start looking for your next home today.

![Why It’s More Affordable To Buy a Home This Year [INFOGRAPHIC] Simplifying The Market](http://benningtonhomes.com/wp-content/uploads/2024/01/202401-1-1.png)

![Home Prices Forecast To Climb over the Next 5 Years [INFOGRAPHIC] Simplifying The Market](http://benningtonhomes.com/wp-content/uploads/2024/01/20240112-Home-Prices-Forecast-To-Climb-Over-The-Next-5-Years-KCM-Share.png)