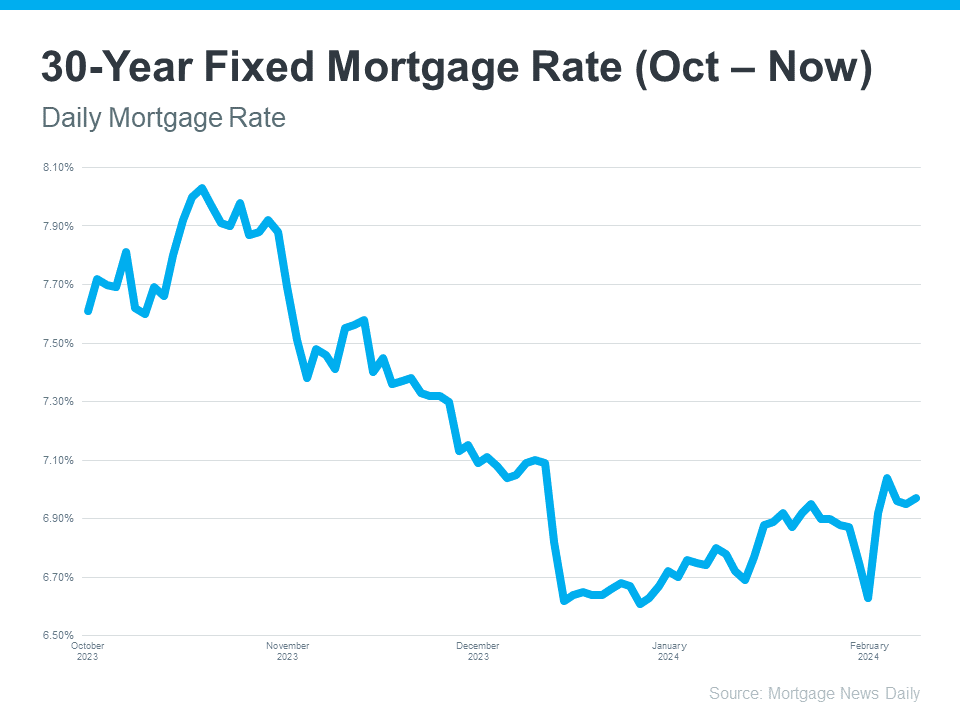

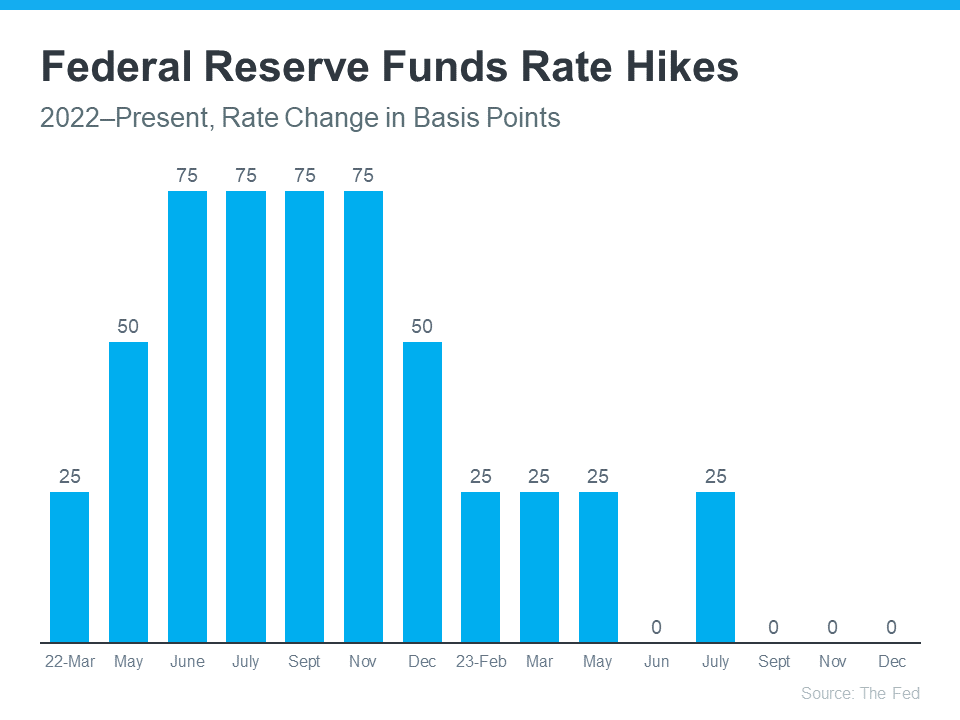

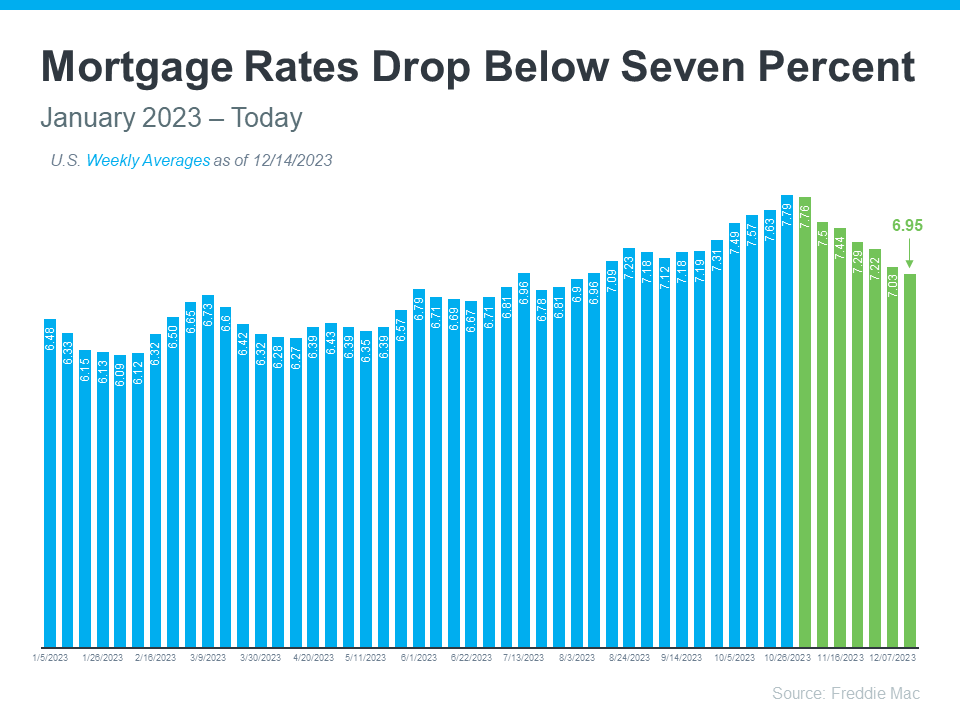

Recent headlines may leave you wondering what’s next for mortgage rates. Maybe you’d previously heard there were going to be cuts this year that would bring rates down. That refers to the Federal Reserve (the Fed) and what they do to their Fed Funds Rate. While cutting, or lowering, the Fed Funds Rate doesn’t directly determine mortgage rates, it does tend to impact them. But when the Fed met last week, a cut didn’t happen — at least, not yet.

There are a lot of factors the Fed considered in their recent decision and most of them are complex. But you don’t need to be bogged down by those finer details. What you really want is the answer to this question: does that mean mortgage rates aren’t going to fall? Here’s what you need to know.

Mortgage Rates Are Still Expected To Drop This Year

While it hasn’t happened yet, that doesn’t mean it won’t. Even Jerome Powell, the Chairman of the Fed, says they still plan to make cuts this year, assuming inflation cools:

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

When this happens, history shows mortgage rates will likely follow. That means hope isn’t lost. As a recent article from Business Insider explains:

“As inflation comes down and the Fed is able to start lowering rates, mortgage rates should go down, too. . .”

What This Means for You

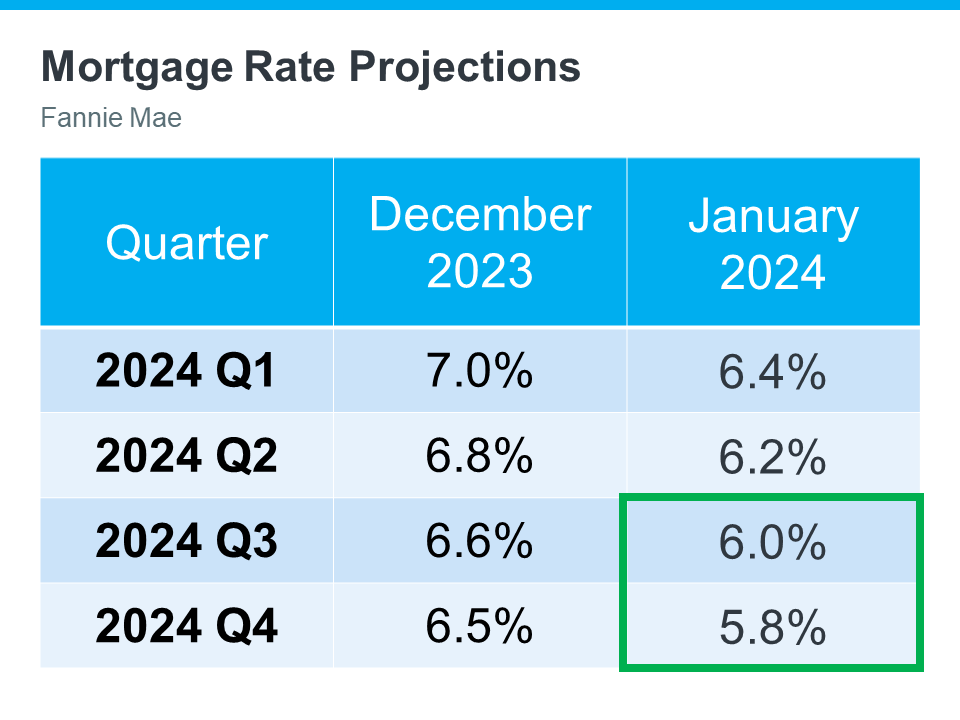

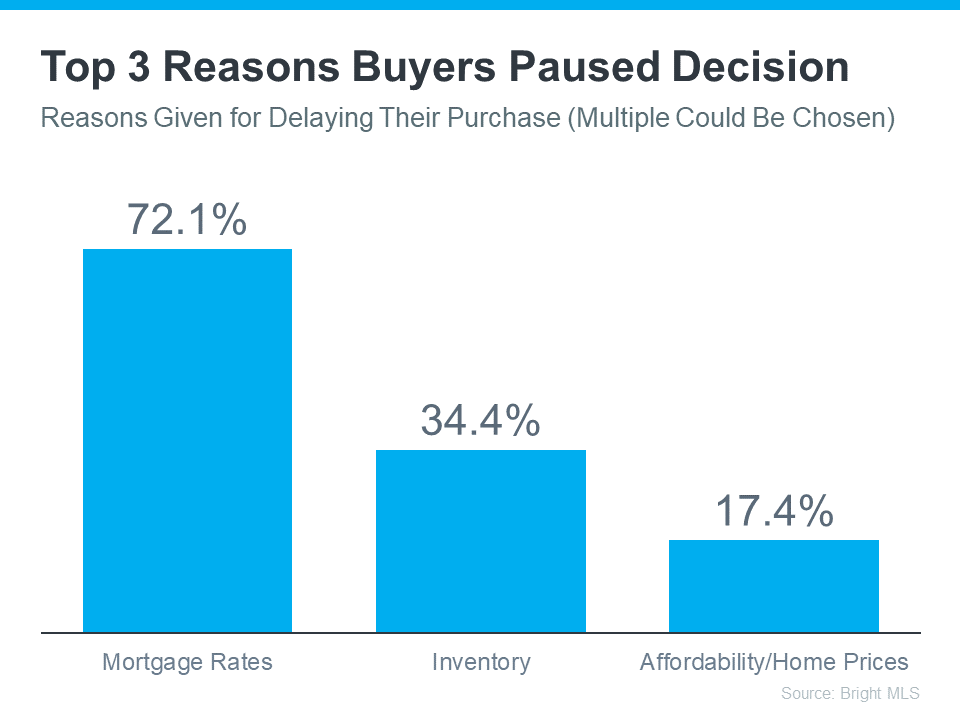

But you don’t necessarily want to wait for it to happen. Mortgage rates are notoriously hard to forecast. There are so many factors at play and any one of those can change the projections as the economy shifts. And it’s why the experts offer this advice. As Mark Fleming, Chief Economist at First American, says:

“Well, mortgage rate projections are just that, projections, not promises and don’t forget how hard it is to forecast them. . . So my advice is to never try to time the market . . . If one is financially prepared and buying a home aligns with your lifestyle goals, then it could be the right time to purchase. And there’s always the refinance option if mortgage rates are lower in the future.”

Basically, if you’re looking to move and trying to time the market, don’t. If you’re ready, willing, and able to move, it may still be worth it to do it now, especially if you can find the home you’ve been searching for.

Bottom Line

If you’re looking to buy a home, connect with a local real estate agent so you have someone keeping you up-to-date on mortgage rates and helping you make the best decision possible.

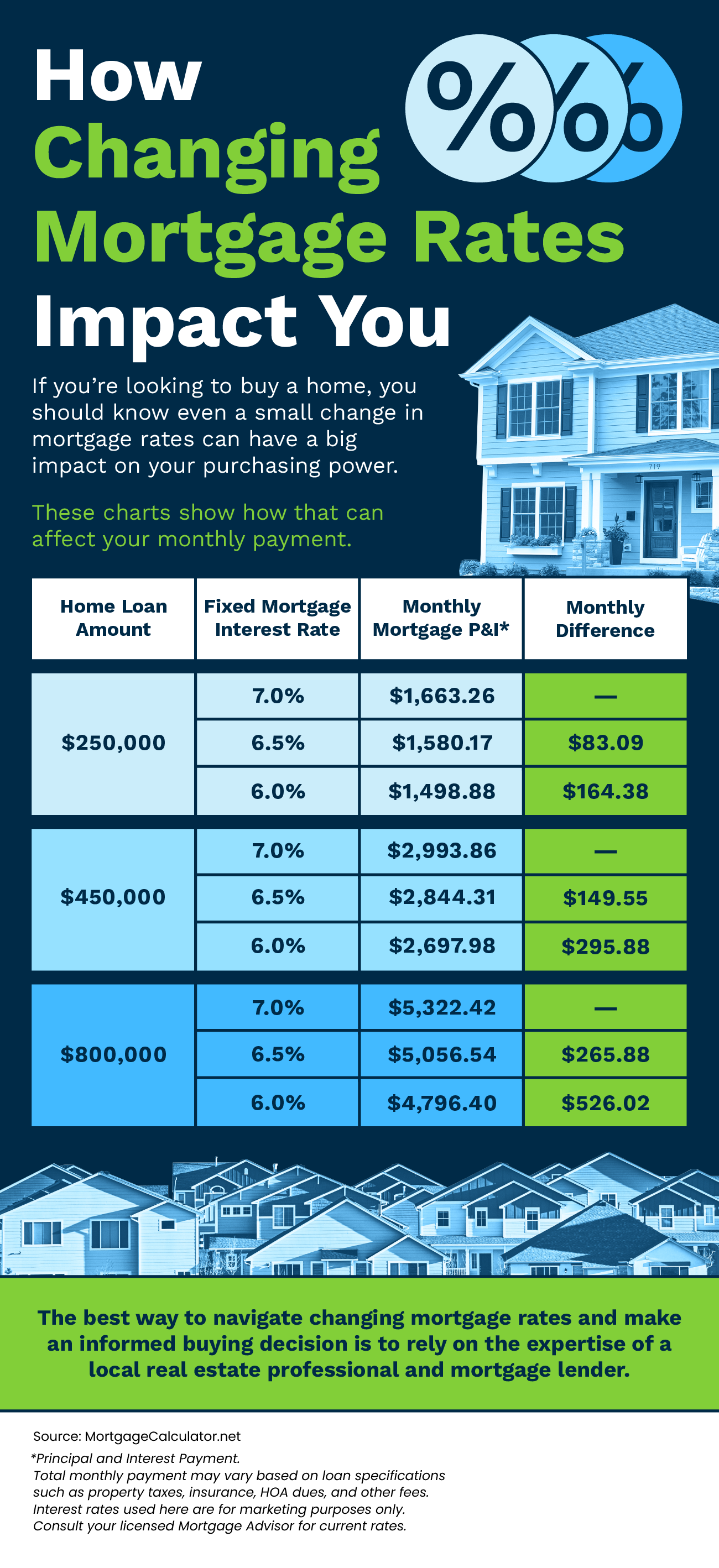

![How Changing Mortgage Rates Impact You [INFOGRAPHIC] Simplifying The Market](http://benningtonhomes.com/wp-content/uploads/2024/02/How-Changing-Mortgage-Rates-Impact-You-KCM-Share-1.png)