There’s a trend taking hold in real estate right now: more buyers are choosing newly built homes. And it’s not just about getting the latest technology or modern floorplans. It’s because they may be able to get a better deal.

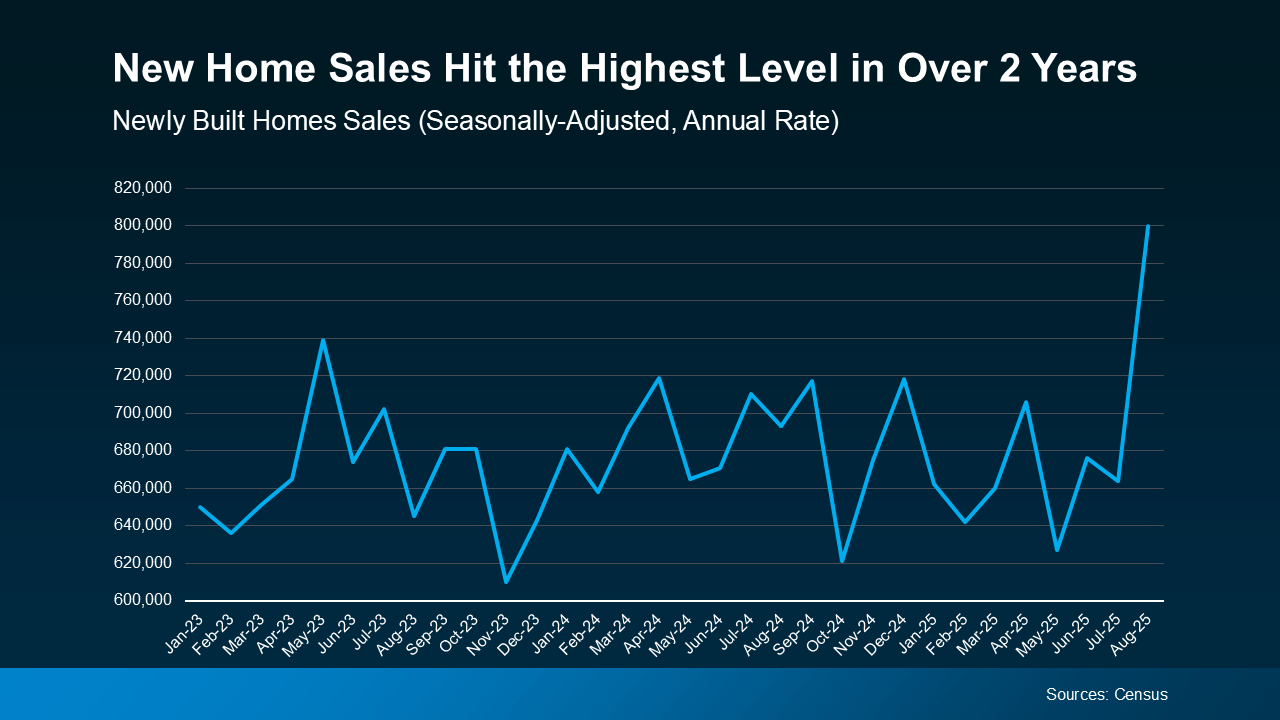

Builders are offering serious incentives today, and people are jumping on them. In fact, new home sales just hit their highest level in over two years (see graph below):

Why Builders Are Throwing in Perks

Why Builders Are Throwing in Perks

There are more newly built homes for sale right now than there have been in years. And as a buyer, that can help you in two big ways. It gives you more options to choose from on the market, and it motivates builders to sell their inventory before they build more.

That’s exactly why more buyers are scoring incentives like these:

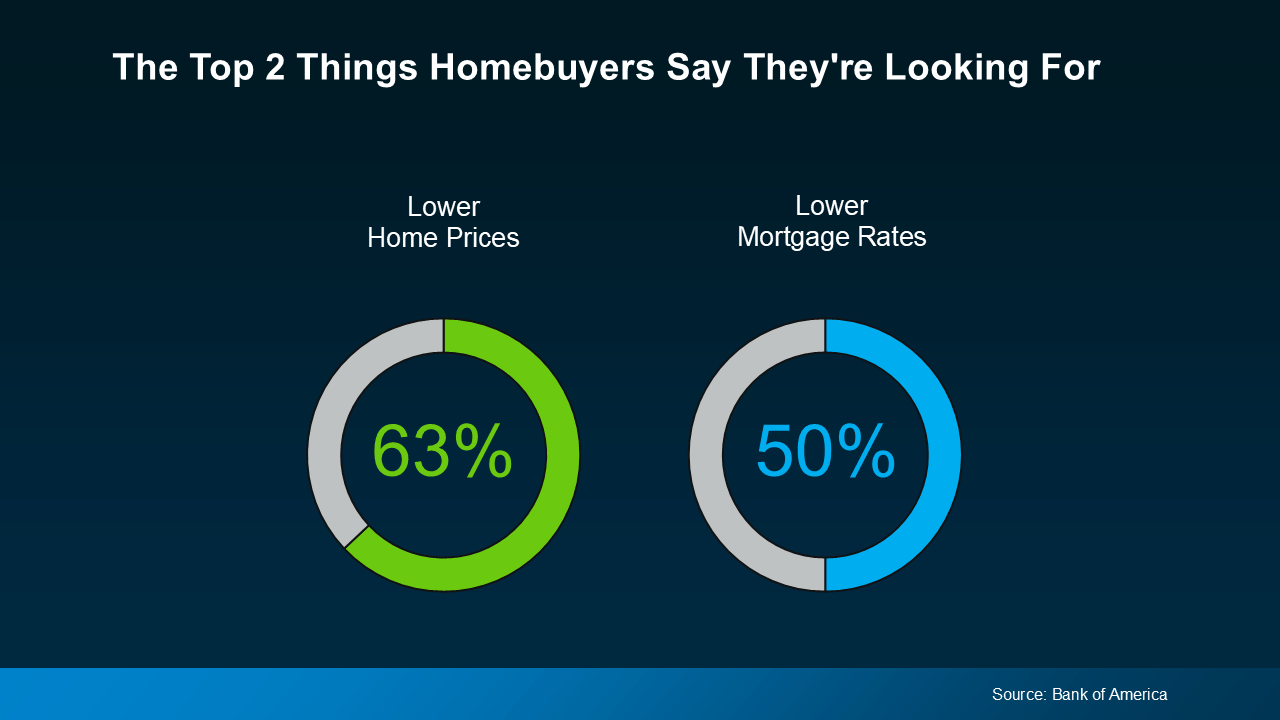

- Mortgage rate buydowns to shrink your monthly payment

- Price cuts that make homeownership more attainable

- Help with closing costs and even upgrades in some communities

The best part is, a lot of builders are offering these perks right now. According to Zonda, nearly 6 out of 10 new home communities are doing incentives on to-be-built homes. And over 75% are doing the same for quick move-ins, which are homes that are already built and ready to move into. As real estate analyst Nick Gerli explains:

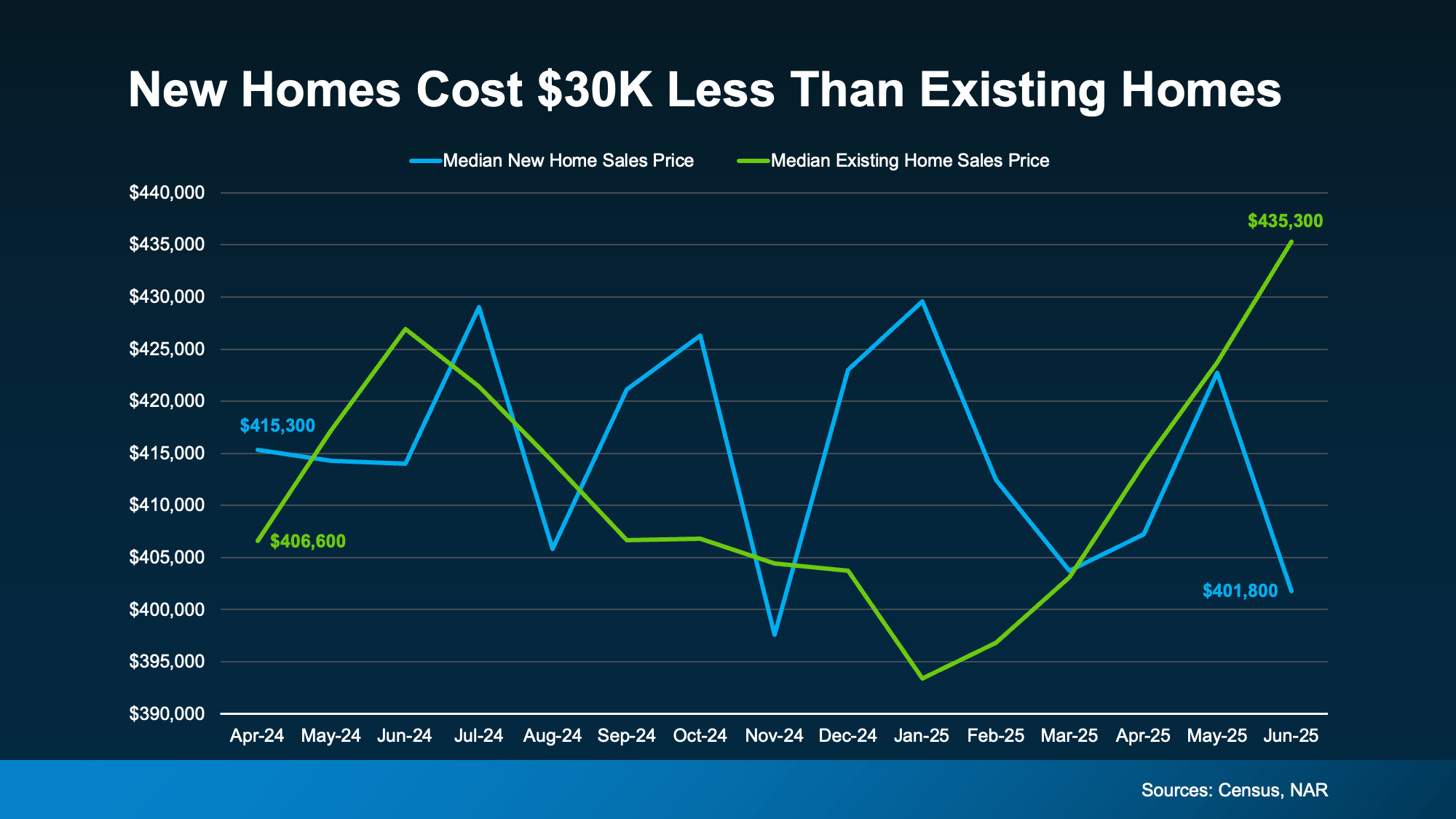

“. . . builders are adjusting to the realities of the current housing market. They’ve cut prices 13 percent from peak, and are giving generous mortgage rate buydowns on top of that.”

The big takeaway is: builders are motivated to sell. So, you could snag a lower price and maybe even a lower mortgage rate if you buy new. If you’ve been feeling priced out, these offers might be your way back in.

You Have More Brand-New Options Than Normal

Since there are more new homes on the market than usual, that gives you more options than you’ve had in years. Whether you’re looking for something turnkey or want to personalize a build, odds are there’s more available near you than you may realize.

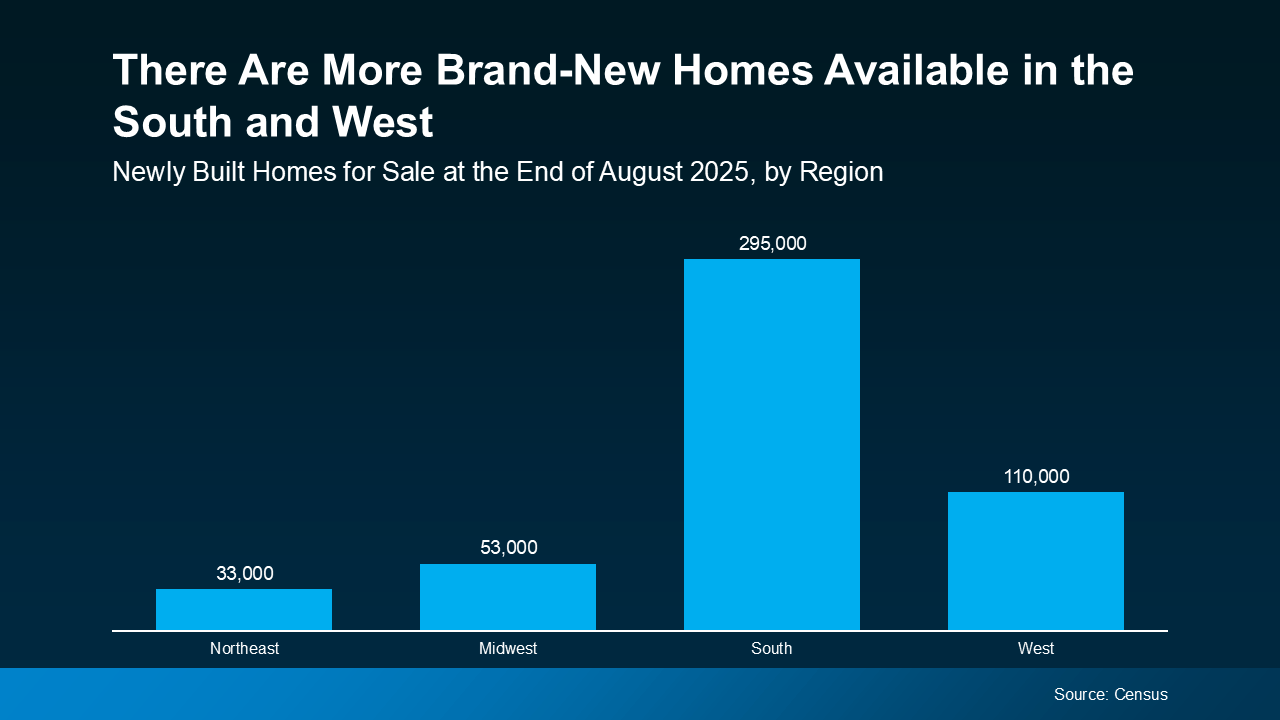

Even though the number of new homes for sale is up throughout the country, there are pockets where you have an even better chance to find a better price. According to Census data, here’s a high-level look at which parts of the country are seeing the biggest boost in newly built homes (see graph below):

Both the South and West have more new homes available, so you may find builders are even more willing to negotiate in these regions.

Both the South and West have more new homes available, so you may find builders are even more willing to negotiate in these regions.

Just know that this opportunity won’t last forever. Recent data shows builders are slowing down their production efforts. And a lot of that is to avoid having too many homes for sale. As Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains:

“The slowdown in single-family home building has narrowed the home building pipeline. There are currently 621,000 single-family homes under construction, down 1% in July and 3.7% lower than a year ago. This is the lowest level since early 2021 as builders pull back on supply.”

Moving forward, the number of new options may start to shrink as builders focus more on selling what’s already built before they add more. So, the best time in years to buy a new home may actually be right now.

Bottom Line

With builders cutting prices and maybe even helping you score a lower monthly payment, that’s not something to overlook.

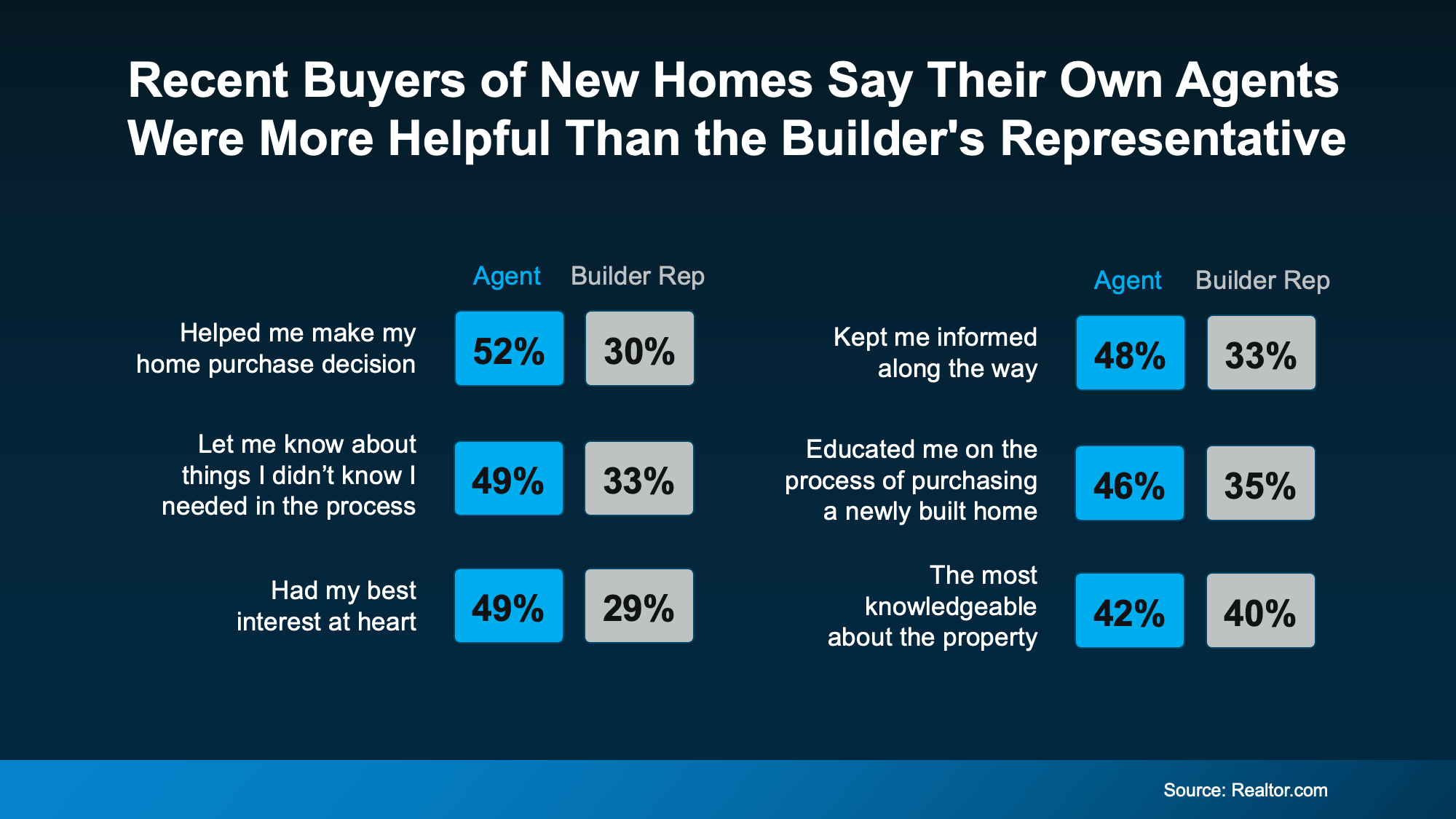

If you want to see how active builders are in your target area and what they’re offering, here’s your power move: before you even begin looking, connect with your own agent.

That way, you have someone to help you compare incentives from multiple builders and negotiate on your behalf, making sure you get the best deal possible.

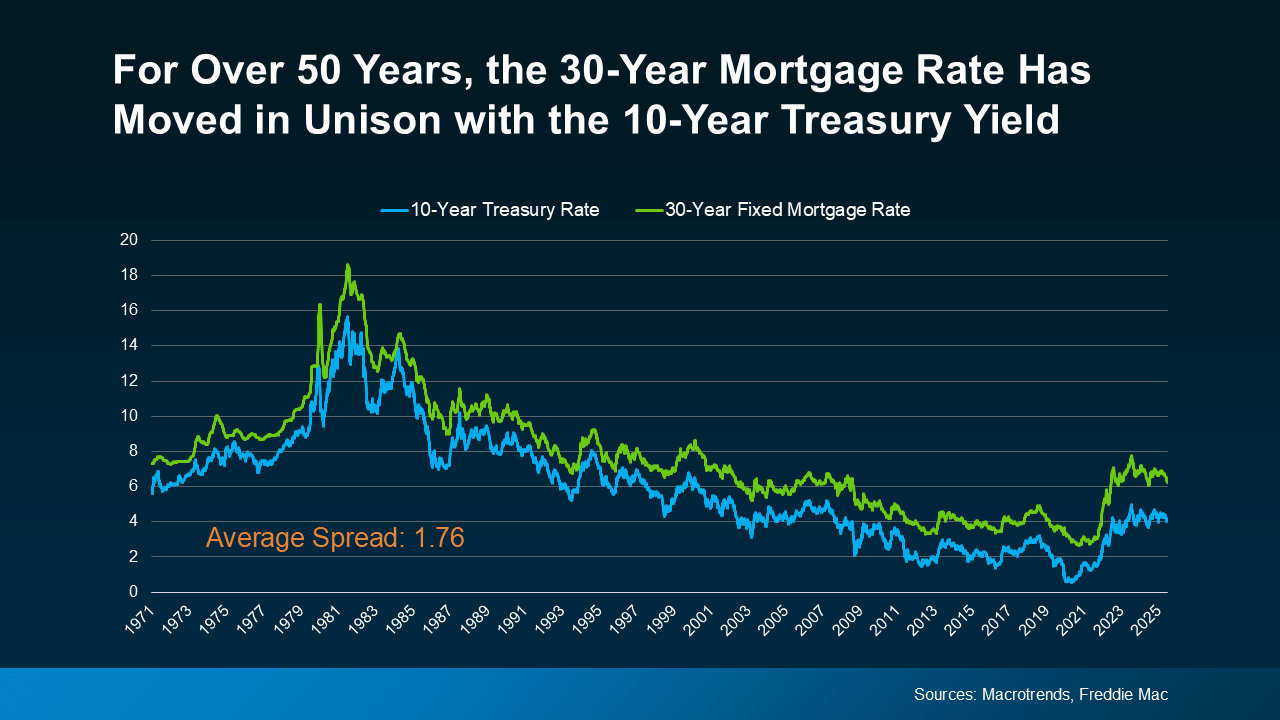

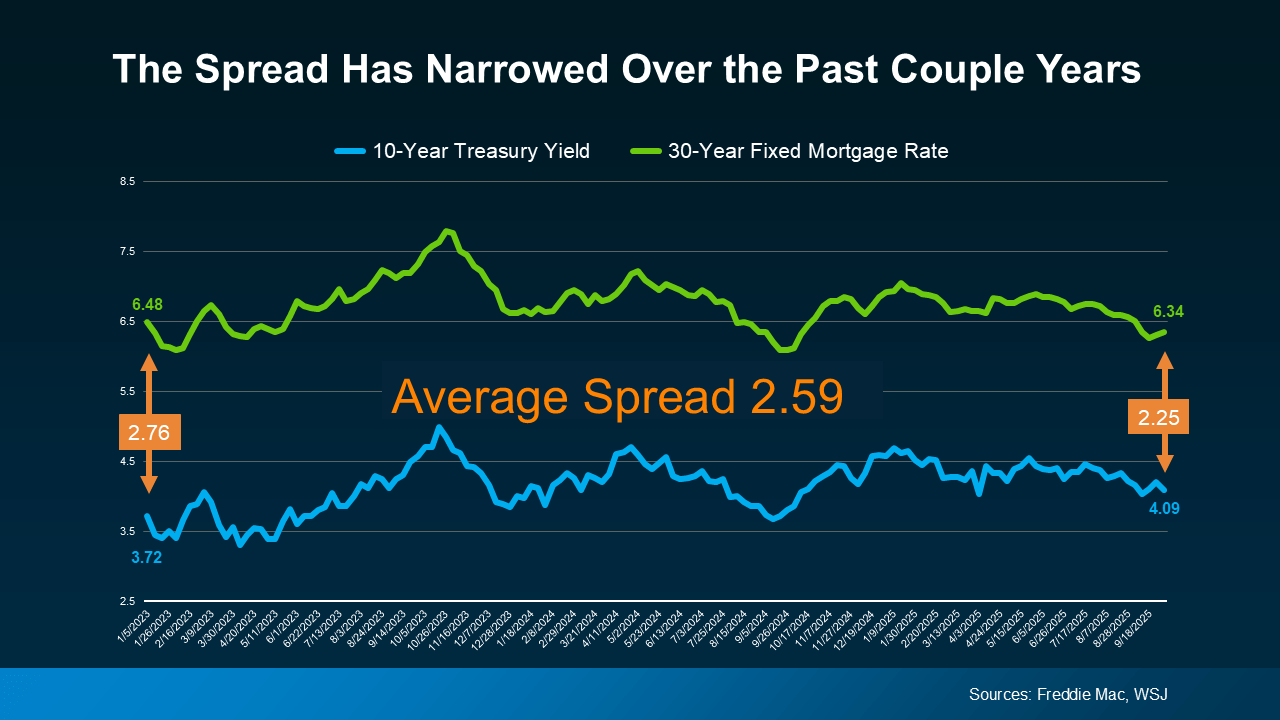

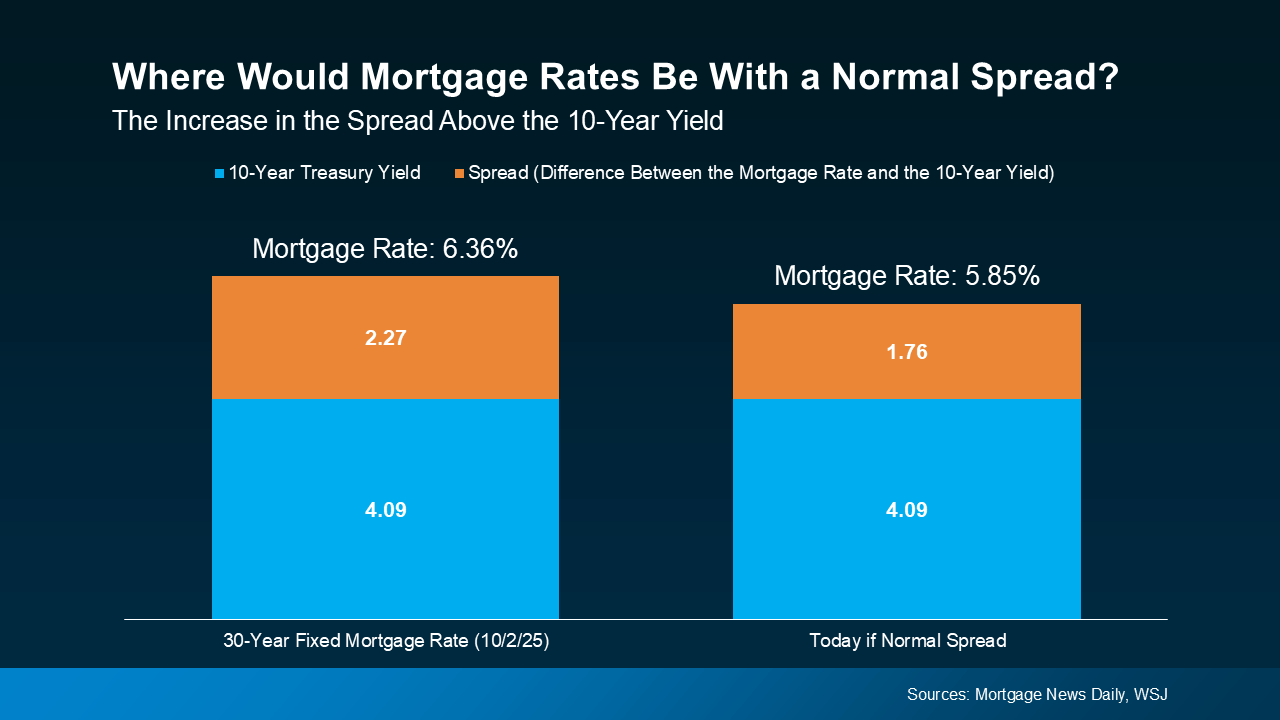

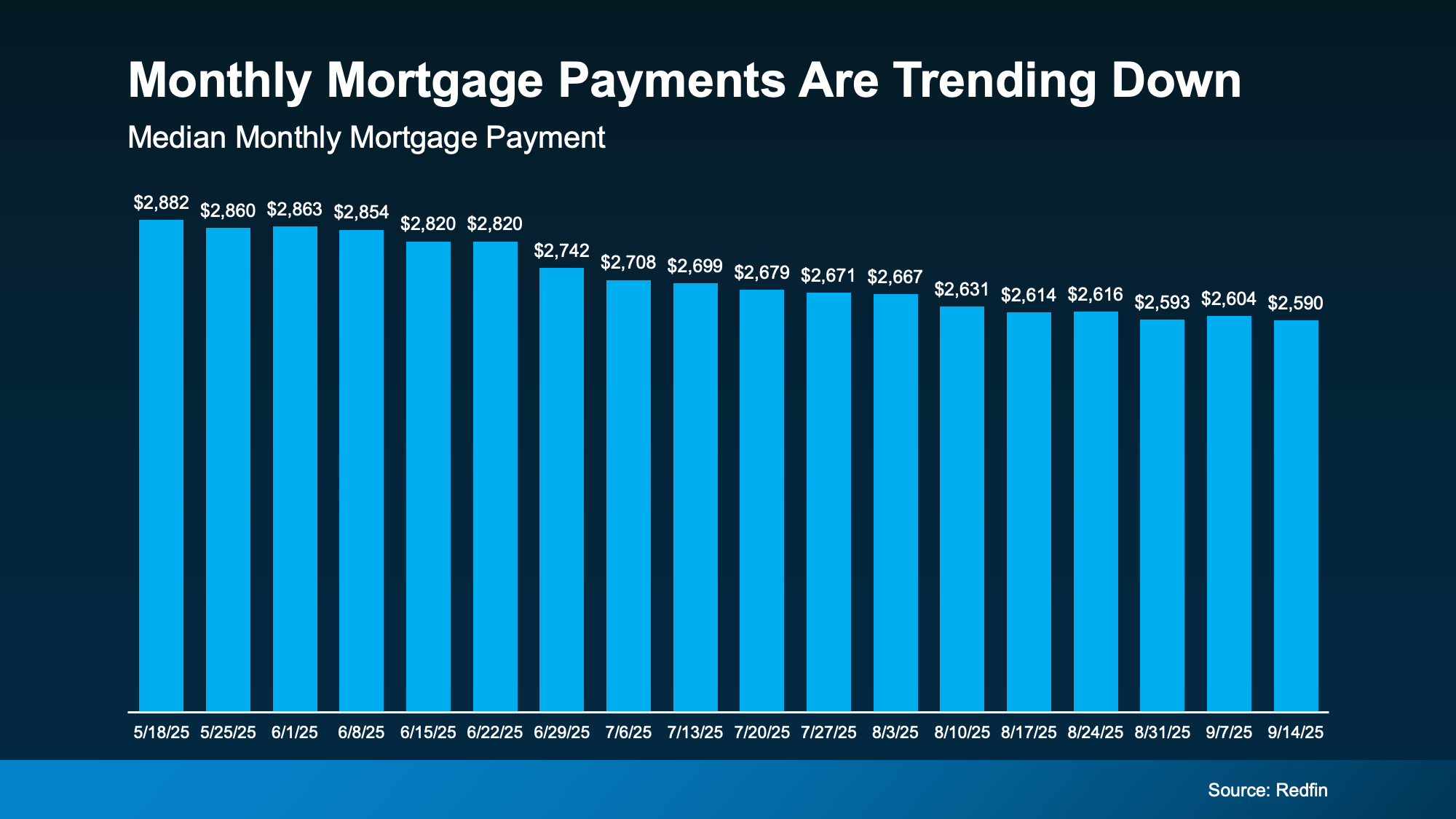

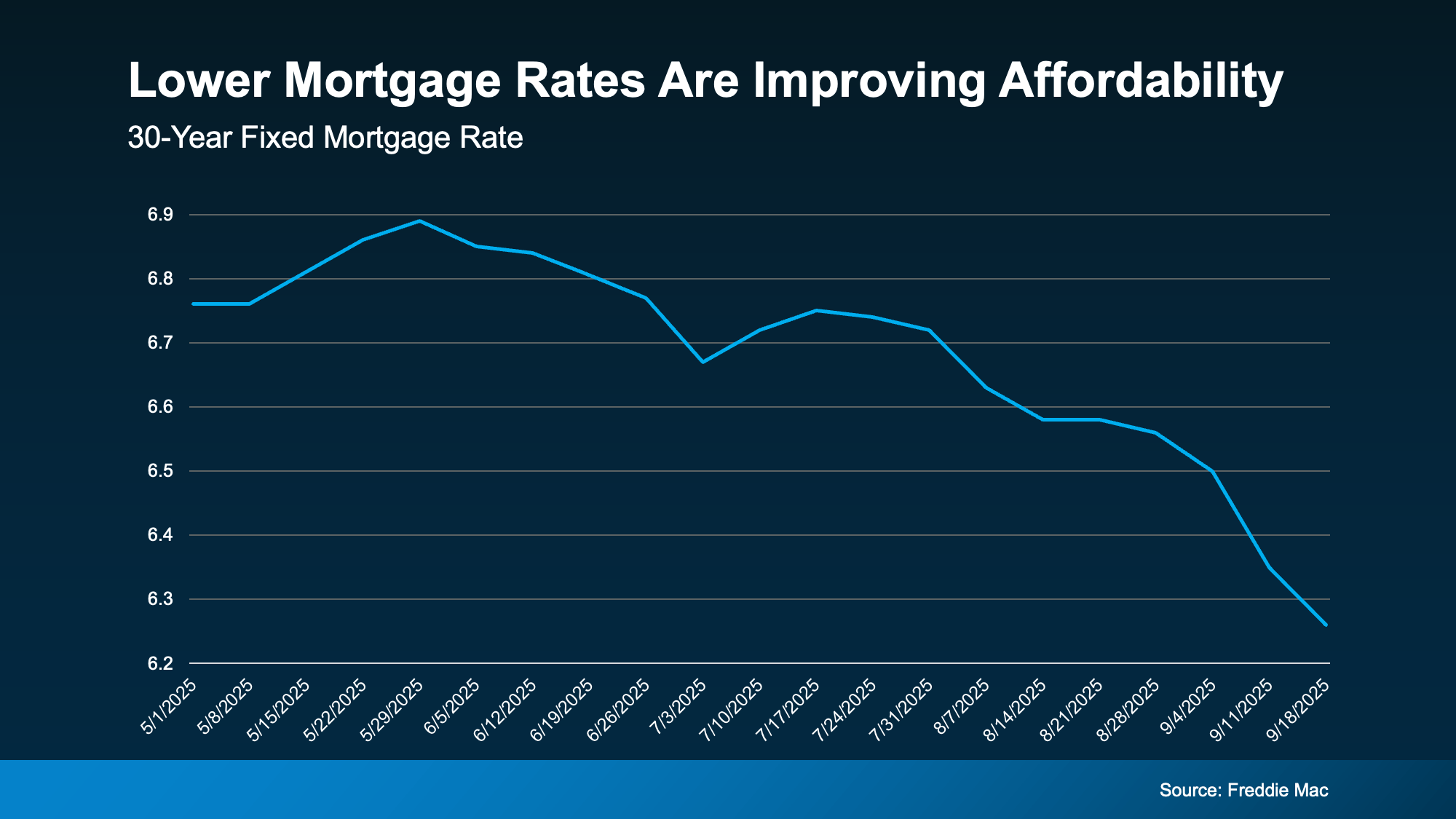

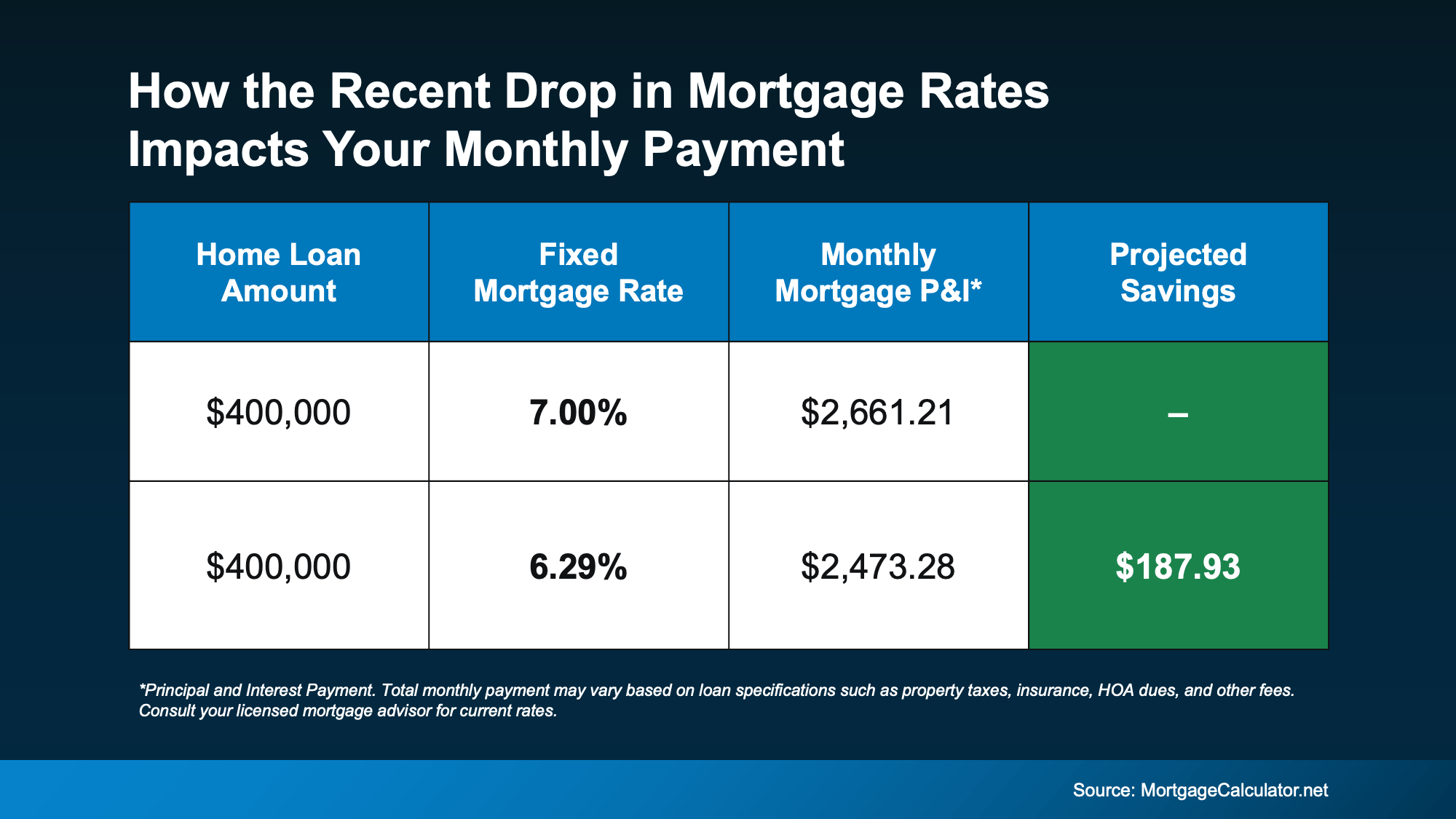

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.