Homeowners looking to sell usually want three things: plenty of interested buyers, strong offers, and a short timeline. Spring is the season that most often delivers all three.

So, if a move has been on your mind this year, this is the window where momentum tends to work in your favor. Here’s what makes this season so powerful for sellers.

1. More Buyers Will Be Looking

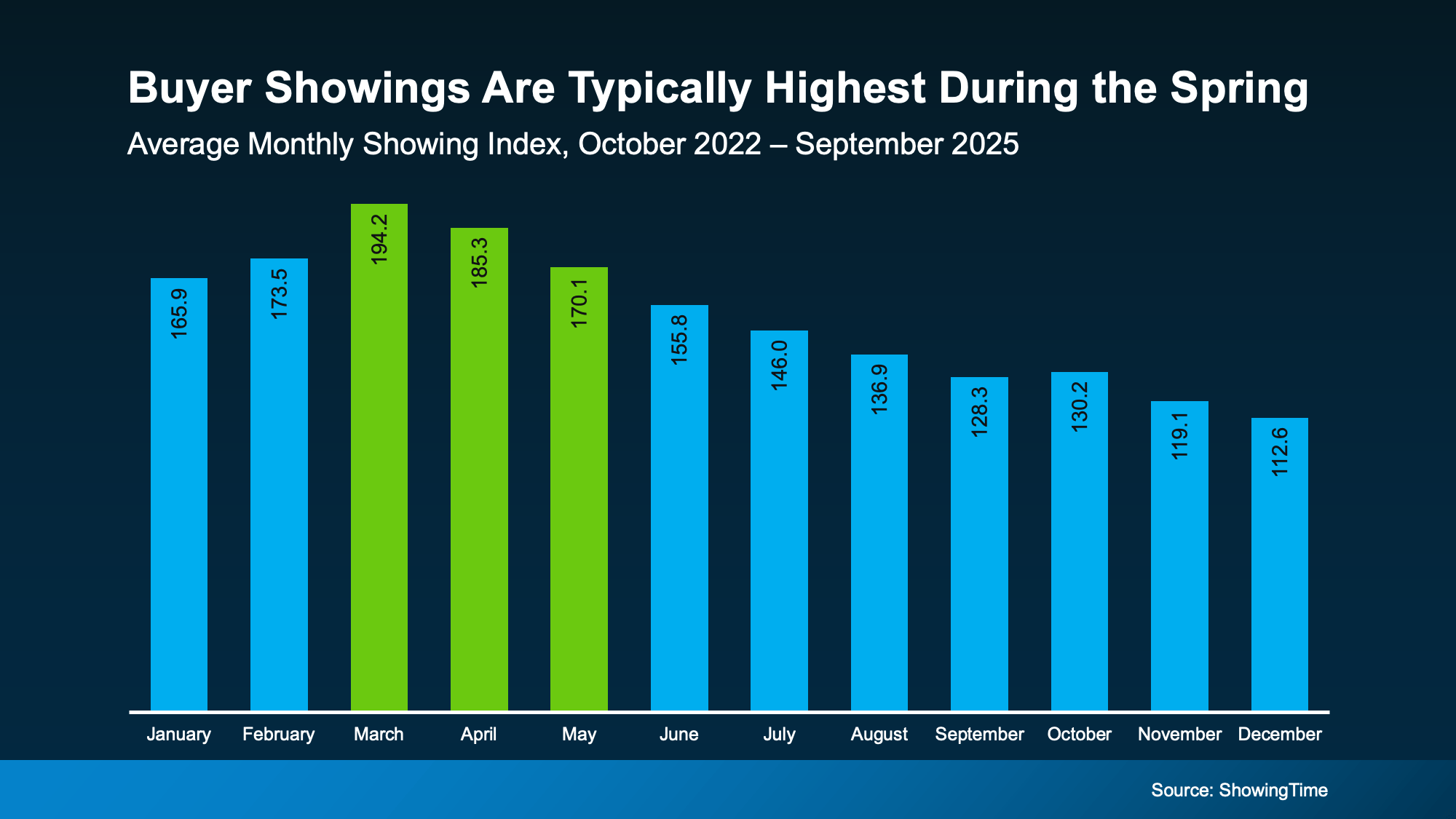

Typically speaking, in the housing market, there’s no more popular time to move than the Spring. Historically, data coming out of ShowingTime proves that’s when buyer activity peaks each year. Take a look for yourself (see graph below):

And this year, there’s more than just the seasonal trend working in your favor. Mortgage rates are also sitting near 3-year lows – and that combination matters.

And this year, there’s more than just the seasonal trend working in your favor. Mortgage rates are also sitting near 3-year lows – and that combination matters.

More buyers + improving affordability = more eyes on your house.

That doesn’t mean the market will return to the frenzy of the pandemic – far from it. But it does mean more buyers will be ready to re-enter the market. And that’s good for you. As Redfin says:

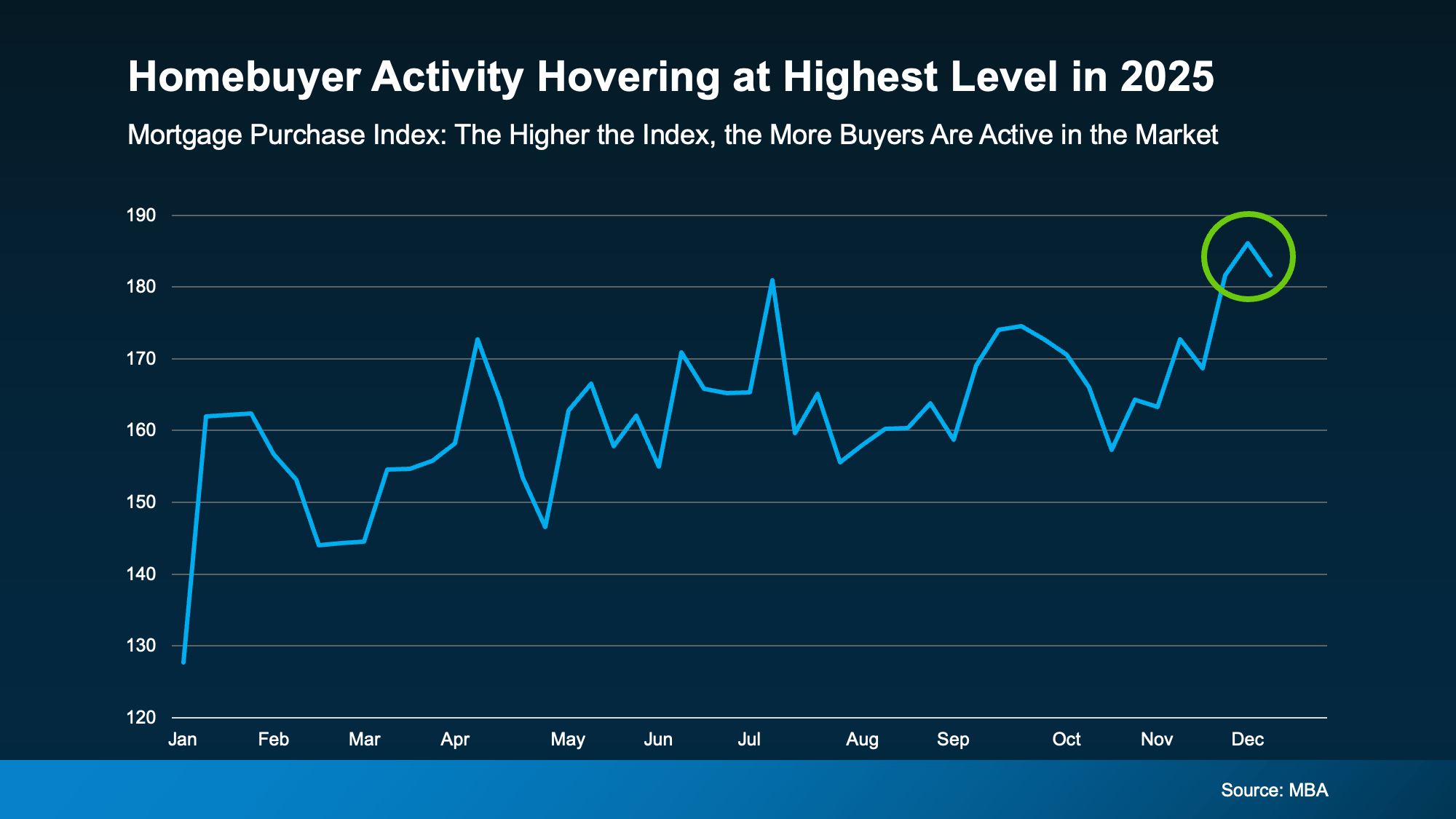

“Homebuying demand is improving . . . and mortgage-purchase applications are sitting near their highest level in three years. . .”

You should make sure your house is listed so you can take advantage of the uptick in demand. Because more activity means one thing: more opportunity to get a deal done.

2. You May Get More Offers

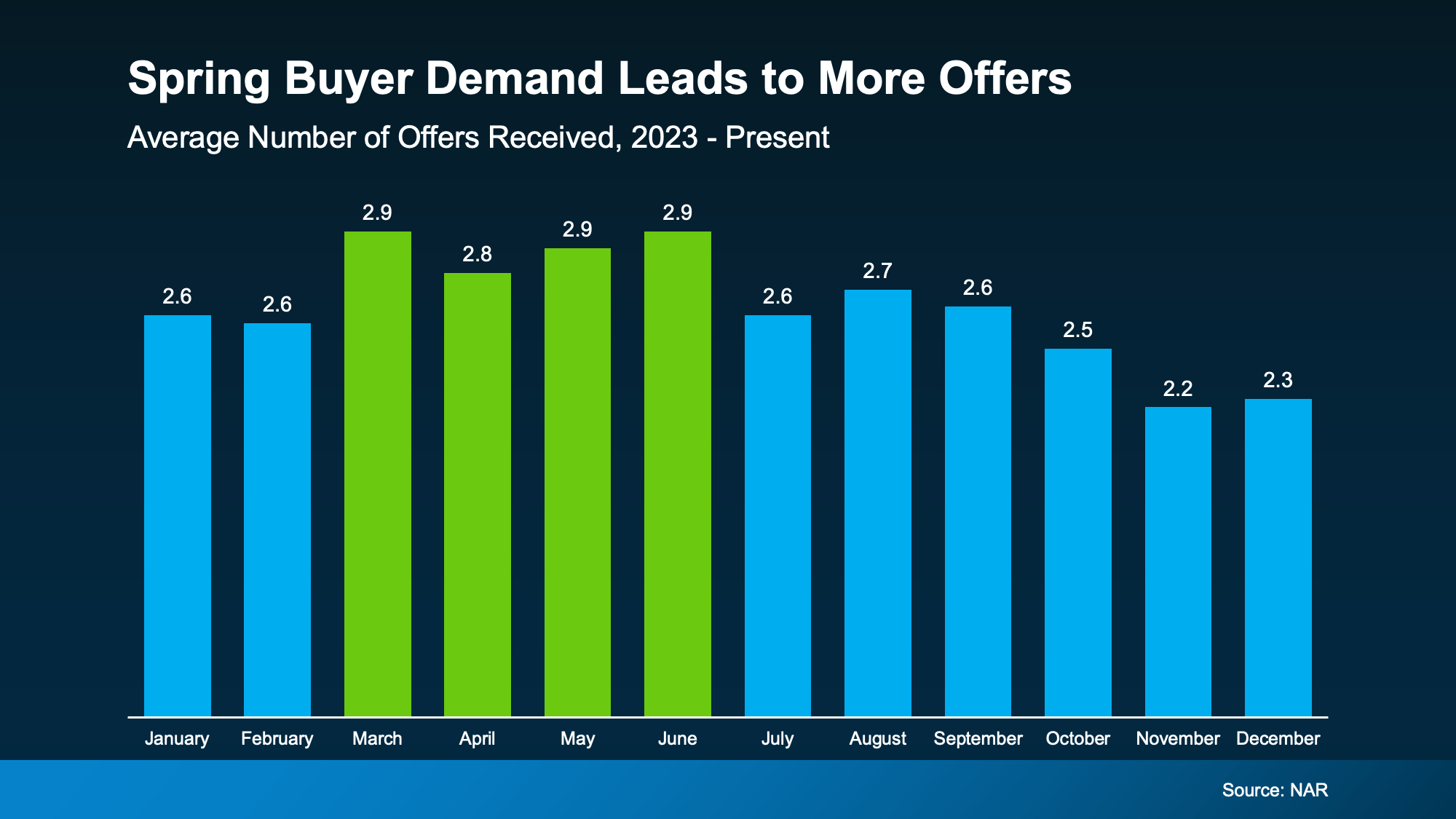

With more buyer demand, it makes sense that you may get more offers on your house. And history shows that’s usually true.

If we look at the data for the last three years from the National Association of Realtors (NAR), and take the averages for each month, it’s clear sellers in the Spring get more offers (see graph below):

Now, don’t expect the excessive bidding wars that were so famous in 2020 and 2021. But it does mean, seasonality could help you out this Spring. As Realtor.com explains:

Now, don’t expect the excessive bidding wars that were so famous in 2020 and 2021. But it does mean, seasonality could help you out this Spring. As Realtor.com explains:

“Spring typically brings out more buyers who are ready to make a move before summer. Listings see more views, showings, and offers during this season.”

And that could be really good for your bottom line.

3. Homes Usually Sell Faster

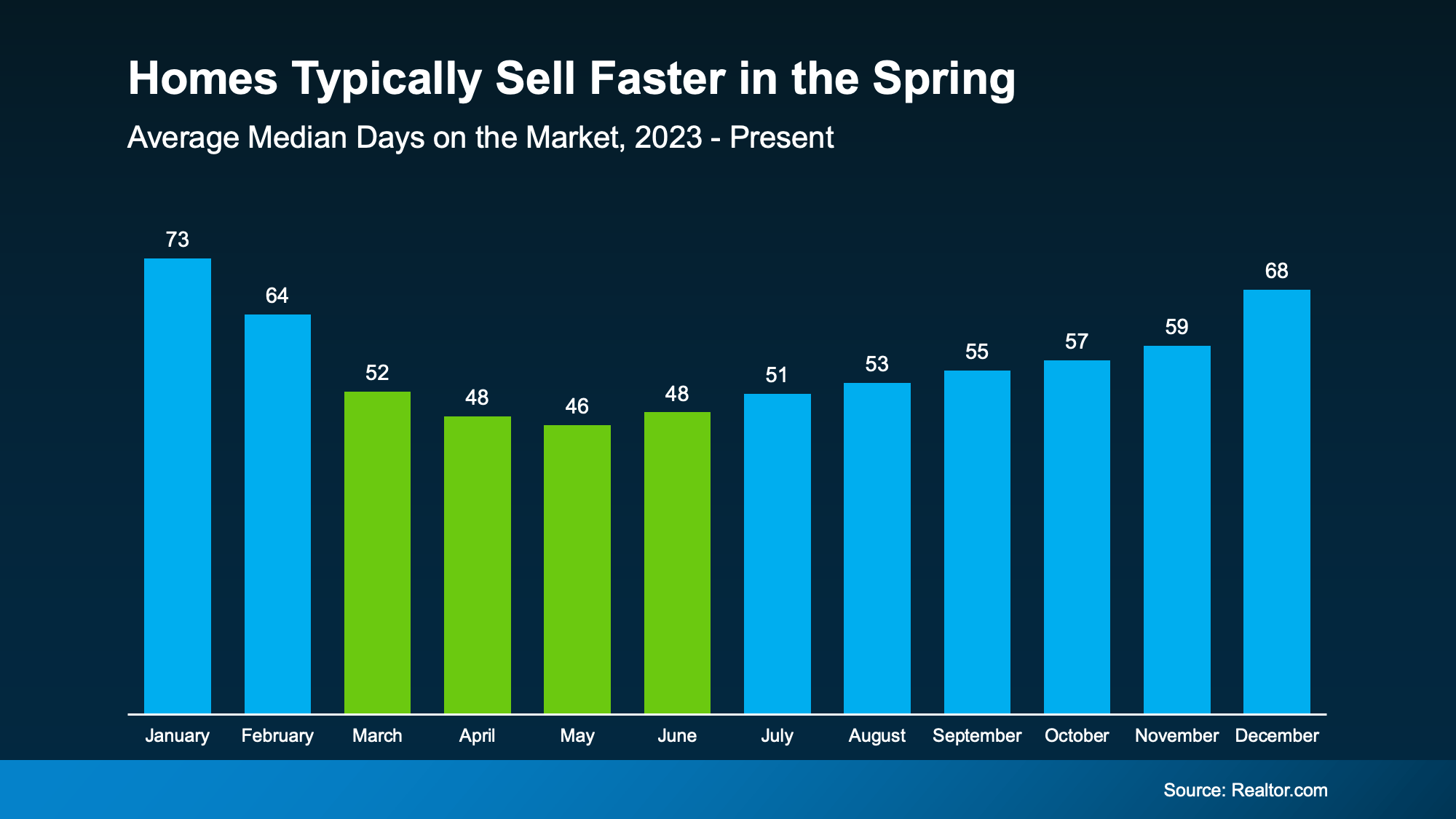

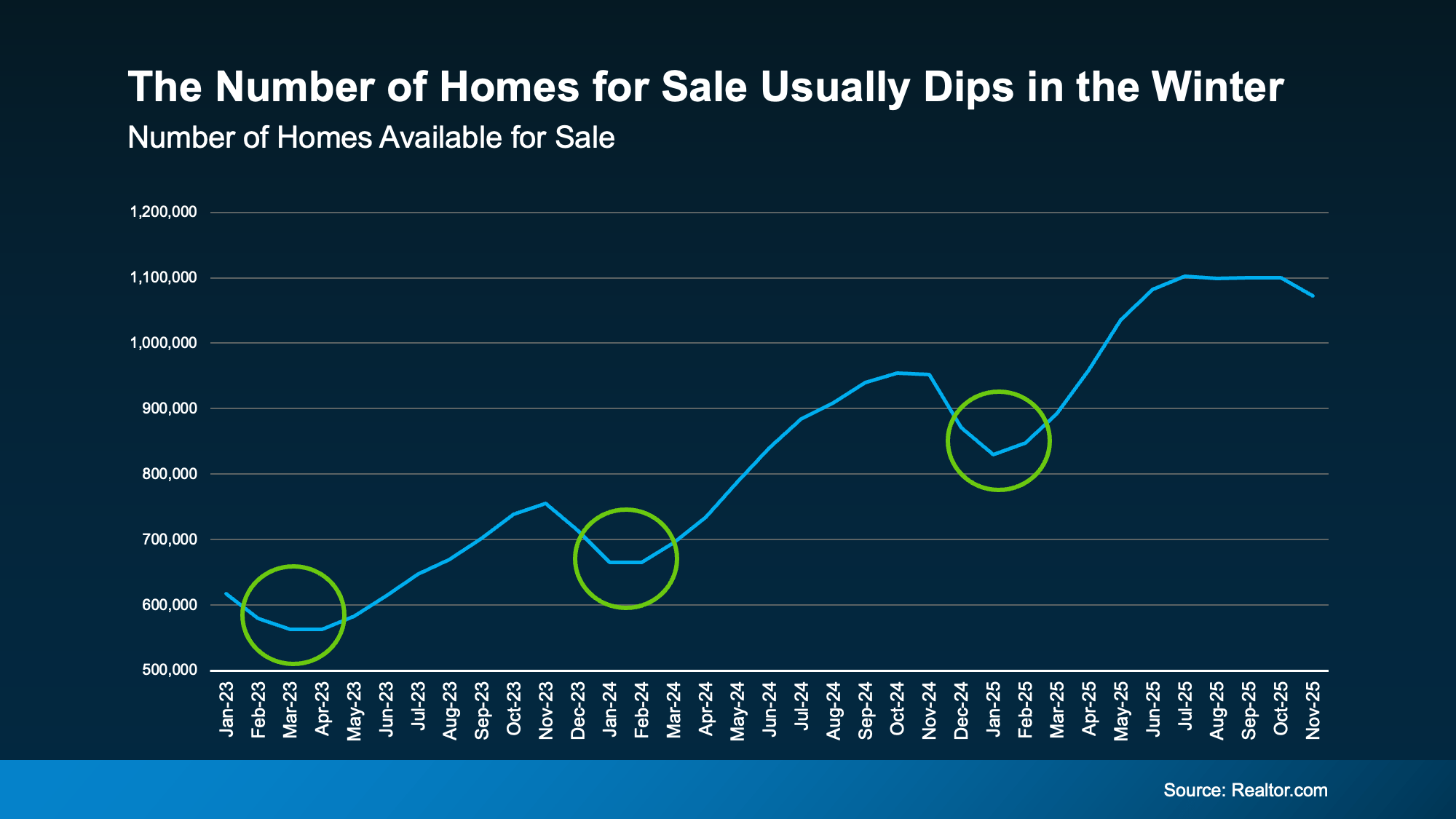

There’s one more predictable pattern that happens pretty much every Spring based on research from Realtor.com. Homes sell faster (see graph below):

On average, homes sell 20 days faster in the Spring compared to the Winter. That’s almost 3 weeks shaved off your timeline. And that’s a difference you can feel.

On average, homes sell 20 days faster in the Spring compared to the Winter. That’s almost 3 weeks shaved off your timeline. And that’s a difference you can feel.

Since homes have been taking longer to sell lately, listing your house during what’s usually the most active time of the year means you’re setting yourself up to move as quickly as possible. And isn’t that what sellers really want?

The faster your home sells, the earlier you can move on to what’s next for you.

If you’re eager to go on to your next chapter, need to downsize, or you’ve run out of space, Spring may be your best time to sell.

Bottom Line

Spring doesn’t guarantee a sale. Strategy still matters. But this season gives you something valuable: momentum.

More buyers. More activity. More opportunity.

The real question is: if you’re going to sell this year, why not do it when the odds are in your favor?

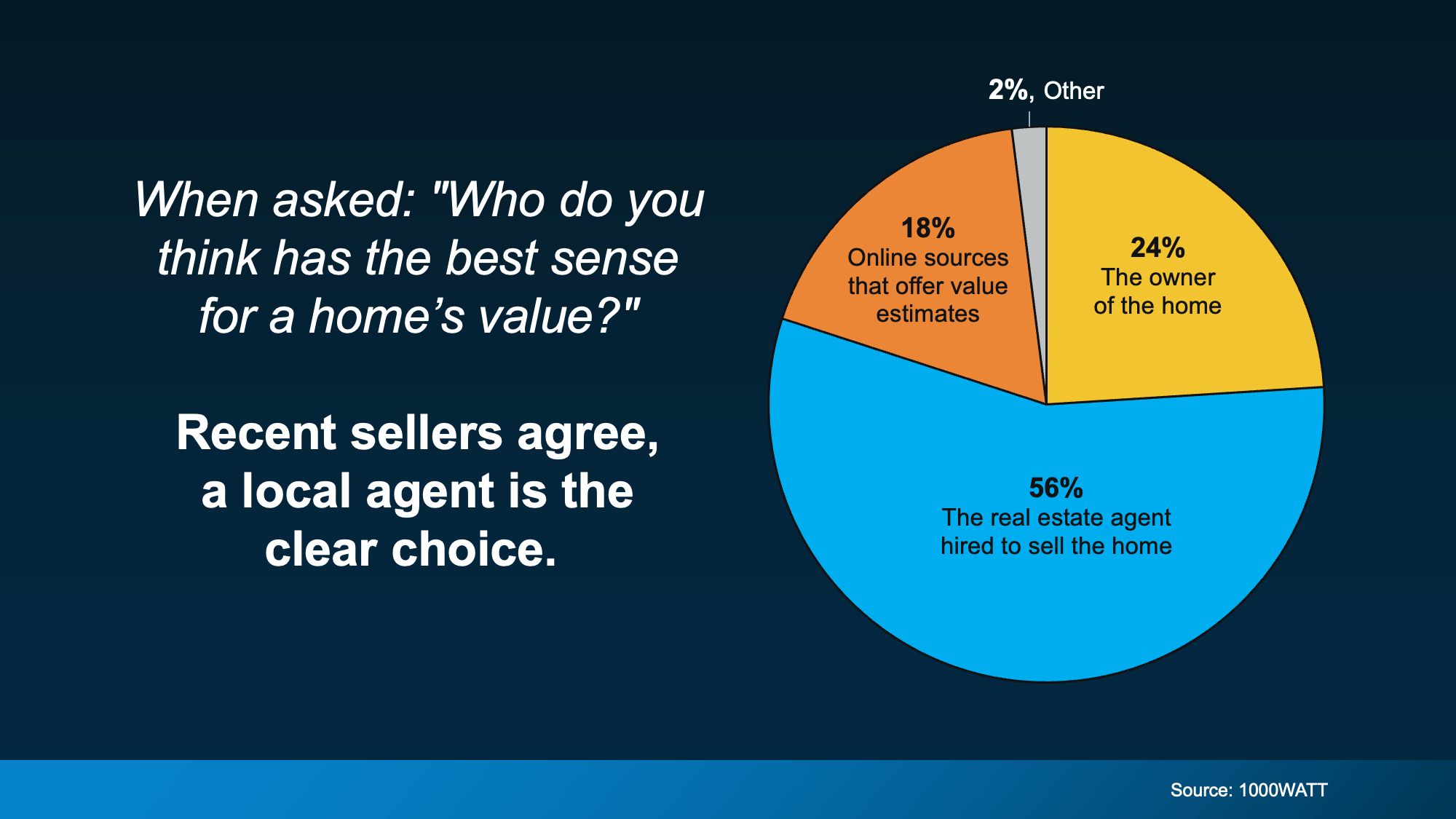

Talk to an agent about what selling this season could mean for your house and your timeline.

The Part Sellers Don’t See Coming

The Part Sellers Don’t See Coming

How an Agent Can Help

How an Agent Can Help

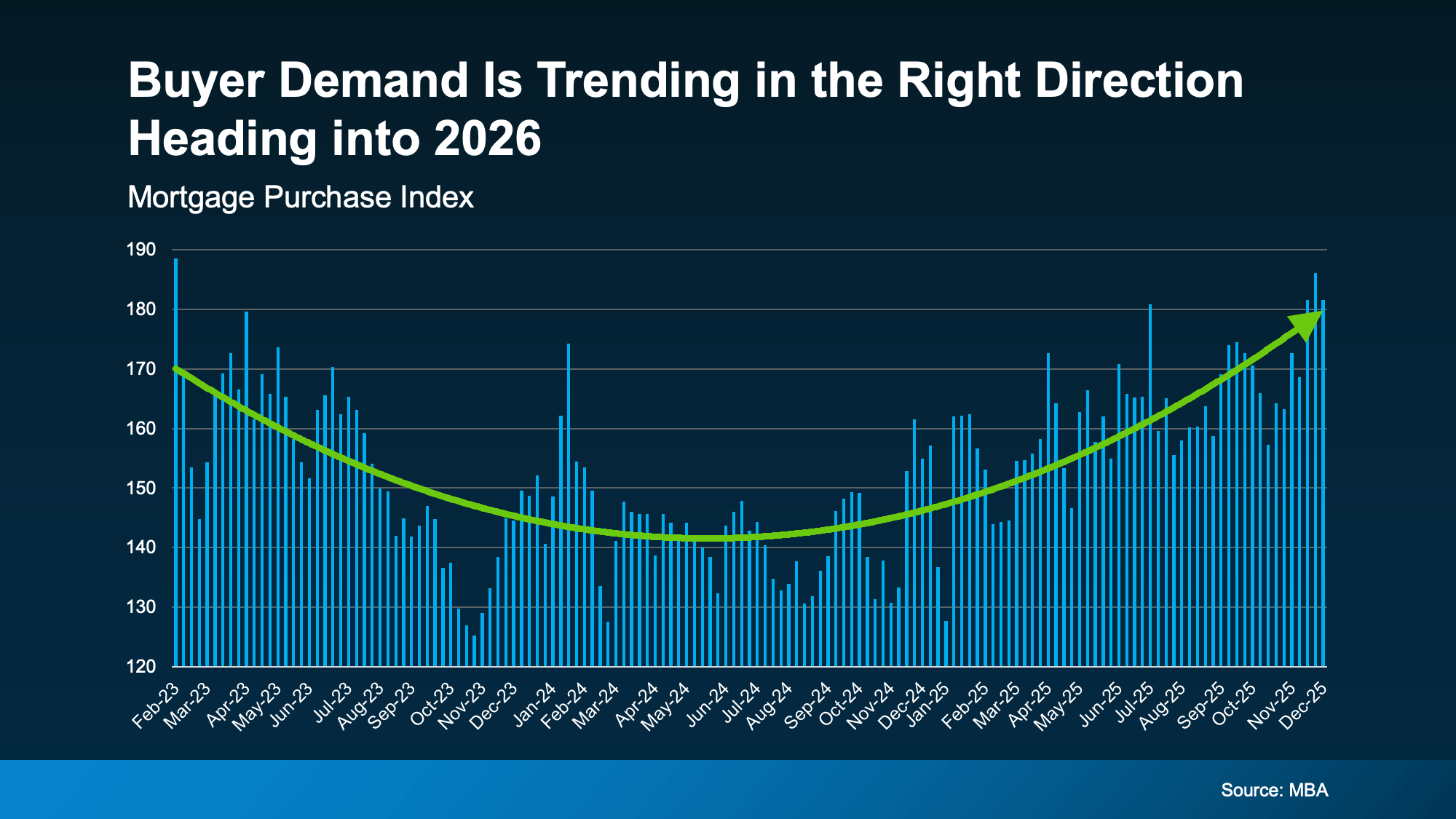

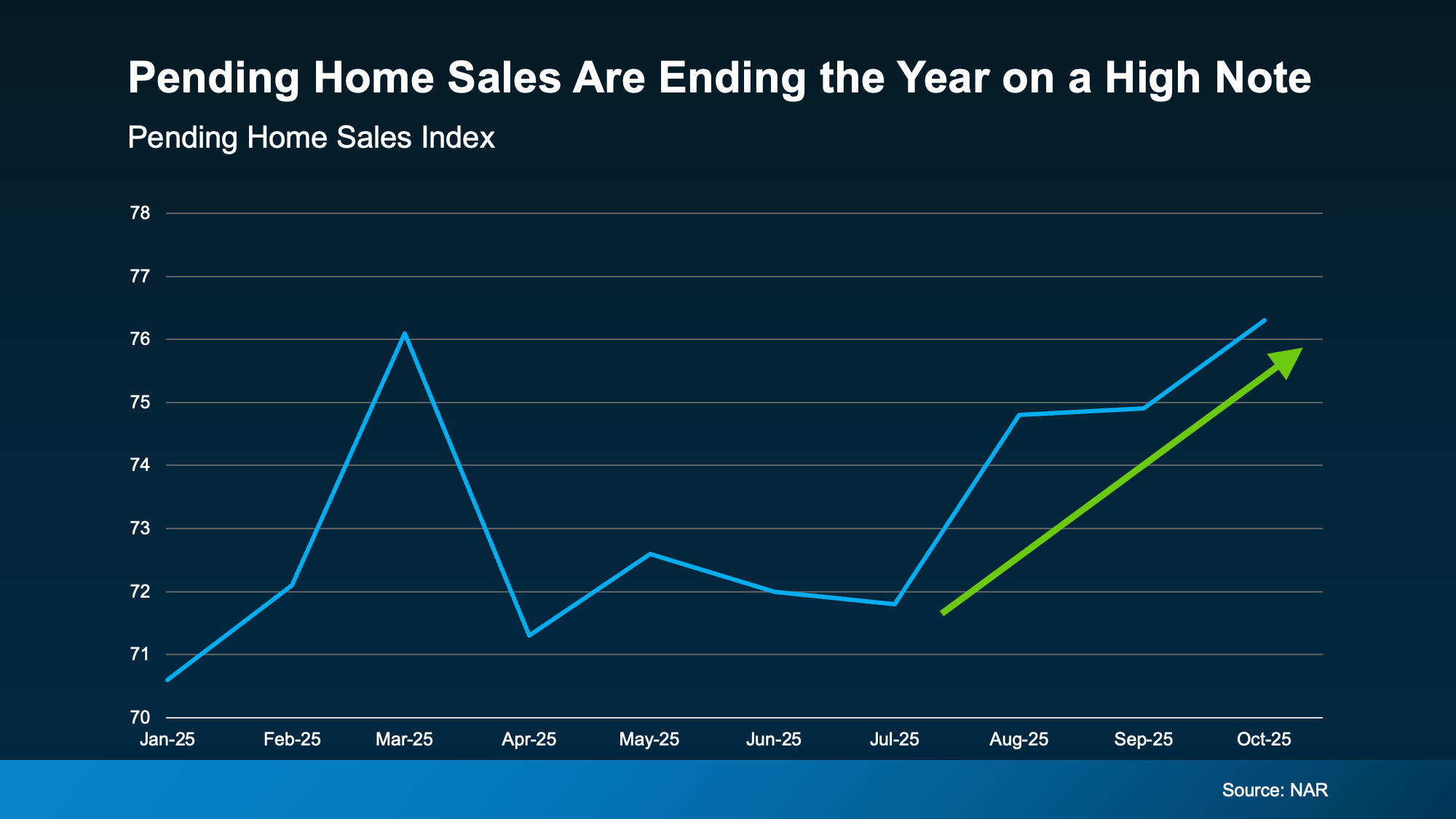

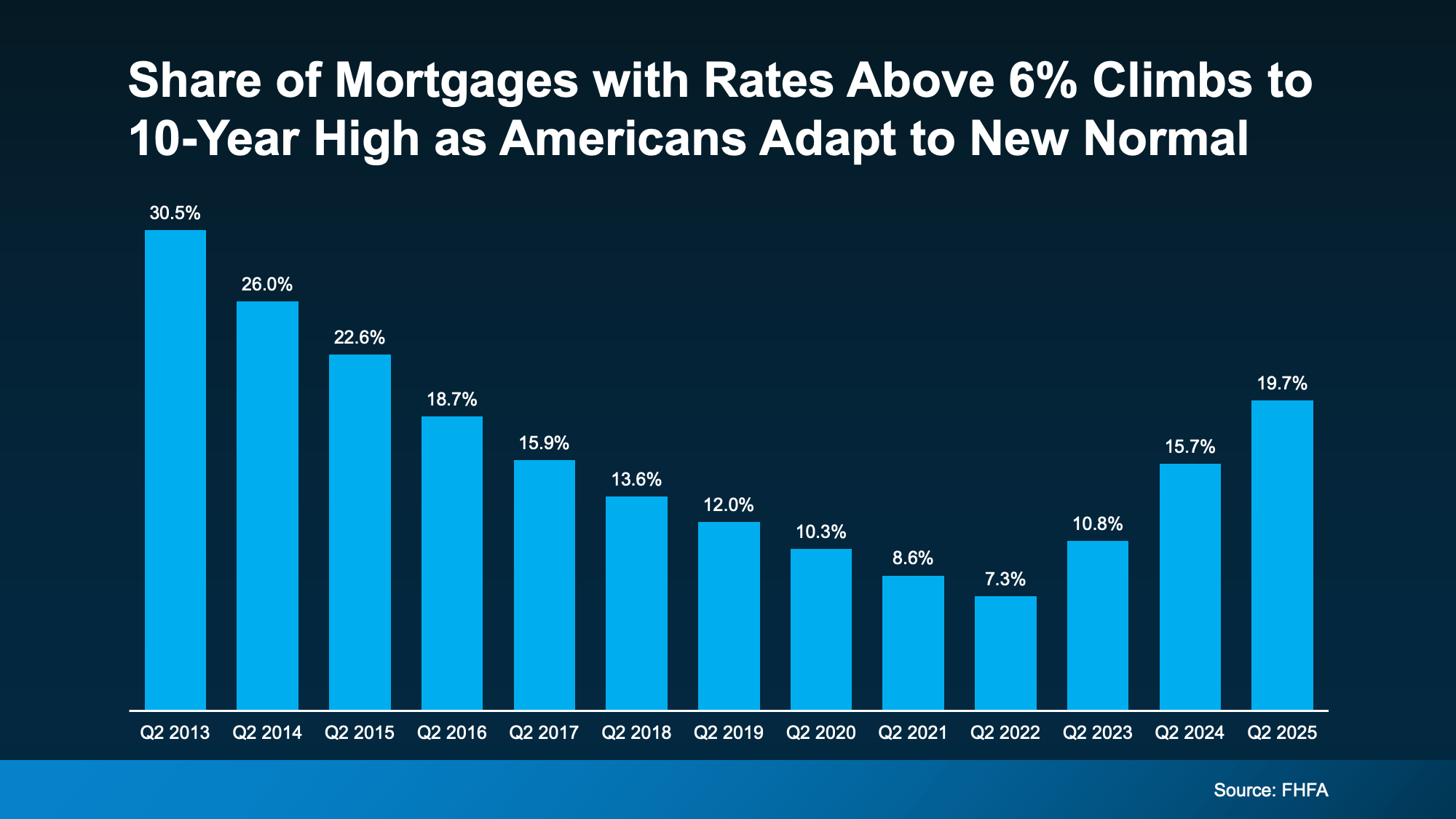

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

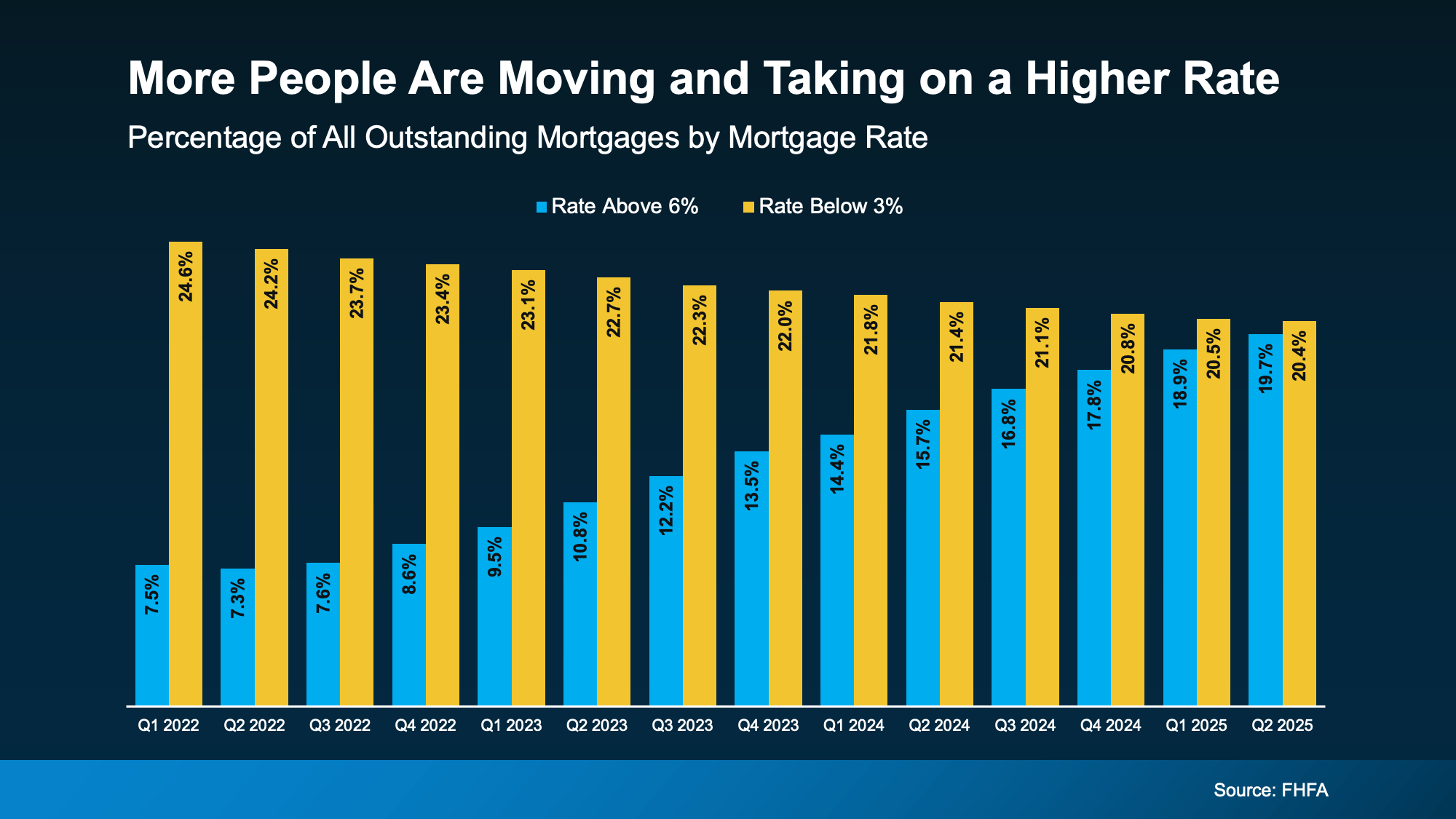

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Why Are More People Moving Now, if It Means Taking on a Higher Rate?