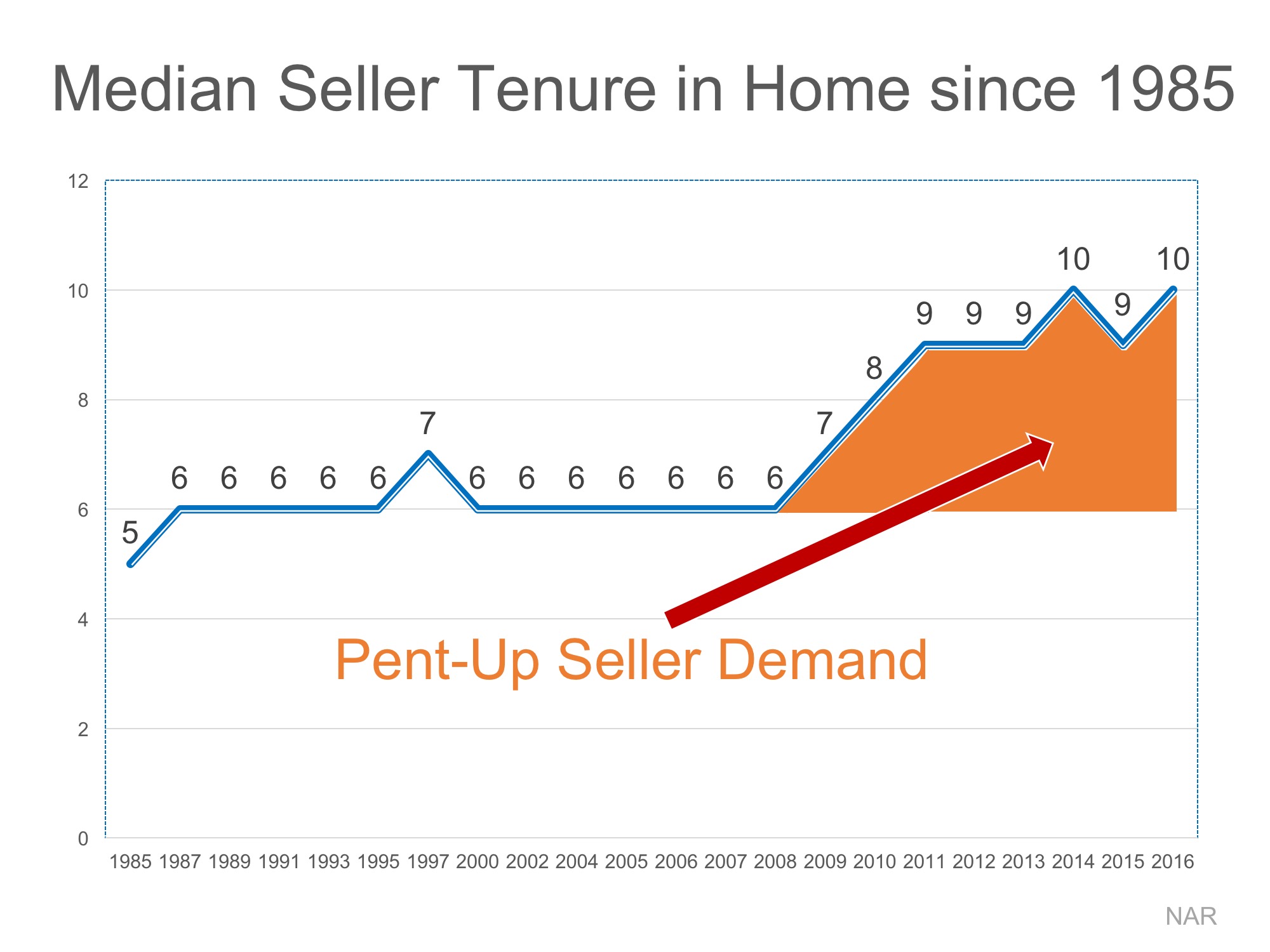

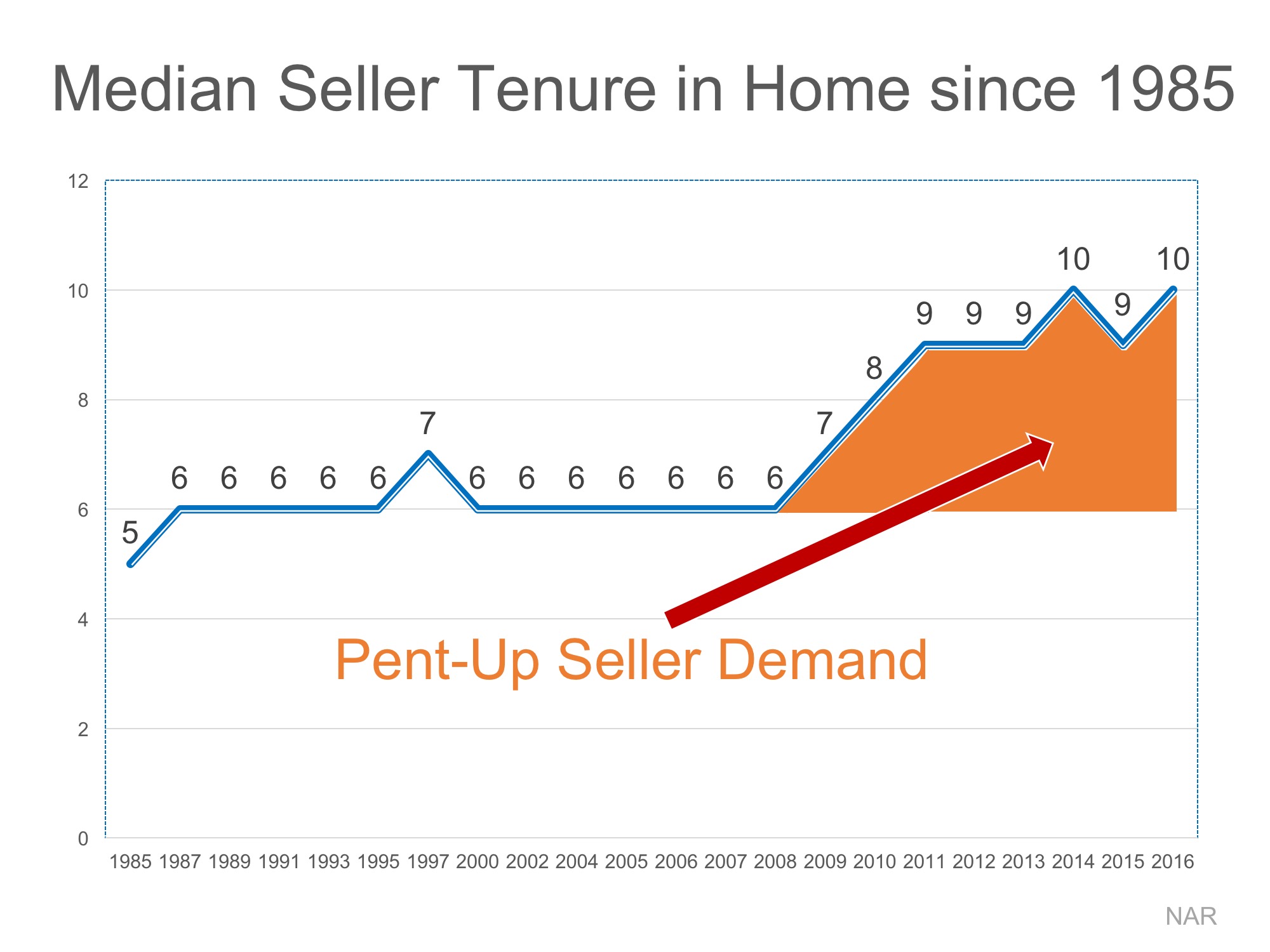

The National Association of Realtors (NAR) keeps historical data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years – an increase of almost 50%.

Why the dramatic increase?

The reasons for this change are plentiful!

The fall in home prices during the housing crisis left many homeowners in a negative equity situation (where their home was worth less than the mortgage on the property). Also, the uncertainty of the economy made some homeowners much more fiscally conservative about making a move.

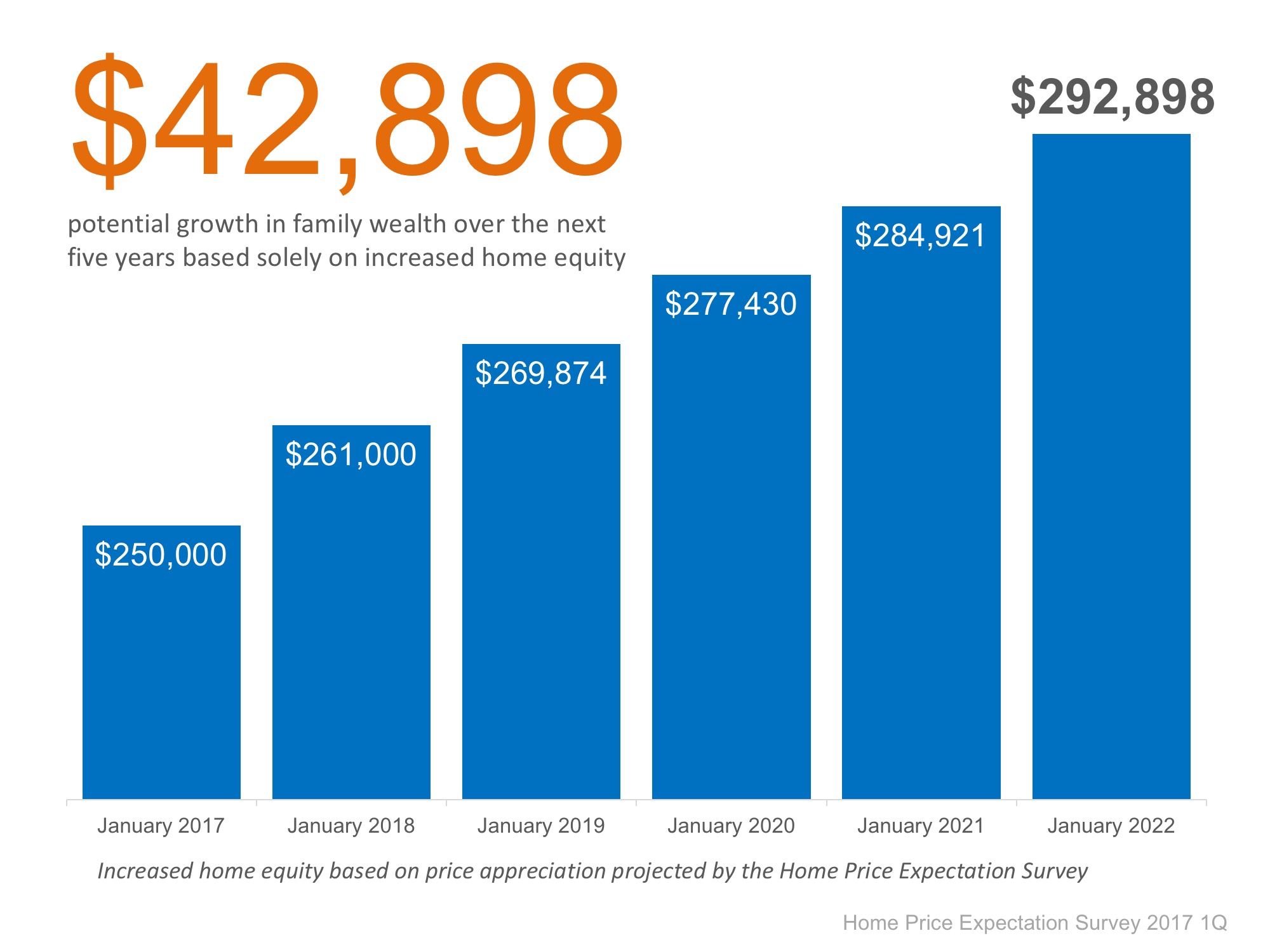

With home prices rising dramatically over the last several years, 93.7% of homes with a mortgage are now in a positive equity situation with 79.1% of them having at least 20% equity, according to CoreLogic.

With the economy coming back and wages starting to increase, many homeowners are in a much better financial situation than they were just a few short years ago.

One other reason for the increase was brought to light during a recent presentation by Lawrence Yun, the Chief Economist of NAR, at the Realtor’s Summit in San Diego, CA. Yun pointed to the fact that historically, young homeowners who were either looking for more space to accommodate their growing family or looking for a better school district were more likely to move more often (every 5 years). The homeownership rate among young families, however, has still not caught up to previous generations resulting in the jump we have seen in median tenure!

What does this mean for housing?

Many believe that a large portion of homeowners are not in a house that is best for their current family circumstances. They could be baby boomers living in an empty, four-bedroom colonial, or a millennial couple planning to start a family that currently lives in a one-bedroom condo.

These homeowners are ready to make a move. Since the lack of housing inventory is a major challenge in the current housing market, this could be great news.

Powered by WPeMatico

![Don’t Let Your Luck Run Out [INFOGRAPHIC] | Simplifying The Market](http://www.benningtonhomes.com/wp-content/uploads/2017/03/20170317-Luck-STM.jpg)

![Spring Forward: The Difference An Hour Makes [INFOGRAPHIC] | Simplifying The Market](http://www.benningtonvermonthomes.com/wp-content/uploads/2017/03/The-Difference-a-Hour-Makes-STM.jpg)