Homebuyers are weighing their options right now, and they certainly have a lot on their minds. With everything going on in the job market, the economy, and more – there’s a lot to think about these days. And maybe that’s making you wonder if it really makes sense to buy a home right now.

But here’s what many recent buyers would tell you: even with all that, making a move is worth it.

And this is why they’re thankful they went ahead and took the plunge already. Life doesn’t wait for better market conditions. So, your decision shouldn’t be about trying to time the market perfectly. It should be about moving when the time is right for you and what you need – and it’s different for everyone.

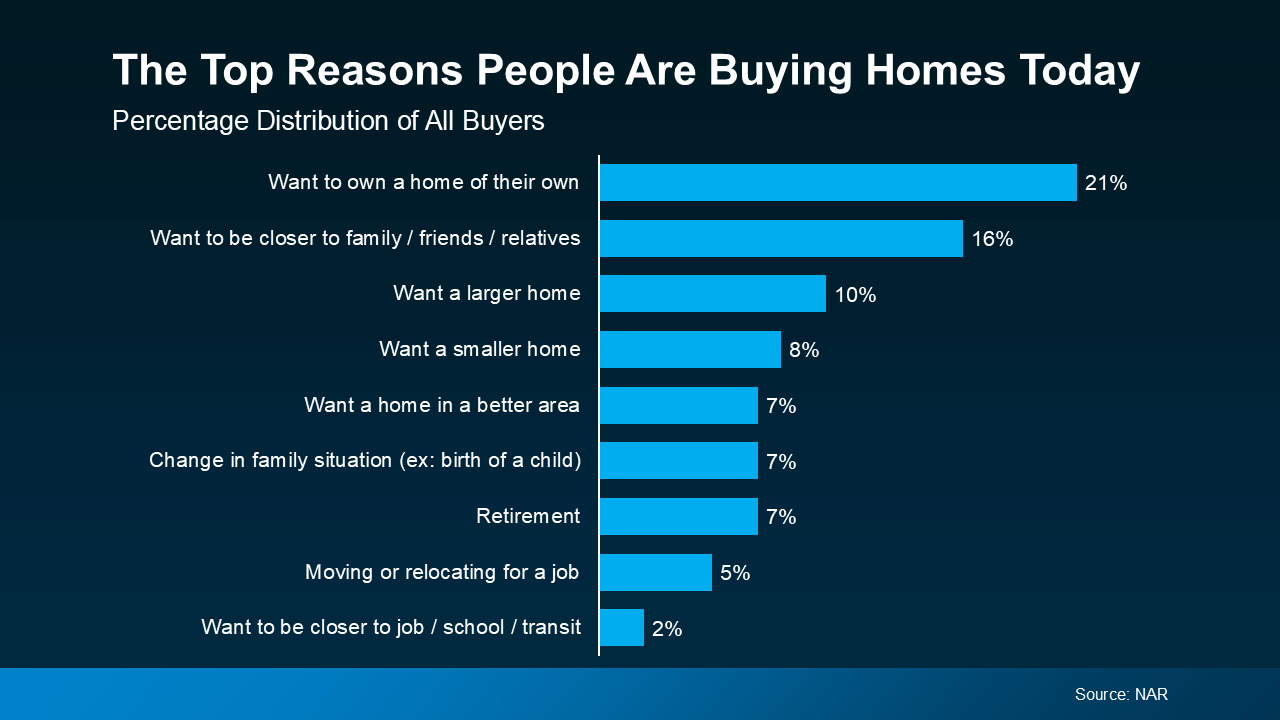

The Real Reasons People Bought a Home

According to the latest report from the National Association of Realtors (NAR), what’s really driving today’s moves is the desire for something better or something different. It’s a personal motivator or a change in what they need out of the home that pushed buyers to act this year (see chart below):

For some, that meant trading an apartment for their very first house – a home they can finally make their own, where they can paint the walls, plant the garden, and build a future.

For some, that meant trading an apartment for their very first house – a home they can finally make their own, where they can paint the walls, plant the garden, and build a future.

For others, it meant getting closer to the people who matter most. Living near family or friends isn’t just convenient, it changes your everyday life. Sunday dinners, quick visits, extra help when you need it – that kind of connection is priceless.

And for many buyers, it’s the peace of finding a home that finally fits. It’s finally having space to grow: a bigger kitchen for family dinners, or bedrooms where kids can decorate their own walls and carve out their own corners of the world.

Or, it’s about simplifying. Downsizing to something smaller, easier to maintain, and closer to what matters most can make everyday life feel lighter and less stressful.

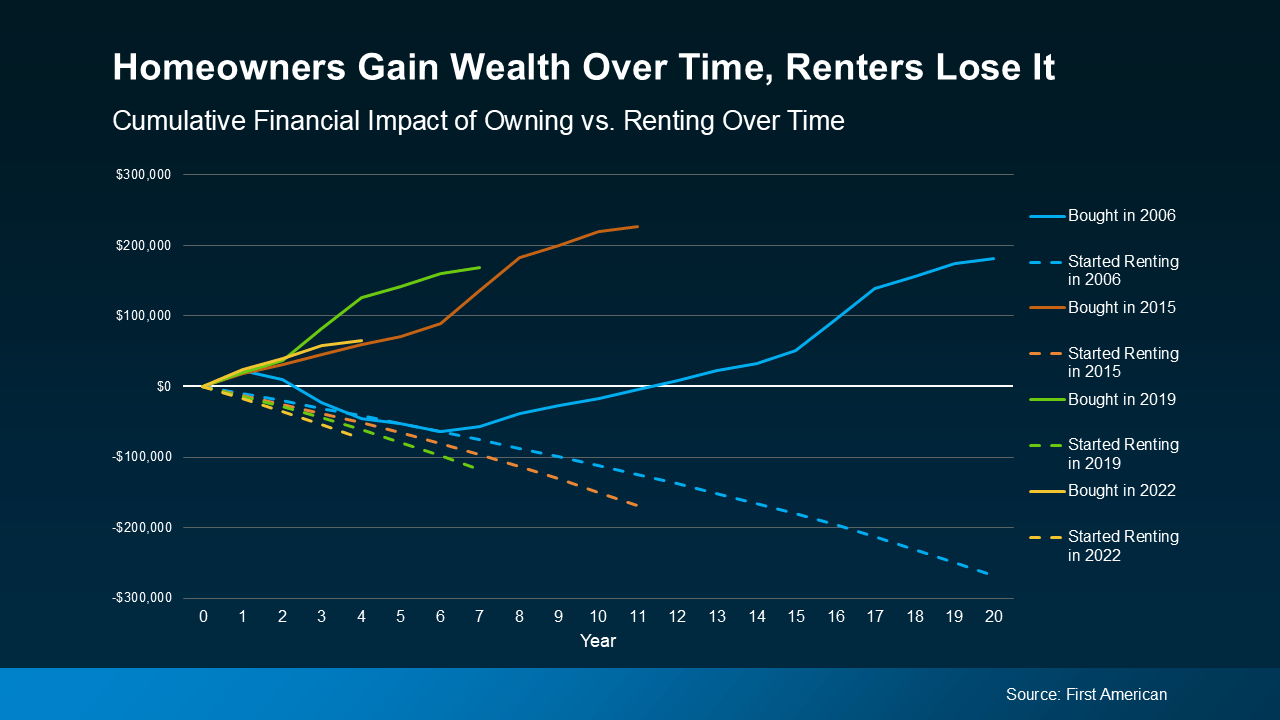

What You Miss Out on If You Try To Time the Market

No matter the reason, these buyers all share something in common: they stopped waiting for perfect timing and focused on creating the life they wanted now. And if you asked them, odds are they’d say that decision is paying off every day.

That’s what makes a move meaningful. Not the market conditions, but the freedom and happiness that come from living in a home that truly fits. So, while headlines may keep everyone guessing, the people who’ve already made their move are sleeping better, living fuller, and enjoying homes that finally feel right.

Because once your home finally matches your life, everything else starts to fall into place. And that’s exactly how you deserve to feel.

Bottom Line

The people who bought a home this year didn’t wait for perfect market conditions to line up. They acted on what they needed in their life. And they’re thankful they did.

If you’re feeling the pull toward something better, talk to an agent about your goals. Your next home could bring you more space, more connection, and more happiness than you think.